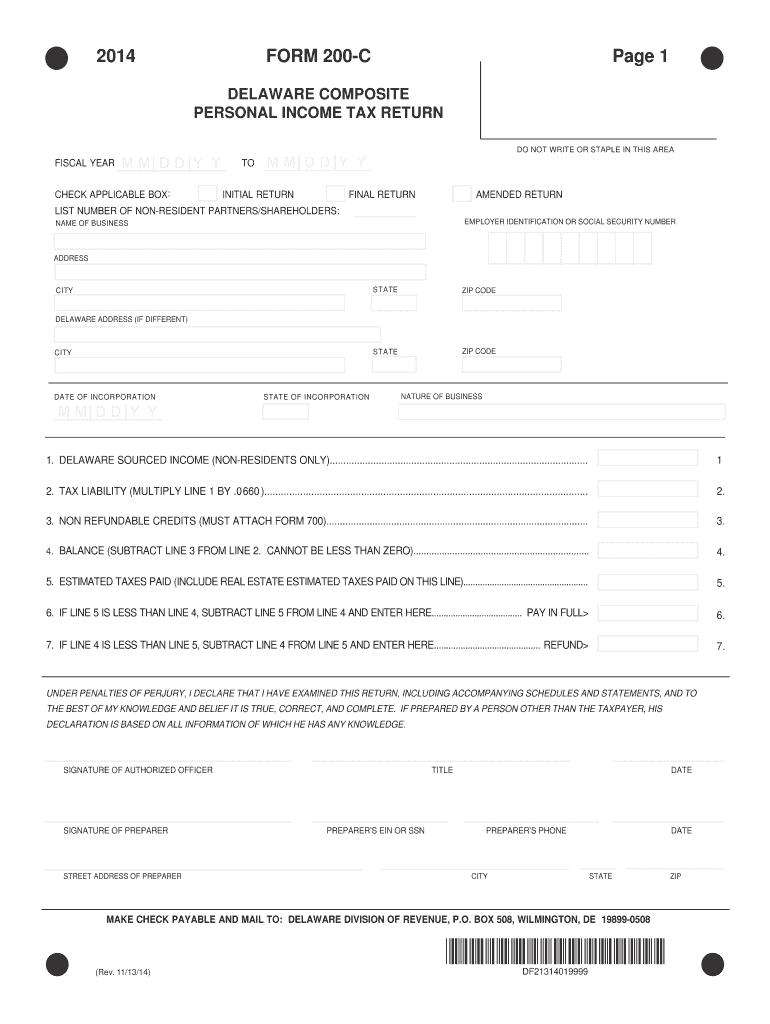

Definition and Meaning of Form 200-C 2014

Form 200-C 2014 is the Delaware Composite Personal Income Tax Return specifically designed for non-resident shareholders of S corporations or partners in partnerships. The form is significant for individuals who must report income derived from Delaware sources but are not residents of the state. The purpose of this form is to streamline the process of tax filing for these individuals, ensuring they comply with Delaware tax regulations promptly and accurately.

How to Use Form 200-C 2014

To effectively use Form 200-C 2014, non-resident shareholders or partners must gather all income statements related to Delaware sources. They should accurately report income, deductions, and any credits applicable to the tax year 2014 on this form. The form is designed to consolidate individual tax liabilities into a single composite filing, which helps avoid the need for each individual to file separately. It's crucial to follow the instructions on the form meticulously to ensure accuracy and compliance with tax laws.

Steps to Complete Form 200-C 2014

-

Gather Necessary Information:

- Collect financial statements from Delaware sources, including K-1 forms from S corporations or partnerships.

- Obtain details of any tax credits or deductions applicable.

-

Fill Out the Form:

- Complete the personal information section, including the identifying details of the entity.

- Enter income and deductions accurately on the relevant lines.

-

Calculate Taxes:

- Use the form’s instructions to calculate the tax owed based on the composite income of the non-resident members.

- Include any adjustments for credits or other applicable benefits.

-

Review and Sign:

- Cross-check the form for accuracy and completeness.

- An authorized officer of the entity must sign the form.

-

Submit:

- Submit the completed form to the Delaware Division of Revenue by the specified deadline.

Important Terms Related to Form 200-C 2014

- Composite Filing: A single filing method for a group of non-resident individuals, simplifying the tax process by consolidating liabilities.

- K-1: A tax document used to report income, deductions, and credits from partnerships or S corporations to an individual’s tax return.

- Non-Resident Shareholders/Partners: Individuals who own shares or have a partnership interest in a Delaware-based entity but do not reside in Delaware.

Key Elements of Form 200-C 2014

Form 200-C 2014 comprises several critical sections, each requiring careful attention:

- Personal Information: Details of the corporate or partnership entity filing the return.

- Income Reporting: Accurate reporting of Delaware-sourced income relevant to non-resident shareholders or partners.

- Deductions and Credits: Documentation and application of any state-specific deductions or credits.

- Signature and Authorization: The form must be authenticated by an authorized officer of the filing entity.

Filing Deadlines and Important Dates

- Deadline: The Form 200-C 2014 must be submitted by the fifteenth day of the third month following the close of the taxable year (March 15 for calendar-year filers).

- Extensions: Extension requests must be submitted before the original filing deadline to avoid penalties.

Required Documents for Form 200-C 2014

- K-1 Forms: From relevant S corporations or partnerships.

- Income Statements: Documenting Delaware-sourced income.

- Verification Documents: Supporting eligibility for deductions or credits claimed.

- Authorization: Documentation confirming the authority of the individual signing the form on behalf of the entity.

Who Typically Uses Form 200-C 2014

This form is primarily used by:

- S Corporations: Delaware-based corporations with non-resident shareholders needing to report Delaware income.

- Partnerships: Partnerships where partners receive income from Delaware sources and are not Delaware residents.

- Qualified Non-Residents: Individuals receiving income from partnerships or corporations operating in Delaware.

Form Submission Methods (Online, Mail)

- Online Submission: Available through the Delaware Division of Revenue’s electronic filing systems for faster processing.

- Mail Submission: Completed forms can be sent via postal service to the designated address provided by the Delaware Division of Revenue.

- In-Person Submission: Though less common, forms can also be hand-delivered to the Revenue Office if preferred.

Penalties for Non-Compliance

Failure to file Form 200-C 2014 accurately and on time may result in:

- Financial Penalties: Late filing or underpayment penalties as determined by the Delaware Division of Revenue.

- Interest on Unpaid Taxes: Accumulating interest on any taxes not paid by the due date.

- Legal Repercussions: Potential legal actions for continued non-compliance or fraudulent reporting.

Software Compatibility (TurboTax, QuickBooks)

- TurboTax and QuickBooks: Software like TurboTax or QuickBooks might assist taxpayers in preparing Form 200-C 2014, although they should verify compatibility specifically for composite returns and Delaware tax forms.

- Tax Professionals: Consulting with a tax professional may be advisable for those unfamiliar with composite filings to ensure accuracy and compliance.

Selecting these blocks ensures comprehensive coverage of Form 200-C 2014, providing essential details and procedural guidance tailored to users’ needs, particularly those based in the United States seeking compliance with Delaware tax laws.