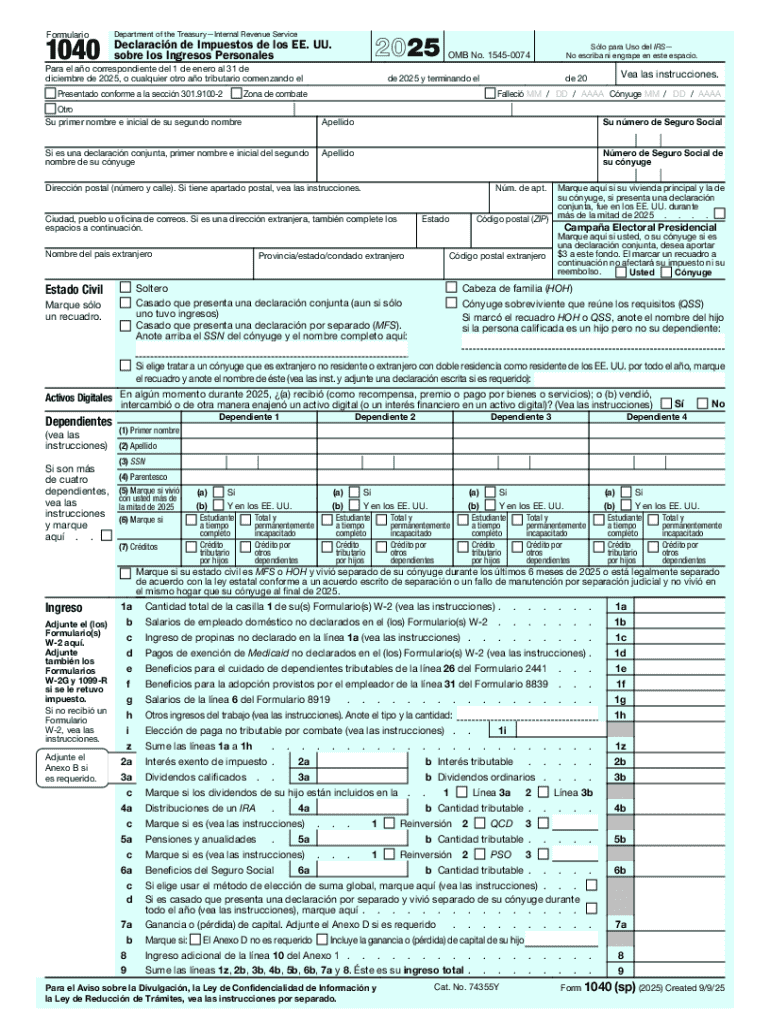

Definition and Purpose of the 2025 Form 1040 (sp)

The "2025 Form 1040 (sp)" is the Spanish version of the U.S. Individual Income Tax Return for the 2025 tax year. Primarily intended for Spanish-speaking taxpayers, this form facilitates the declaration and reporting of an individual's annual income to the Internal Revenue Service (IRS). This form is essential for determining tax obligations, eligibility for refunds, and compliance with U.S. tax laws.

- Primary Function: It enables taxpayers to calculate their total taxable income and tax liability.

- Target Audience: Spanish-speaking residents or citizens of the United States.

- Legal Mandate: Filing the Form 1040 is a legal requirement under the U.S. tax code, ensuring accountability in financial reporting.

Steps to Complete the 2025 Form 1040 (sp)

Completing the 2025 Form 1040 (sp) involves several key steps to ensure accuracy and compliance with tax regulations. Here is a detailed breakdown of the process:

-

Gather Necessary Documents:

- Collect all financial documentation, including W-2s and 1099 forms, to report income accurately.

- Retain records of deductions and credits, such as receipts for charitable donations and educational expenses.

-

Fill Out Personal Information:

- Accurately enter personal details such as your name, Social Security number, and filing status.

- Ensure consistency with previous filings to avoid discrepancies.

-

Report Income:

- List all sources of income, including wages, dividends, and any business income.

- Utilize proper documentation to ensure amounts are reported correctly.

-

Claim Deductions and Credits:

- Identify applicable deductions and credits to lower your tax liability.

- Common deductions include mortgage interest and student loan interest.

-

Calculate Tax Liability:

- Use the IRS-provided tax tables to determine total tax owed.

- Consider using tax software for accurate calculations.

-

Complete Payment and Filing:

- Arrange payment for any taxes owed by the stipulated deadline.

- File the form either online through IRS e-file or by mailing the completed form.

How to Obtain the 2025 Form 1040 (sp)

Securing the 2025 Form 1040 (sp) can be done through multiple channels:

-

Online Resources:

- Downloadable from the IRS website, ensuring you have the most updated version.

- Accessible through tax preparation software platforms, which integrate the form into their systems.

-

Physical Copies:

- Obtainable at local IRS offices or through authorized tax service providers.

- Copies may also be available at certain public libraries or community centers catering to Spanish-speaking populations.

Key Elements of the 2025 Form 1040 (sp)

Ensuring clarity and correctness in the following components is crucial when completing the form:

-

Filing Status:

- The chosen status, such as single, married filing jointly, or head of household, impacts tax rates and standard deductions.

-

Income Declaration:

- Income must be accurately reported in designated sections, corresponding to different income types like wages and business income.

-

Tax Credits and Deductions:

- Proper application of credits and deductions can significantly reduce overall tax liability.

-

Signatures and Date:

- Both the taxpayer and any preparer must sign and date the form to validate its authenticity.

IRS Guidelines for the 2025 Form 1040 (sp)

Adhering to IRS guidelines ensures compliance and helps avoid potential penalties:

-

Accuracy in Reporting:

- Provide accurate figures backed by documentary evidence, as discrepancies may trigger audits.

-

Timeliness:

- File by the prescribed deadline to avoid late fees.

-

Amendments:

- Use Form 1040-X if amendments are necessary after submission.

Filing Deadlines and Important Dates

Being aware of the timeline is essential for timely compliance:

- Standard Deadline: The IRS usually sets the filing deadline for April 15th of each year.

- Extensions: Request an extension if needed, but note that payment deadlines remain unchanged.

Required Documents for the 2025 Form 1040 (sp)

Efficient preparation involves gathering all necessary documentation:

- Income Documents: W-2s, 1099s, and records of any additional income.

- Deduction Records: Invoices, receipts, and statements.

- Previous Year Returns: Helpful for referencing past tax situations and ensuring continuity.

Form Submission Methods: Online, Mail, and In-Person

There are several options for submitting the form:

-

Online Submission:

- Fast and efficient through IRS e-file or approved tax software.

-

Mail:

- Send the completed form to the appropriate IRS office address, based on your residence.

-

In-Person:

- Direct submission at local IRS offices is possible, though less common.

Penalties for Non-Compliance with the 2025 Form 1040 (sp)

Failing to correctly file or pay taxes can lead to significant consequences:

- Late Filing Penalties: Failure to file on time incurs fees and interest charges.

- Underreporting Penalties: Providing inaccurate information may result in substantial fines.

- Legal Repercussions: In severe cases, non-compliance might lead to legal actions, including audits or court proceedings.

Understanding these aspects of the 2025 Form 1040 (sp) ensures Spanish-speaking taxpayers can accurately and efficiently manage their annual tax responsibilities in the United States.