Definition and Meaning

The Evidence of Commercial Property Insurance is a document that provides proof of insurance coverage for commercial properties. This form serves as verification that a business has a valid insurance policy in place, protecting against potential risks and liabilities. It typically includes essential information such as the policyholder's name, insurance company details, coverage types, policy limitations, and the term of the insurance. This document is often required by lenders, landlords, or other entities to ensure that a business is financially protected in case of property damage or loss.

How to Use the Evidence of Commercial Property Insurance

This document is used to demonstrate that a business holds a sufficient insurance policy. Typically, it comes into play during three main scenarios:

- Lending Agreements: When securing loans, financiers often require businesses to provide this form to ensure collateral properties are insured.

- Lease Agreements: Landlords may request this form to verify that the tenant has adequate insurance, protecting both parties.

- Contractual Agreements: Vendors and partners might require it as part of contractual stipulations to confirm that business operations are adequately insured.

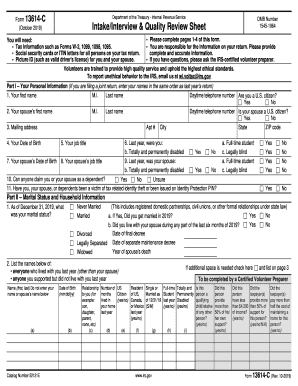

Steps to Complete the Evidence of Commercial Property Insurance

- Verify Policy Details: Ensure that your insurance policy is active and meet the required stipulations.

- Contact Your Insurer: Request the form directly from your insurance provider. They typically fill it out for you.

- Check Information for Accuracy: Review all details including coverage limits, policy numbers, and correct any mistakes.

- Distribute as Required: Provide the completed document to the requesting party, whether it be a financial institution, landlord, or business partner.

Why Should You Have Evidence of Commercial Property Insurance

Having this document provides several benefits, including:

- Risk Management: Shows proactive risk management, safeguarding your business against unforeseen incidents.

- Contractual Compliance: Fulfills legal and financial requirements in various agreements.

- Credibility: Enhances credibility with partners and clients, signaling a structured, reliable business approach.

Who Typically Uses the Evidence of Commercial Property Insurance

This form is predominantly used by:

- Business Owners: Ensures their commercial operations have necessary protective measures.

- Lenders and Financial Institutions: As part of due diligence to verify risk coverage.

- Property Owners and Landlords: To confirm tenant business operations maintain appropriate insurance levels.

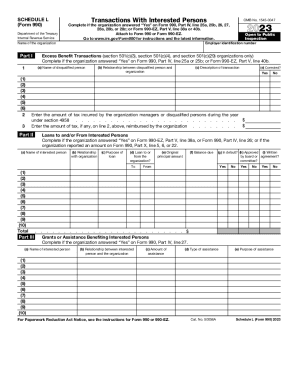

Key Elements of the Evidence of Commercial Property Insurance

The form generally contains the following sections:

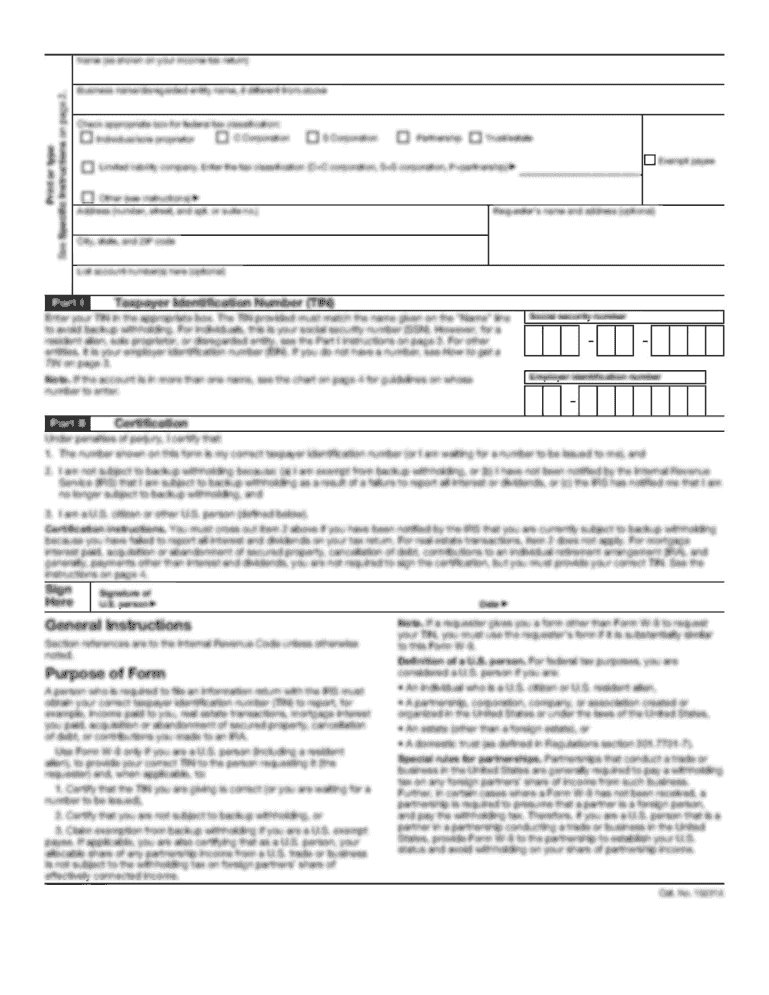

- Insured’s Information: Name and contact details of the policyholder.

- Insurer’s Details: Name and contact information of the insurance company.

- Coverage Details: Types of coverage, including property and liability aspects.

- Policy Information: Effective dates, policy number, and coverage amounts.

Important Terms Related to Evidence of Commercial Property Insurance

- Policyholder: The business or individual who owns the insurance policy.

- Premium: The payment made for the insurance policy.

- Deductible: The amount paid out of pocket before the insurer pays a claim.

- Coverage Limit: The maximum amount an insurance policy will pay for a covered loss.

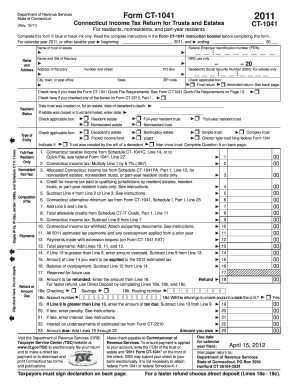

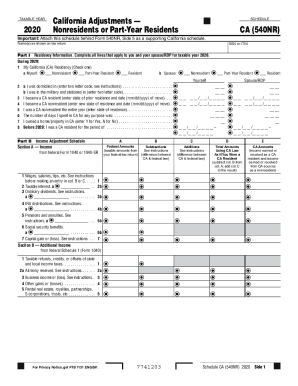

State-Specific Rules for Evidence of Commercial Property Insurance

While this document follows a general structure, specific state regulations might influence:

- Coverage Requirements: Different states might mandate unique insurance levels based on regional risks.

- Document Requirements: Variations in documentation standards or additional forms needed.

- Compliance Standards: Diverse state insurance board requirements that align with local legislation.

Examples of Using Evidence of Commercial Property Insurance

- Retail Chain Expansion: A retail business securing a loan for new stores must provide this document to show potential premises are insured.

- Office Space Leasing: A technology company provides insurance evidence to confirm they have coverage complying with lease agreements.

- Supplier Contracts: A manufacturing firm includes this document in agreements to guarantee to partners that production facilities are safeguarded.

By understanding these components, businesses can ensure comprehensive knowledge about their insurance documentation, remaining compliant and resilient against potential property risks.