Definition and Meaning

A claim voucher is a formal document used as a statement of charges or claim for payment. Typically utilized in business or governmental settings, a claim voucher details amounts that are owed for goods or services provided. This document serves as a key component in financial transactions, allowing organizations to keep accurate records of expenses and verify claims before processing payments.

How to Use the Claim Voucher

When using a claim voucher, it is important to follow a structured process to ensure accuracy and compliance with financial protocols. This typically includes:

- Preparation of the Claim: Gather all necessary information, such as vendor details, billing information, and the specific goods or services provided.

- Completing the Form: Carefully fill out each section of the voucher, ensuring all required fields are completed accurately. This might include dates of service, invoice numbers, and amounts owed.

- Authorization: Obtain the necessary signatures from authorized personnel to validate the claim.

- Submission: Submit the completed claim voucher to the appropriate department for processing.

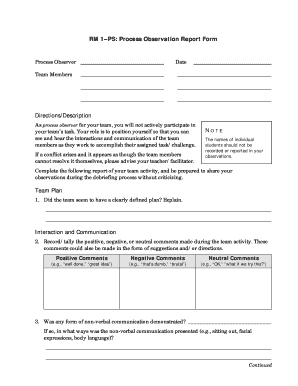

Steps to Complete the Claim Voucher

Completing a claim voucher involves detailed documentation and verification. Follow these steps to ensure the process is handled properly:

- Collect all Necessary Documentation: Ensure that all invoices, receipts, and relevant documentation are organized and available.

- Fill In Required Fields: Enter all pertinent information such as vendor name, amount claimed, dates, and descriptions of services.

- Verify Accuracy: Double-check the accuracy of all entered information to avoid any discrepancies.

- Approval: Route the voucher for approval by the designated authorities, ensuring that all required signatures are obtained.

- Submit for Processing: After approval, submit the form to the financial or accounting department for payment processing.

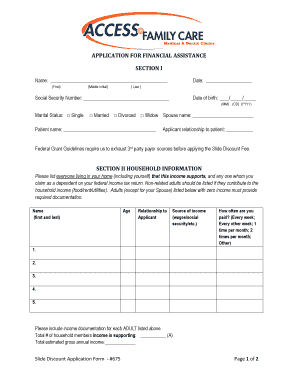

Key Elements of the Claim Voucher

A comprehensive claim voucher should contain specific elements that facilitate payment processing and validation:

- Vendor Information: Includes name, address, and contact information.

- Details of the Claim: Descriptions of goods or services provided, including dates and itemization.

- Invoice Number: A unique identifier for the transaction linked with the claim.

- Amount: The total cost for the goods or services provided.

- Authorization Signatures: Signatures from authorized personnel validating the legitimacy of the claim.

Legal Use of the Claim Voucher

The legal use of a claim voucher involves compliance with relevant governmental and organizational regulations. Important considerations include:

- Accuracy and Honesty in reporting all transactions, ensuring that all claims are legitimate.

- Adhering to Internal Policies for voucher usage, ensuring all steps are followed correctly.

- Compliance with State and Federal Laws, observing any applicable regulations concerning the use of claim vouchers in financial transactions.

Who Typically Uses the Claim Voucher

Claim vouchers are used by a variety of individuals and organizations including:

- Government Agencies: Often used to process payments for services and goods.

- Businesses: To record payable amounts to vendors or suppliers.

- Non-Profit Organizations: To keep track of expenses and payments.

- Accounting Departments: For verifying and processing payments, ensuring accurate financial records.

Important Terms Related to the Claim Voucher

Understanding specific terminology associated with claim vouchers can enhance clarity and efficiency:

- Invoice: A detailed bill showing the amounts and costs of the product or service provided.

- Approver: The person responsible for reviewing and validating the claim.

- Payer: The entity or individual responsible for the actual payment of the claim.

- Remittance: The action of sending money in payment or as a gift, especially by mail.

Penalties for Non-Compliance

Failure to adhere to the correct procedures when using claim vouchers can result in a range of penalties, including:

- Financial Penalties: Fines or corrective actions imposed on the organization or individuals responsible for inaccurate claims.

- Legal Consequences: Possible legal action for fraudulent claims or misreporting.

- Internal Sanctions: Disciplinary action within the organization for failure to comply with internal protocols or regulatory standards.