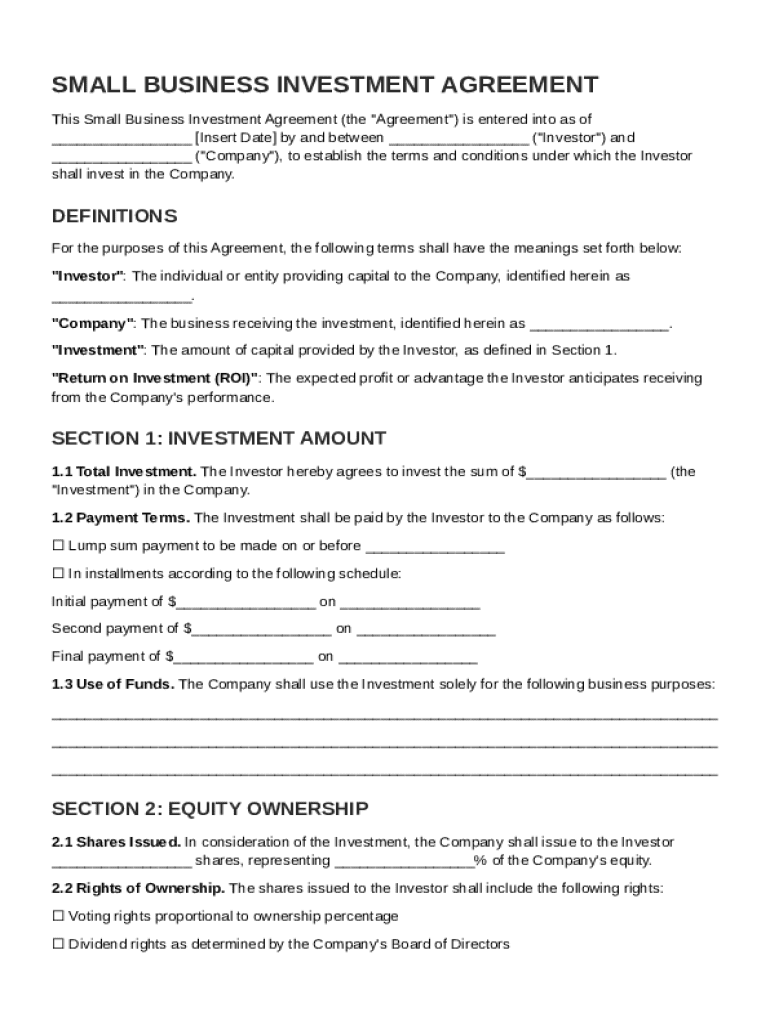

Definition & Meaning

A Small Business Investment Agreement Template is a formal document that outlines the terms and conditions under which an investor agrees to provide capital to a small business. This agreement serves as a foundational contract, detailing the rights, obligations, and expectations of both the investor and the business receiving the investment. It includes crucial elements such as investment amounts, payment terms, equity distribution, and exit strategies. Such documents are essential for clarifying the investment structure and ensuring both parties have a shared understanding of the transaction.

How to Use the Small Business Investment Agreement Template

To effectively use a Small Business Investment Agreement Template, both parties should follow a structured approach:

- Review Template: Familiarize yourself with the template’s structure, ensuring it fits the investment type and business model.

- Customize Terms: Modify sections such as payment schedules, equity stakes, and roles involved, tailoring them to reflect the specifics of your agreement.

- Consult Legal Experts: Engage a legal professional to review the drafted agreement, ensuring it aligns with legal requirements and adequately protects both parties' interests.

- Discuss with Investor: Meeting with investors to review the modified template allows for collaboration, ensuring all parties agree on the terms.

- Finalize Agreement: Upon reaching consensus, finalize the document for execution by obtaining the necessary signatures from all parties involved.

Steps to Complete the Small Business Investment Agreement Template

Completing a Small Business Investment Agreement Template involves several key steps that ensure accuracy and compliance:

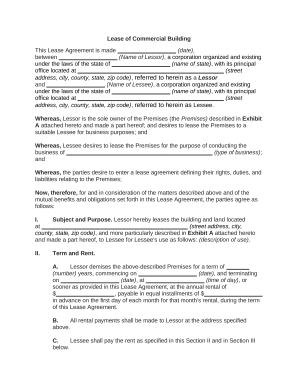

- Prepare Business Details: Gather and input essential information about the business, including names, addresses, and the nature of the business.

