Definition & Meaning

Arkansas offers certain taxpayers the opportunity to utilize specific tax-related programs that are designed to provide financial relief or incentives. These opportunities may include tax credits, deductions, exemptions, or special filing statuses that aim to reduce the tax burden for eligible individuals and businesses. Understanding the specific criteria and benefits associated with these opportunities is essential for maximizing potential savings during tax season.

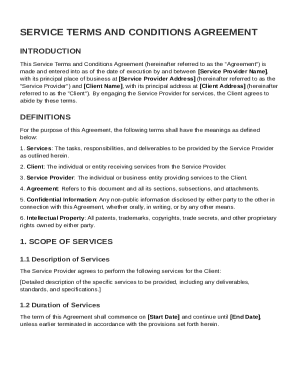

How to Use the Arkansas Offers Certain Taxpayers the Opportunity To

To effectively use these opportunities, taxpayers must first identify which programs they qualify for based on income, filing status, or specific eligibility criteria. Once identified, taxpayers can incorporate these opportunities into their tax filings, often requiring the completion of additional forms or schedules. It's important to carefully read Arkansas tax guides and instructions, as this will ensure that taxpayers correctly apply and claim the relevant opportunities.

Steps to Complete the Arkansas Offers Certain Taxpayers the Opportunity To

- Identify Eligibility: Determine if you meet the specific criteria for each opportunity.

- Gather Documentation: Collect any necessary documents that prove eligibility, such as income statements or proof of residency.

- Complete Necessary Forms: Fill out the forms required to claim the opportunity, ensuring accuracy and completeness.

- Submit with Tax Return: Include the completed forms when you file your Arkansas state tax return.

- Review for Accuracy: Before submission, double-check all forms and calculations to avoid mistakes that could delay processing.

Key Considerations:

- Documentation: Always retain copies of all submitted forms and supporting documents.

- State Guidance: Refer to the Arkansas Department of Finance and Administration for official guidance and updates.

Eligibility Criteria

Eligibility for each tax opportunity varies, often based on factors such as income level, filing status, and specific life circumstances. For instance, students, senior citizens, first-time homebuyers, or businesses engaged in certain activities may qualify for different programs. It's crucial to consult the official Arkansas tax guidelines to determine eligibility accurately, as assumptions can lead to disqualification or penalties.

Required Documents

Taxpayers must prepare several documents to substantiate their claims for the opportunities offered:

- Income Documentation: W-2s, 1099s, or other proof of income.

- Proof of Expenses: Receipts or statements for deductible expenses.

- Identity Verification: Social Security cards or valid IDs.

- Previous Tax Returns: Copies of prior year returns if applicable to the claim.

Legal Use of the Arkansas Offers Certain Taxpayers the Opportunity To

When utilizing these opportunities, it is imperative to do so legally and ethically. Taxpayers must adhere to Arkansas state tax laws to prevent issues such as audits or penalties. Misstating information or attempting to exploit tax opportunities contrary to law can result in significant consequences, including fines and potential legal action.

State-Specific Rules for the Arkansas Offers Certain Taxpayers the Opportunity To

Arkansas has unique rules governing tax opportunities that may not align with federal guidelines. These include state-specific deductions or exemptions that require awareness of local tax legislation. Always prioritize understanding these rules to ensure compliance and optimize any available financial benefits.

Examples of Using the Arkansas Offers Certain Taxpayers the Opportunity To

Consider a self-employed individual who is eligible for a specific state tax credit. By accurately calculating business expenses and correctly documenting their income, this taxpayer can significantly reduce their state tax liability. Another example includes a family using deductions for educational expenses for dependents – by documenting these expenditures, they can enhance their savings.

Scenarios:

- Self-employed individuals: May claim additional deductions for business-related expenses.

- Retirees: Could be eligible for certain retirement income exemptions.

- Families with dependents: Might access deductions for education-related costs.

Application Process & Approval Time

The application process typically involves completing specific sections of the Arkansas state tax return. Approval times can vary depending on the complexity of the claim and the accuracy of the submitted documents. Taxpayers should allow ample time for processing and consider contacting Arkansas tax offices for assistance or any required clarifications.