|

|

PDCFlow | |

|---|---|---|

| No Downloads | ||

| Search Form Online | ||

| New Form and Document Creator | ||

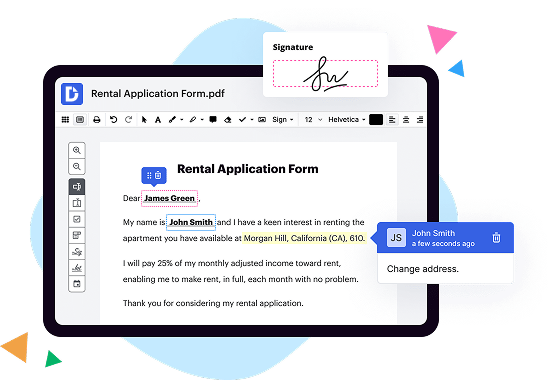

| Edit PDF | ||

| Fill Online | ||

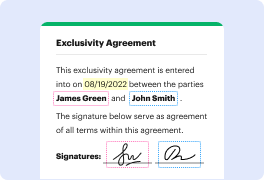

| Sign Online | ||

| PDF converter | ||

| Annotate PDF | ||

| Search text in PDF | ||

| Encryption and Security | ||

| Two-Factor Authentication | ||

| Unlimited Cloud Storage | ||

| Fax Online | ||

| API | ||

| Get DocHub for free |

Late payment fee: In most cases, youll be hit with a late payment fee. This fee is often up to $41. Penalty APR: A late payment can cause your interest rate to spike docHubly higher than your regular purchase APR.

DocHub implements reasonable measures to comply with industry-leading standards, regulations, and certifications so you can securely edit, fill out, sign, and send documents and forms.