- Define Investment Terms: Clearly specify the investment amount, method of contribution (e.g., cash, stock), and timelines for delivery.

- Outline Equity Distribution: Detail the percentage of business equity the investor will receive in return for their investment.

- Include Management and Operational Roles: Clarify any involvement the investor will have in business operations or decision-making processes.

- Establish Exit Strategies: Define potential exit strategies, such as buyout options or IPO opportunities, outlining how the investor may liquidate their investment.

- Ensure Legal Compliance: Incorporate relevant legal clauses, addressing representations, warranties, and confidentiality provisions necessary for adherence to regulations.

Important Terms Related to Small Business Investment Agreement Template

Understanding important terms within the Small Business Investment Agreement Template is crucial for clarity:

- Equity Ownership: Represents the share of the company the investor receives in return for their capital investment.

- Exit Strategy: A plan that outlines how an investor can exit their investment, including potential return on investment.

- Representations and Warranties: Legal assertions by both parties guaranteeing certain facts and conditions are true at the time of the agreement.

- Confidentiality: Provisions ensuring that sensitive business information shared with the investor is not disclosed to unauthorized parties.

- Governing Law: Indicates which state laws will be used to interpret the agreement.

Key Elements of the Small Business Investment Agreement Template

Key elements of the Small Business Investment Agreement Template include:

- Definitions: Clarification of terms used throughout the agreement, ensuring mutual understanding between parties.

- Investment Amount and Method: Specifics regarding the total investment, including form (cash or other assets) and timing.

- Ownership and Equity Shares: Clear delineation of percentages of ownership awarded to the investor.

- Roles and Responsibilities: Description of the management roles, if any, that the investor will have within the business.

- Confidentiality Obligations: Terms that protect any confidential information shared between the parties during the investment process.

- Miscellaneous Provisions: Additional clauses that cover other aspects like amendments, notices, and dispute resolutions.

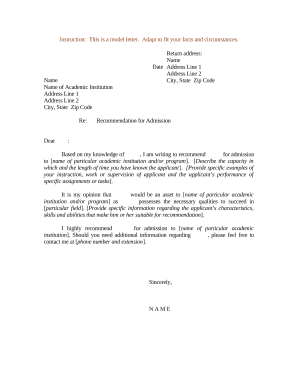

Legally Binding Electronic Signatures

In modern agreements, it's important that electronic signatures are understood and utilized effectively:

- Legality: Electronic signatures on the Small Business Investment Agreement Template are binding under the ESIGN Act, ensuring they hold the same legal weight as handwritten signatures.

- Creation: Signatures can be created using a variety of methods including drawing with a trackpad or uploading a scanned signature image.

- Authentication and Security: DocHub’s platform provides secure methods of capturing and storing electronic signatures, including the use of encryption and audit trails.

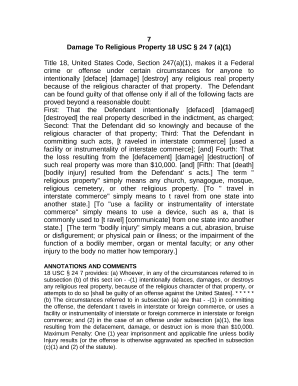

State-Specific Rules for the Small Business Investment Agreement Template

Given the U.S.-centric focus, understanding state-specific rules is critical:

- Varying Regulations: Each state may have unique requirements or protocols for investment agreements, necessitating customization of the template to comply with local laws.

- Legal Consultation: It is advisable to consult with a legal expert familiar with regional requirements to ensure that the template meets all applicable legal standards in the state where it will be executed.

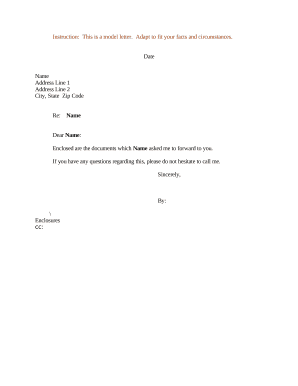

Software Compatibility

The Small Business Investment Agreement Template’s compatibility should be considered for ease of use:

- Document Formats: DocHub supports various file formats like DOC, PDF, and TXT, offering flexibility in document preparation and sharing.

- Cloud Integration: Direct compatibility with Google Workspace and other cloud services facilitates seamless document management and collaboration.

- Edit and Share: The platform’s integration capabilities allow documents to be easily edited and shared across devices and operating systems, ensuring that all parties can access and sign documents efficiently.