Definition and Meaning of "3 50%* - UW Credit Union"

The term "3 50%* - UW Credit Union" may refer to a specific financial product or promotion offered by the UW Credit Union. These types of terms often indicate specialized offers that include a promotional interest rate or credit facility designed for particular transactions or customer bases. UW Credit Union, known for offering personal loans, student loans, and credit consultation services, tends to craft such promotions to cater to diverse financial needs, encouraging members to engage more with their services.

Potential Promotions and Their Nature

- Interest Rate Promotions: The "50%*" notation might relate to a special interest rate offer, such as a reduction on interest rates for specific services such as loans or credit cards.

- Credit Facilities: The offer could encompass an initiative where a percentage of the credit usage is rewarded or acknowledged through cashback or interest rebates.

How to Use the "3 50%* - UW Credit Union"

Using an offer like "3 50%*" requires understanding the specific terms and conditions associated with it. Typically, such offers involve engaging with specific financial products or maintaining certain account conditions with the Credit Union.

Practical Implementation Steps

- Identify Applicable Products: Verify the range of products the offer applies to, such as savings accounts or credit facilities.

- Meet Eligibility Criteria: Ensure adherence to membership criteria and conditions, such as minimum deposit requirements or contractual obligations.

- Monitor Usage: Utilize promotional rates or benefits effectively by keeping track of their timelines and any associated limits.

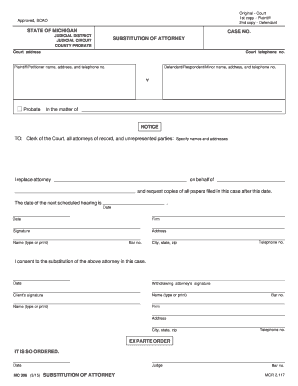

Steps to Complete the "3 50%* - UW Credit Union"

Completing processes related to financial offers or forms from the UW Credit Union entails precise adherence to their described procedures.

Detailed Process

- Gather Necessary Information: Collect required personal or financial documentation.

- Understand the Terms: Review any terms and conditions linked with the offer to ensure compliance.

- Submit Application: Provide the completed form or application through designated methods like online submissions or in-person visits.

Key Elements of the "3 50%* - UW Credit Union"

The key elements of such financial offers generally include interest rates, reward mechanisms, eligibility criteria, and usage terms.

Common Components

- Interest Rate: Reduced or promotional rates applied to specific products.

- Rewards System: Potential cashback or rebates based on credit usage.

- Eligibility Requirements: Specific criteria that dictate participant eligibility.

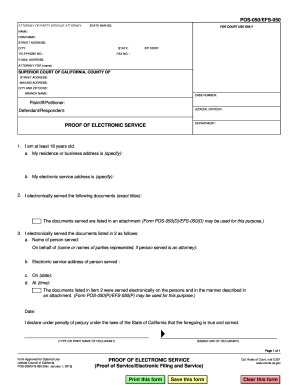

Legal Use of the "3 50%* - UW Credit Union"

Legal considerations are essential when engaging with financial offers to ensure compliance with federal and state laws.

Legal Framework

- Compliance with Regulations: Follow federal and state financial regulations, such as anti-discrimination laws.

- Contractual Obligations: Understand contractual obligations stipulated by the offer to avoid legal repercussions.

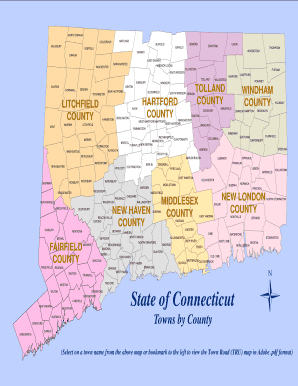

State-Specific Rules for the "3 50%* - UW Credit Union"

Financial promotions can vary by state due to regulatory differences and specific legislation affecting credit unions.

Considerations Based on Location

- Regulatory Variations: Different states may have unique regulations that affect the applicability or structure of credit offers.

- State-Specific Benefits: In some instances, state laws might provide additional consumer protections or benefits.

Examples of Using the "3 50%* - UW Credit Union"

Exploring practical usage scenarios can elucidate the advantages of engaging with such financial promotional offers.

Scenario Examples

- Interest Rate Reduction: Members may take advantage of lower interest rates for specified loan types.

- Cashback Offers: Utilizing a credit card with cashback applied to particular sectors like retail or groceries.

Who Typically Uses the "3 50%* - UW Credit Union"

These kinds of promotional offers often target specific customer segments within the UW Credit Union membership.

Typical Users

- Students: Often targeted for special student loan rates or credit card features.

- First-Time Borrowers: Promos may appeal to new members or first-time borrowers to establish credit usage.

Each block here provides in-depth coverage on various aspects of "3 50%* - UW Credit Union," ensuring readers are well-informed about the subject with maximum utility and precision.