Definition and Meaning of the Texas Resale Certificate

A Texas resale certificate is an essential document used by buyers to claim tax exemption on items intended for resale. It serves as a legal declaration that the buyer will not pay sales tax on these items as they are being purchased for resale purposes rather than for personal consumption. The Texas resale certificate must be provided to the seller at the time of purchase and is used primarily in commercial transactions.

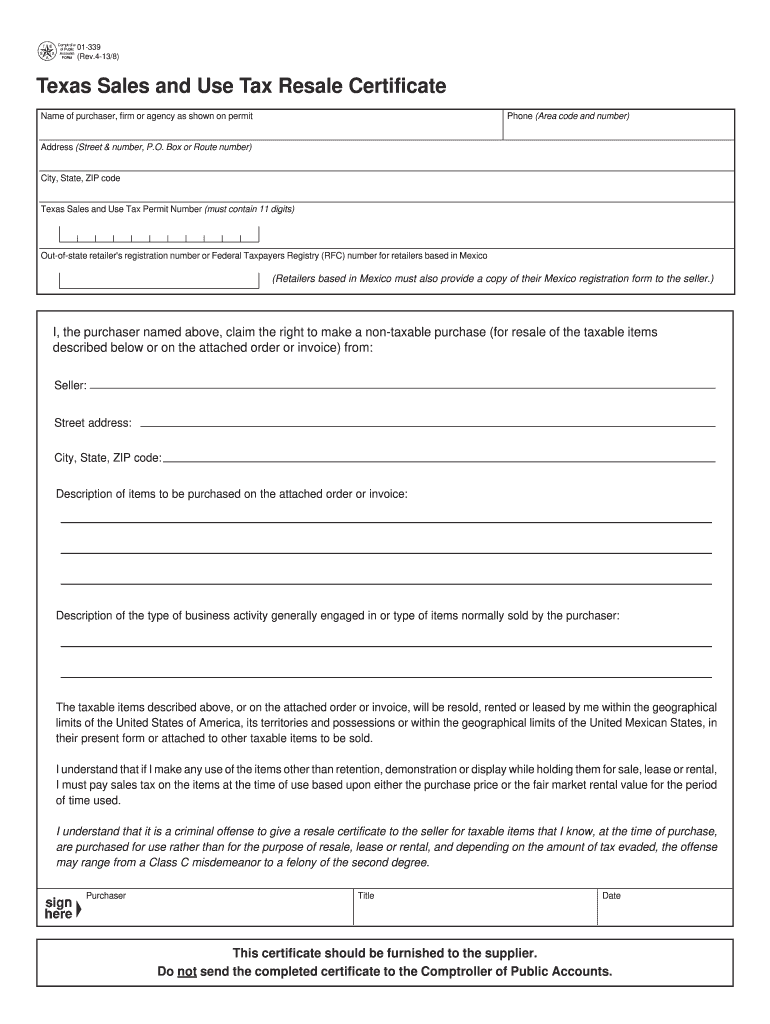

This certificate outlines the purchaser's details, including the name, address, and Texas sales tax permit number, alongside the seller’s information. It also specifies the nature of the items being purchased that are qualified for resale. By accepting a resale certificate, sellers can validate the buyer's tax-exempt status and are not held responsible for collecting sales tax on these transactions.

How to Use the Texas Resale Certificate

The process for utilizing a Texas resale certificate involves several straightforward steps, ensuring clear communication between buyers and sellers:

-

Obtain the Certificate: Buyers must first acquire a Texas resale certificate form. This document is usually available through the Texas Comptroller's website or other reliable sources.

-

Complete the Certificate: Buyers must fill out necessary details, including their name, address, sales tax permit number, and the specifics of the items being purchased. Accuracy is crucial to avoid issues later on.

-

Present the Certificate to the Seller: Once completed, the buyer must provide the resale certificate directly to the seller at the time of the transaction. This action confirms the non-taxable status of the sale.

-

Keep Records: Both the buyer and seller should retain copies of the resale certificate for their records, as this documentation is vital for tax purposes and potential audits.

By following these steps, businesses can leverage the Texas resale certificate to manage their sales tax liabilities effectively.

Important Terms Related to the Texas Resale Certificate

Understanding key terminology associated with the Texas resale certificate can aid in ensuring compliance and clarity in transactions. Common terms include:

- Purchaser: The individual or business acquiring items for resale.

- Seller: The entity providing the goods to the purchaser.

- Exemption Certificate: A broader category that includes various forms enabling tax exempt purchases, including the Texas resale certificate.

- Sales Tax Permit: A state-issued permit that businesses must obtain to collect sales tax on behalf of the state.

Familiarity with these terms ensures that all parties involved are on the same page and makes the process of using the resale certificate more efficient.

Steps to Complete the Texas Resale Certificate

Completing the Texas resale certificate correctly is essential to maintain its validity. Here is a step-by-step guide to ensure proper completion:

-

Download the Form: Access the Texas resale certificate (Form 01-339) from the Texas Comptroller’s website.

-

Fill in the Buyer Information: Enter the name, address, and sales tax permit number of the buyer. This information verifies the buyer’s legitimacy.

-

Specify the Seller Information: Record the seller's name and address, ensuring all details are accurate for record-keeping.

-

Describe the Items: Clearly list the items being purchased for resale. This description prevents confusion and confirms the nature of the transaction.

-

Sign and Date: The buyer must sign and date the certification, attesting to the accuracy of the information provided and the intent to use the items for resale.

-

Submit the Certificate: Present the completed resale certificate to the seller before finalizing the transaction.

By adhering to these steps, businesses can effectively utilize the Texas resale certificate and avoid potential tax liabilities.

Key Elements of the Texas Resale Certificate

The Texas resale certificate comprises several key elements that are critical for its validity. These include:

-

Purchaser Identification: Detailed buyer information, including name, address, and sales tax permit number, identifies who is making the tax-exempt purchase.

-

Seller Identification: Clear seller information outlines who is providing the goods, which is necessary for record-keeping and compliance.

-

Description of Goods: A thorough description of the items being purchased for resale, which establishes the nature of the transaction and supports the exemption claim.

-

Signature and Date: The purchaser’s signature and date completed validate the document, confirming the buyer's intent and acknowledgment of legal responsibilities.

Ensuring that all these elements are accurately included protects both parties and maintains compliance with Texas sales tax laws.

Legal Use of the Texas Resale Certificate

The legal application of the Texas resale certificate is crucial for businesses looking to navigate tax laws effectively. This certificate is explicitly designed for use in transactions where goods are purchased strictly for resale. Using the resale certificate inappropriately—such as using it for personal items or non-resale purchases—can lead to penalties, including fines.

Businesses should ensure that they maintain proper records of all transactions involving resale certificates. This documentation can serve as proof during audits or disputes with tax authorities. Permanent records must be kept detailing the items purchased under each resale certificate, reinforcing compliance and accountability to the Texas Comptroller.

By understanding the legal framework surrounding the Texas resale certificate, businesses can safeguard themselves from potential liabilities and ensure that their operations remain compliant with state tax regulations.