Definition & Meaning of Mortgage Loan Application

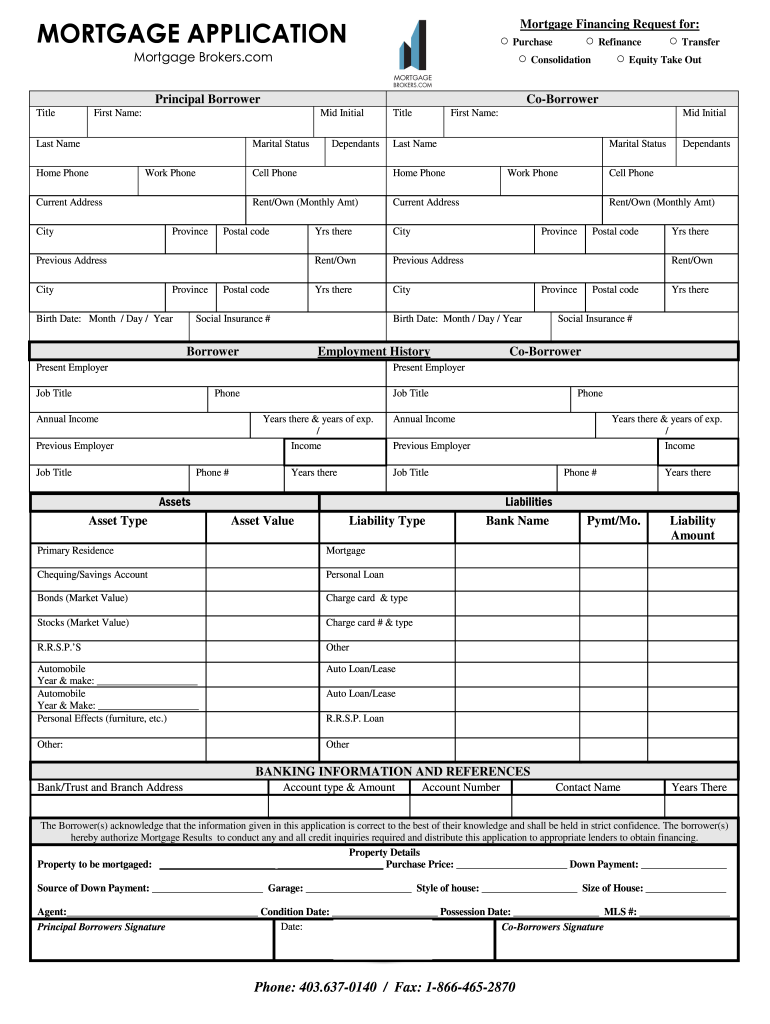

The mortgage loan application is a structured form used to gather critical financial and personal information necessary for obtaining a mortgage. It serves as an official request for a loan secured by real property and outlines various options for mortgage financing, including purchase, refinance, transfer, consolidation, and equity take-out. The application is essential for lenders to assess the borrower's creditworthiness and ability to repay the loan.

In general, the mortgage loan application includes detailed sections on:

- Personal Information: This includes the principal borrower’s and co-borrower’s names, addresses, social security numbers, and contact details.

- Employment History: Lenders require a record of employment for at least two years, including employer names, positions held, and salary details.

- Financial Overview: The application requests information about assets, liabilities, and any additional income sources to give lenders a complete picture of the borrower's financial standing.

- Property Details: Information related to the property being financed, including its address, type (single-family home, condo, etc.), and intended use (primary residence, rental, etc.), is gathered to ascertain the loan's risk.

This comprehensive collection of data allows lenders to analyze the applicant’s financial situation and determine whether to approve the loan for the requested amount.

Steps to Complete the Mortgage Loan Application

Completing a mortgage loan application involves several clear steps that ensure all necessary information is correctly provided. Here’s a structured approach to filling out the form:

-

Gather Necessary Documents: Before starting the application, collect all relevant documents. This typically includes:

- Identification (e.g., driver's license, passport)

- Proof of income (pay stubs, tax returns)

- Details about your debts and assets (bank statements, investment accounts)

- Information on the property (listing agreement, purchase contract)

-

Fill Out Personal Information: Enter your details and those of any co-borrowers. Accuracy is crucial, as discrepancies can delay processing.

