Definition and Purpose of Form IT-370

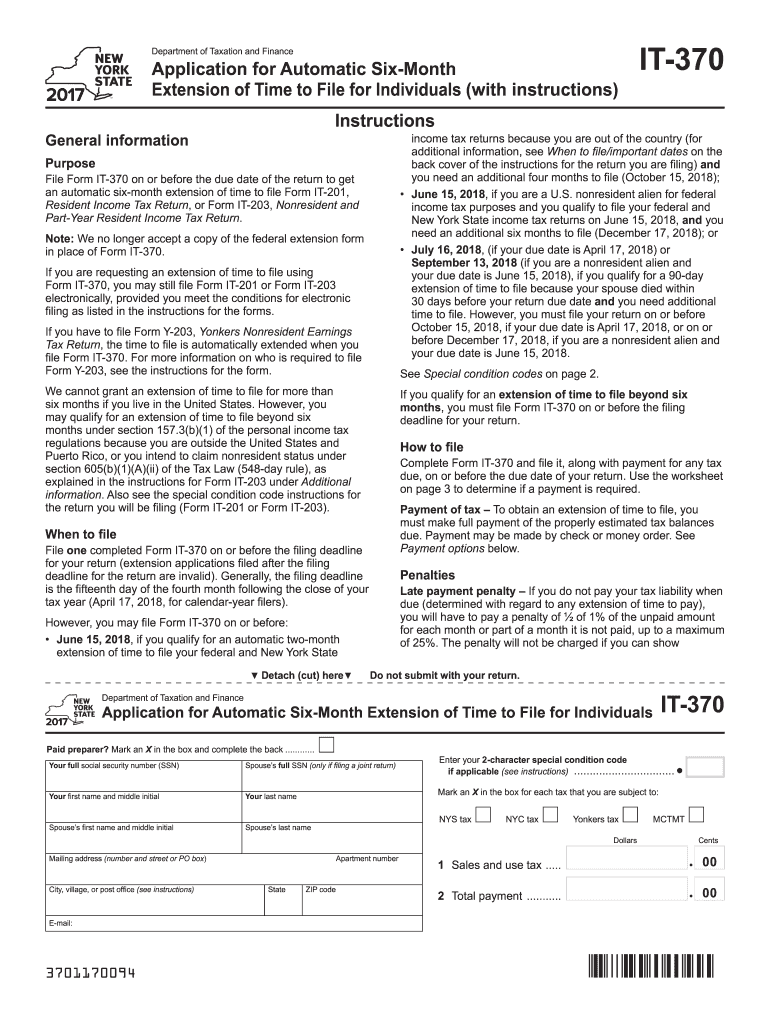

Form IT-370, specifically for the year 2017, is designed for individuals seeking an automatic six-month extension to file their New York State income tax returns. This form pertains to taxpayers who need additional time to submit their tax documents, such as Form IT-201 or IT-203. It outlines specific guidelines and requirements to remain compliant with state tax laws and avoid penalties associated with late filing.

How to Use Form IT-370

To effectively use the IT-370 form, individuals must accurately complete and submit it by the original tax filing deadline. The form serves as a formal request for more time to file, not an extension for payment. Therefore, any tax due should be estimated and paid by the original deadline to avoid interest charges and late payment penalties. This section explains how to complete essential fields and what information is crucial for a successful filing.

How to Obtain Form IT-370

Individuals can obtain the IT-370 form through several methods, ensuring ease of access:

- Downloading from the official New York State Department of Taxation and Finance website.

- Ordering a physical copy by calling the department's automated service line.

- Visiting local Taxpayer Assistance Centers.

Each method is outlined with detailed instructions on steps to secure the form, allowing filers to choose the most convenient option.

Steps to Complete Form IT-370

Filing Form IT-370 requires careful attention to detail. The steps include:

- Enter personal information, including name and Social Security number.

- Estimate total income tax liability for the year.

- Subtract any tax amount already paid to calculate the balance due.

- Specify the amount you are paying with the extension request.

- Ensure all data is accurate, and sign the form.

These steps are designed to help taxpayers navigate the filing process accurately and efficiently. Additional subsections offer example calculations and explain common errors to avoid.

Who Typically Uses Form IT-370

Form IT-370 is commonly used by:

- Individuals who need more time to organize their financial records.

- Married couples filing jointly who require additional time for coordination.

- Self-employed individuals requiring extra time for accurate income reporting.

Understanding the typical users helps tailor instructions and address common concerns this demographic may encounter during the filing process.

Filing Deadlines and Important Dates

Submitting Form IT-370 must occur by the original tax return due date to be valid. Typically, for tax year 2017, this deadline coincides with the federal tax deadline in April. Failure to file on time may result in the denial of an extension request, emphasizing the significance of timely submissions.

Certain taxpayers may have unique deadlines due to extenuating circumstances, such as military service or residing abroad. These exceptions are highlighted with relevant examples.

Required Documents for Form IT-370

To successfully file Form IT-370, gather relevant documents, including:

- Previous year’s tax returns for reference.

- Documentation of estimated tax payments, such as withholding statements or estimated tax payment receipts.

- Records of income, deductions, and credits expected for the current tax year.

These documents ensure accurate calculation of tax liability and payment amounts. A detailed breakdown of various forms, such as W-2s and 1099s, is included to help taxpayers prepare comprehensively.

Penalties for Non-Compliance

Failing to file or inaccurately completing Form IT-370 might lead to penalties. These include:

- Interest charges on unpaid taxes starting from the original due date.

- Additional penalties for late payment if no payment accompanies the extension request.

- Potential future audits if inaccuracies suggest a pattern of non-compliance.

Outlining the consequences reinforces the importance of compliance and proactive payment of estimated taxes due.

Digital vs. Paper Version of Form IT-370

Form IT-370 can be submitted digitally or in paper form:

- Online submission offers a faster, more streamlined process with immediate confirmation of receipt.

- Paper submissions, while traditional, may incur postal delays but serve those without internet access.

Discussing both options provides a complete understanding of submission methods, helping filers select the most appropriate path for their circumstances. Comparison of benefits and potential drawbacks aids in informed decision-making.

Software Compatibility and Support

Tax preparation software such as TurboTax and QuickBooks can assist in filing Form IT-370, providing:

- Pre-filled information based on prior filings.

- Accurate calculations of estimated tax due.

- E-filing capabilities directly through the program.

Users benefit from the software’s user-friendly interfaces and robust customer support, ensuring a straightforward filing process. Examples of software functionality help clarify its practical application.