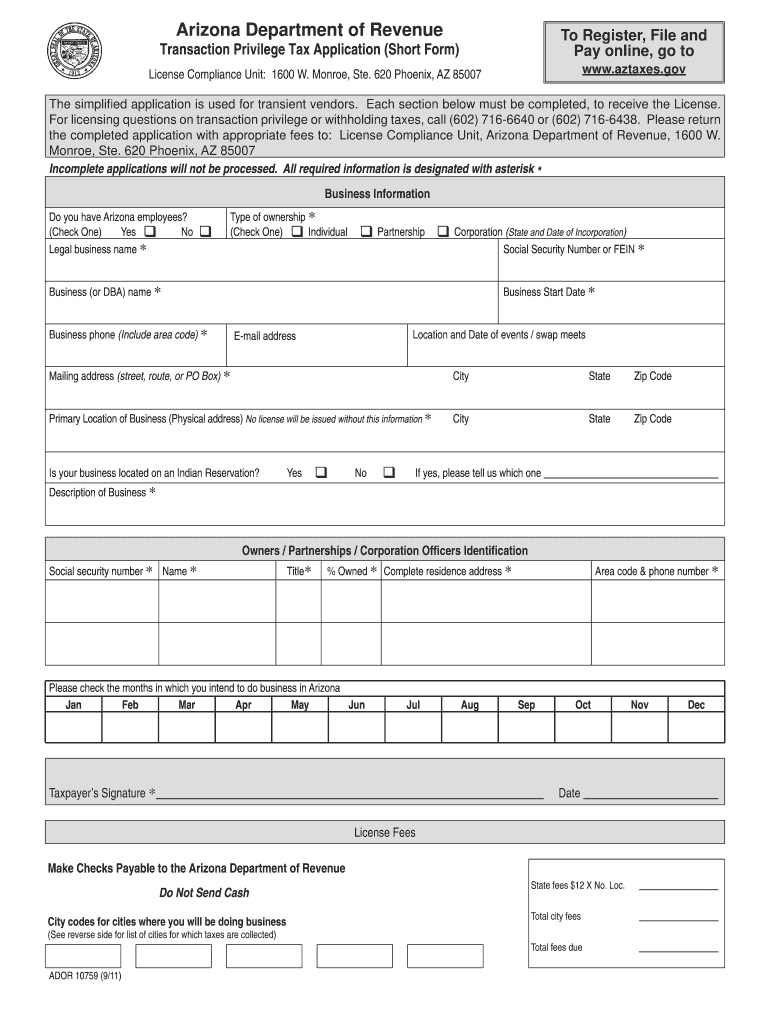

Definition & Meaning of the Arizona Transaction Privilege Tax Application Short Form 2011

The Arizona Transaction Privilege Tax (TPT) Application Short Form 2011 is a streamlined document utilized for registering businesses to collect transaction privilege taxes in Arizona. This form simplifies the process for transient vendors, allowing them to efficiently apply for a TPT license, which is essential for engaging in sales within the state.

The transaction privilege tax is essentially a sales tax levied on businesses for the privilege of conducting business activity within Arizona. It is important to understand that this tax applies not only to goods sold but also to various services. The short form typically captures essential information regarding the business, its ownership structure, and other relevant operational details that the Arizona Department of Revenue requires for approval.

Key Components of the TPT Application Short Form

- Business Information: This includes the business name, type, and operational address.

- Ownership Structure: Applicants must define whether they are a sole proprietor, partnership, corporation, or another business entity type.

- Event Location: For transient vendors, specifying the event or location where business activities will take place is crucial.

- Fees: Knowledge of applicable fees associated with the registration process is necessary for completion.

Steps to Complete the Arizona Transaction Privilege Tax Application Short Form 2011

Completing the Arizona TPT Application Short Form systematically ensures that you provide all required information accurately, minimizing processing delays. The following steps outline how to fill out the form effectively:

- Gather Required Information: Collect your business details, including ownership specifics and event location.

- Fill in Business Information: Enter your business name and address accurately, and specify the nature of your business activities.

- Define Ownership Structure: Clearly mark the type of ownership, as this impacts future tax obligations.

- Specify Event Location: If applicable, identify the specific location of your transient business activities.

- Review Fees: Confirm that you are aware of the fees involved with your application and ensure you budget accordingly.

- Double-Check Your Information: Before finalizing the application, verify that all sections are complete and correct.

- Submit the Form: Choose your preferred submission method—either online, by mail, or in person.

How to Obtain the Arizona Transaction Privilege Tax Application Short Form 2011

Obtaining the Arizona TPT Application Short Form 2011 can be done through various channels:

- Online Access: The form is available for download from the Arizona Department of Revenue's website, ensuring easy access.

- In-Person Requests: You can request a physical copy directly from a local Arizona Department of Revenue office.

- Third-Party Tax Services: Some tax preparation companies offer access to relevant forms, including the TPT application.

Important Considerations

- Ensure that you have the most current version of the form, as previous versions might not be accepted.

- If you are unsure how to navigate the state resources, consider consulting with a tax professional, particularly if you’re a first-time applicant.

Reasons to Use the Arizona Transaction Privilege Tax Application Short Form 2011

Utilizing the TPT Application Short Form 2011 is crucial for businesses operating within Arizona for several reasons:

- Compliance: Registering for a TPT license is mandatory for any commercial activity within the state, ensuring compliance with state tax laws.

- Legitimacy: The license serves as a legitimate endorsement from the state, which can enhance consumer trust.

- Tax Collection: With a TPT license, businesses can legally collect taxes from customers, enabling them to remit tax revenues appropriately.

Common User Scenarios

- Transient Vendors: Those participating in fairs, festivals, or other temporary events benefit from the short form's simplicity.

- Startups: New businesses looking to establish themselves in Arizona must complete this application as part of their setup.

Key Elements Related to the Arizona Transaction Privilege Tax Application Short Form 2011

Understanding the key elements of the Arizona TPT application is fundamental for successful completion. These elements typically include:

- Contact Information: Basic contact details of the applicant for follow-up or clarification.

- Identification Numbers: If applicable, provide past tax identification numbers or business registration numbers to streamline processing.

- Required Documentation: Accompanying documents may be necessary, such as a copy of your Arizona Business License or any other related tax documentation.

Security and Compliance

- Data Protection: When submitting the application, provide sensitive information securely to maintain compliance with state regulations.

- Record-Keeping: Keep copies of the TPT application, as well as any correspondence with the Arizona Department of Revenue, for your records.

Legal Considerations for the Arizona Transaction Privilege Tax Application Short Form 2011

The legal implications of failing to register for a TPT license can be significant, including potential penalties and back tax liabilities. As such, understanding the legal framework surrounding the TPT is essential for businesses:

- Compliance Requirements: Businesses must comply with not only state tax laws but also local ordinances that may affect how TPT is applied.

- Penalties for Non-Compliance: Failing to register or pay the required taxes can lead to fines or legal action by state authorities.

Importance of Staying Informed

- Frequent changes in tax legislation could affect business operations, making it important to stay updated through state resources or legal advisories focusing on tax issues.

Overall, understanding each aspect of the Arizona Transaction Privilege Tax Application Short Form 2011 enhances business readiness and legal compliance in the state of Arizona, empowering businesses to operate confidently within the parameters of state tax law.