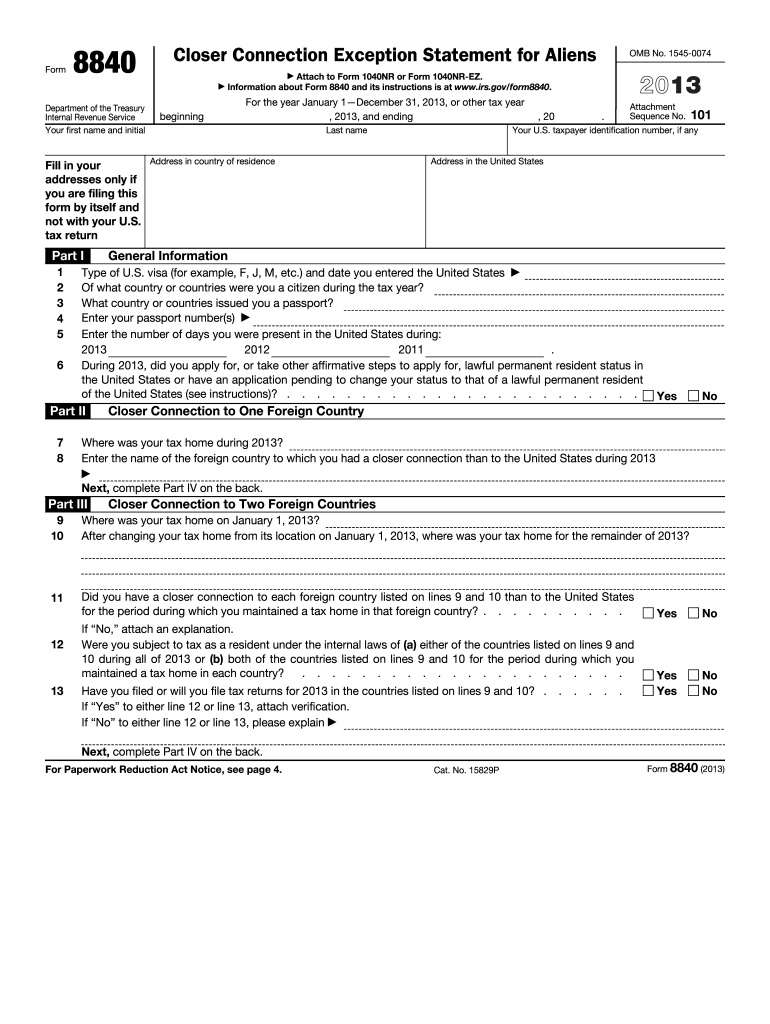

Definition and Purpose of Form 8840

Form 8840, known as the Closer Connection Exception Statement for Aliens, is a document designed by the IRS to allow nonresident aliens to claim a closer connection to a foreign country than to the United States for tax purposes. This form is crucial in helping individuals avoid being classified as U.S. residents under the substantial presence test, which can significantly impact their tax obligations. Nonresident aliens use this form to provide detailed information about their connection to a foreign jurisdiction versus the United States, thereby establishing eligibility for the exception.

Eligibility Criteria for Filing Form 8840

To qualify for the closer connection exception, individuals must meet several specific criteria. Primarily, nonresident aliens must not exceed 183 days spent in the United States during the current year. Furthermore, they should have a tax home in a foreign country throughout the year, and demonstrate significant connections with that country rather than the U.S. These connections can include factors such as permanent residence, family ties, business activities, and cultural or social ties. The form requires detailed information about these connections to ensure accurate assessment by the IRS.

How to Obtain Form 8840

Obtaining Form 8840 is straightforward. The IRS provides this form on its official website, IRS.gov, where individuals can download the PDF version directly. Alternatively, the form can be acquired through tax professionals or IRS taxpayer assistance centers. Users seeking a digital solution can upload the form into DocHub, which offers a variety of tools to fill out, annotate, and store documentation securely. DocHub’s integration with cloud services like Google Drive also allows for seamless document management and data preservation.

Steps to Complete Form 8840

Completing Form 8840 involves several key steps. Individuals must first download the form and gather all relevant information, including travel records, visa status, and additional documentation supporting their foreign connections. The form requires detailed input of days spent in the U.S. and other countries, as well as comprehensive descriptions of the ties to foreign jurisdictions. Filling out all sections accurately is critical, with fields related to personal identity, visa status, and detailed narrative on the significant connections to the foreign home country.

IRS Guidelines for Form 8840

The IRS provides specific guidelines for the completion and submission of Form 8840. The form must be filed annually and should accompany the individual's nonresident alien tax return if required. The IRS highlights the importance of keeping thorough documentation supporting claims made on the form, as these may be audited. Taxpayers must ensure the form is submitted by the filing deadline applicable to their tax return, and any errors or omissions should be corrected promptly to avoid penalties.

Filing Deadlines and Important Dates

The deadline for submitting Form 8840 aligns with the taxpayer’s annual income tax return filing, typically due by April 15th. However, extensions may be available under specific circumstances, such as if the taxpayer is eligible for an automatic extension related to residing outside of the United States on the tax deadline. It's imperative to adhere to the filing timeline to prevent penalties for late submission. Missing the deadline may result in assuming U.S. resident status for tax purposes, which could increase the tax liability.

Required Documents for Supporting Form 8840

Supporting documentation for Form 8840 encompasses a variety of records to substantiate claims of closer connection to a foreign country. These documents can include foreign residency permits, employment and tax records in the foreign country, travel itineraries demonstrating days spent inside and outside the U.S., and records of family and business ties. Documenting the maintenance of a principal residence in the foreign country and any significant social or economic ties is essential to reinforce the claims listed on the form.

Examples and Scenarios for Using Form 8840

Several scenarios necessitate the use of Form 8840. For example, a Canadian citizen working temporarily in the U.S. but maintaining a primary residence and family ties in Canada would use this form to assert a closer connection to Canada. Similarly, international students studying in the U.S. might file Form 8840 to prove stronger ties to their home country if they intend not to change their tax residency status. Each case requires comprehensive documentation and accurate record-keeping to support the closer connection claim.

Penalties for Non-Compliance

Failure to submit Form 8840 may result in default classification as a U.S. tax resident under the substantial presence test. This status change can lead to higher taxes on global income, obligatory reporting of worldwide assets, and potential penalties for non-compliance. Timely and accurate submission of Form 8840, therefore, is crucial to avoid unintended tax consequences and to maintain compliance with IRS regulations. Ensuring that all eligibility criteria are continually met is key to preventing complications during audits or IRS reviews.