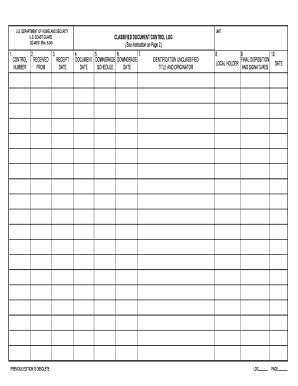

Definition and Meaning

The "Do not send to the Oklahoma Tax Commission" phrase is specific to particular documents related to Oklahoma tax matters. It indicates that these forms, typically for internal use or documentation purposes, should not be submitted to the Oklahoma Tax Commission. Instead, they are meant for personal records or to be provided to another entity, such as an employer or financial institution. This instruction is crucial for ensuring that the documentation follows the intended process.

How to Use the Form

Successfully utilizing the form requires understanding its purpose and the entities involved. The form generally includes information essential for record-keeping or third-party submission. To utilize it correctly:

- Review the instructions at the top of the document to determine its purpose.

- Compile any necessary information, such as taxable income figures or refund details.

- Follow any included guidelines for completing specific sections.

- Retain a copy for personal records or provide it to the designated entity as instructed.

Steps to Complete the Form

Completing this form involves several steps to ensure accuracy:

- Gather Required Information: Collect all necessary financial details, including income, deductions, and credits.

- Fill in Personal Details: Enter the taxpayer’s name, address, and identification number.

- Report Financial Data: Carefully input taxable income and refund information where required.

- Authorize Electronic Transactions: If applicable, complete sections related to electronic payments and direct deposits.

- Sign and Date: The taxpayer, as well as any involved preparers, must provide signatures.

Who Typically Uses These Forms

Such forms are commonly used by individuals and entities that engage in electronic filing for taxes in Oklahoma. This includes:

- Taxpayers: Both individuals and businesses that file taxes.

- Tax Preparers: Professionals who prepare and file taxes on behalf of others.

- Financial Institutions: Entities that require documentation for verification purposes.

Key Elements of the Form

The form contains several key components that need careful attention:

- Taxpayer Information: Includes demographic details and taxpayer identification.

- Income Reporting: Sections for detailing income levels and tax liabilities.

- Consent Sections: Authorization for transactions like direct deposits.

- Signatures: Spaces for the taxpayer and preparers to affirm the information’s accuracy.

State-Specific Rules

Oklahoma has unique regulations affecting the use of tax forms:

- Separate Guidelines: Distinct rules may dictate how forms interact with state tax systems.

- Filing Procedures: Certain documents must align with Oklahoma-specific filing practices.

- Compliance Requirements: Ensure adherence to state law regarding tax documentation and filing procedures.

Legal Use Considerations

Understanding the legal context is critical:

- Record Keeping: Legal obligations may require retaining certain forms for a specified period.

- Validity: Ensure that the document is completed accurately and meets all legal standards.

- Privacy Compliance: Follow guidelines to protect taxpayer information.

Examples of Using the Form

Practical scenarios highlight the form's application:

- Self-Employed Individuals: Use for itemizing business expenses and income.

- Students: Submit to institutions for financial aid verification without sending to the tax authority.

- Companies: Provide to auditors as part of financial records keeping.

Electronic vs. Paper Version

Two formats cater to different preferences:

- Digital Version: Allows for electronic completion and storage, simplifying data management.

- Paper Version: Some prefer this when computer access is limited or for tangible record-keeping.

Filing Deadlines

Awareness of crucial dates prevents late submissions:

- Tax Year Considerations: Filing aligns with the standard tax calendar.

- Deadlines for Particular Forms: Specific due dates may apply to the release or usage of certain documents, depending on their internal purpose.

Penalties for Non-Compliance

Failure to adhere to guidelines can result in repercussions:

- Missed Deadlines: May incur fines or interest on unpaid taxes.

- Incorrect Submissions: Errors could lead to audits or penalties from the IRS or state authorities.

- Record Mismanagement: Lapses in documentation can create compliance issues later.

Through thoughtful preparation and understanding, individuals and businesses can navigate the requirements associated with the "Do not send to the Oklahoma Tax Commission" directive, ensuring compliance and proper record-keeping.