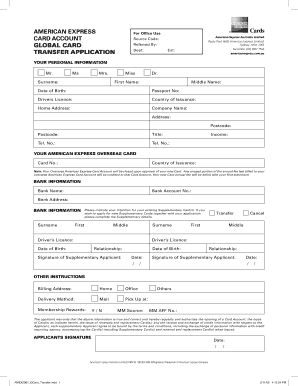

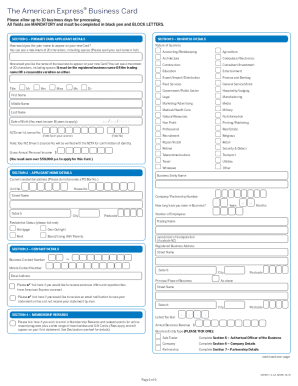

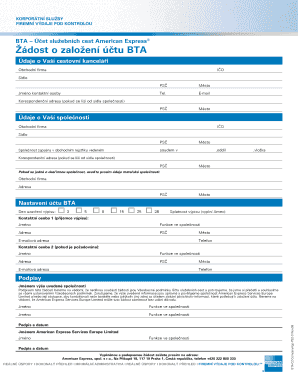

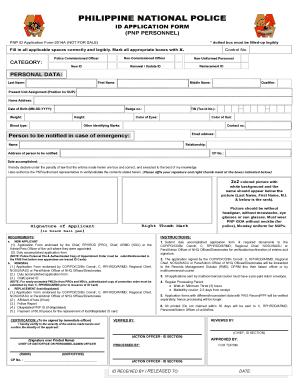

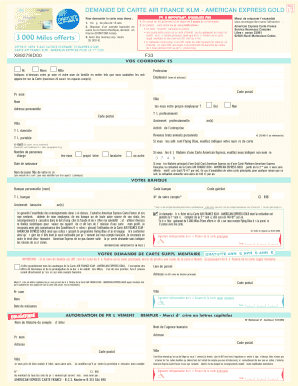

Find and manage case-specific American express Application Forms documents with DocHub. Complete, manage, and send your document without losing any significant information along the way.

Improve your form operations with our American express Application Forms library with ready-made templates that meet your requirements. Get your form, alter it, complete it, and share it with your contributors without breaking a sweat. Begin working more efficiently with the documents.

How to use our American express Application Forms:

Examine all the opportunities for your online file administration with the American express Application Forms. Get a totally free DocHub profile right now!