-

Add Employment History: List all relevant employment information, ensuring it covers at least the past two years. Include names, addresses, job titles, and length of employment.

-

Detail Financial Information: Provide a complete view of your finances, including:

- Assets: Checking and savings accounts, retirement accounts, real estate owned

- Liabilities: Any current debts, including student loans, credit cards, and car loans

- Monthly expenses for accurate debt-to-income ratio calculations

-

Specify Property Information: Complete the section related to the property you intend to finance. Be prepared to share details about its value, condition, and purpose.

-

Review and Submit: Double-check all entries for accuracy and completeness before submission. An incomplete application can lead to delays. Submit the application via the chosen method—online, by mail, or in-person—to your lender.

By carefully following these steps, applicants can facilitate a smoother approval process for their mortgage loan.

Key Elements of the Mortgage Loan Application

Understanding the key elements of the mortgage loan application is essential for prospective borrowers. These components provide insights into what lenders are looking for when evaluating a loan request:

-

Borrower Information: This section captures personal details, including full names, contact information, and social security numbers of all borrowers involved.

-

Income Verification: Lenders ask for comprehensive information regarding the borrower's income to assess financial stability. This includes:

- Base salary

- Bonuses or commissions

- Any side income from rental properties or investments

-

Debt Information: Applicants must disclose all outstanding debts. This helps lenders calculate the debt-to-income (DTI) ratio, a critical measure of financial health.

-

Asset Disclosure: The application requires disclosure of assets to assure lenders of the borrower's financial backing. Common assets include:

- Bank balances

- Investment accounts

- Real estate and other properties

-

Property Details: Prospective borrowers must provide specifics about the property they wish to purchase or refinance, including its purchase price, property type, and whether it will be owner-occupied or rented out.

-

Acknowledgment Section: This area emphasizes the importance of the information's accuracy. Borrowers typically sign to affirm that the data provided is true and to authorize a credit check.

Mastering these elements is vital for applicants to enhance their chances of securing mortgage approval and also ensures transparency with the lender.

Important Terms Related to Mortgage Loan Application

Understanding key terms associated with mortgage loan applications aids in navigability and improves communication with lenders. Here are some of the essential terms one should know:

-

Principal: The amount borrowed or the remaining balance on a loan, excluding interest.

-

Interest Rate: The cost of borrowing expressed as a percentage of the principal, which significantly affects the total repayment amount.

-

Debt-to-Income Ratio (DTI): A financial measure used by lenders, calculated by dividing total monthly debt payments by gross monthly income. A lower DTI indicates better financial health.

-

Loan-to-Value Ratio (LTV): This ratio compares the amount of the mortgage loan to the appraised value of the property, influencing loan approval and terms.

-

Pre-approval vs. Pre-qualification: Pre-approval involves a thorough credit check and verification of financial documents, resulting in a conditional loan offer, while pre-qualification is a less formal estimate based on the borrower's self-reported financial data.

-

Escrow: A third party holds funds or documents on behalf of the borrower and lender until specified conditions are met, often used in property transactions to protect both parties.

Familiarity with these terms allows borrowers to better understand the mortgage process and communicate effectively with lenders.

Required Documents for Mortgage Loan Application

Various documents are necessary for a mortgage loan application, ensuring that lenders have a comprehensive understanding of the borrower's financial status. Here’s a breakdown of the essential documentation required:

-

Identification: Valid government-issued photo ID, such as a driver's license or passport, to verify identity.

-

Proof of Income: Recent pay stubs, tax returns (typically for the past two years), W-2 forms, or 1099 statements for self-employed individuals.

-

Financial Statements: Recent bank statements covering checking and savings accounts, investment account details, and any other asset documentation.

-

Credit History: Lenders will require authorization to run a credit report, assessing creditworthiness and existing liabilities.

-

Asset Documentation: Verify tangible and liquid assets through statements for retirement accounts, investment portfolios, and properties owned.

-

Property Information: In cases where a specific property is involved, provide a sales contract, property listing, or information on appraisals relevant to the transaction.

Gathering these documents beforehand can streamline the application process and minimize delays in loan approval. Each piece of documentation plays a critical role in depicting the borrower's financial health and ability to manage the loan.