Definition & Purpose of the SC990-T Form

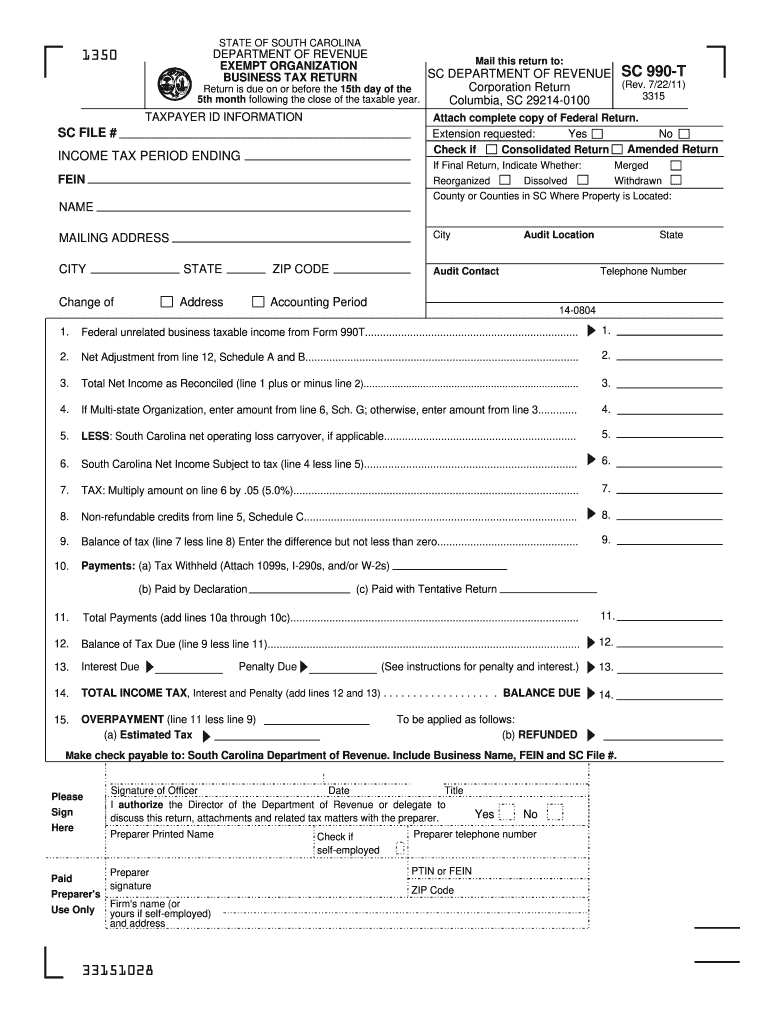

The SC990-T form, officially known as the South Carolina Exempt Organization Business Tax Return, is used by organizations to report unrelated business income. This form is essential for exempt organizations, such as nonprofits, that need to declare income from activities not directly related to their primary exempt purpose. By completing this form, organizations can calculate and pay any taxes due on their unrelated business income.

Key Features

- Reporting unrelated business income for exempt organizations.

- Mandatory for organizations with gross income of $1,000 or more from unrelated business activities.

- Includes income adjustments, deductions, and credits specific to this type of income.

Practical Example

Consider a nonprofit organization that operates a gift shop. Even though the organization is exempt from tax, the income from the gift shop is considered unrelated business income and must be reported using the SC990-T form to determine if any taxes are owed.

How to Use the SC990-T Form

Organizations must accurately document unrelated business income, adjustments, and applicable deductions on the SC990-T form. This requires a thorough understanding of what constitutes unrelated business income according to IRS guidelines.

Steps for Usage

- Gather Financial Records: Compile all income and expense documents related to the unrelated business activities.

- Calculate Gross Income: Determine the total income from all unrelated business activities.

- Deduct Expenses: Subtract all legitimate business expenses directly connected to the unrelated activities.

- Complete the Form: Fill out the SC990-T form with precise figures, ensuring all sections are accurately completed.

- Review and Submit: Double-check all details before submitting the form to the South Carolina Department of Revenue.

Steps to Complete the SC990-T Form

Completing the SC990-T form requires attention to detail to ensure compliance and accuracy. Organizations must follow specific steps to correctly fill out the form.

Procedure

- Identify Unrelated Business Activities: Clearly define which activities generate unrelated income.

- Document Income and Expenses: Use detailed financial records to list all income and corresponding expenses.

- Calculate Tax: Apply the appropriate tax rates to the net income derived from the unrelated business activities.

- Fill Out Tax Information: Enter all calculated values into the respective sections of the form.

- Attach Required Schedules: If applicable, include any necessary schedules or attachments to support the figures reported.

- Sign and Date: Ensure the form is signed by an authorized representative before submission.

Required Documents for Filing

Accurate documentation is crucial when preparing the SC990-T form. Organizations must ensure they have all necessary documents to support their income and expense claims.

Commonly Required Documents

- Detailed profit and loss statements for unrelated business activities

- Receipts for deductible business expenses

- Contracts or agreements related to the business activities

- Federal Form 990-T copy, if applicable

Filing Deadlines and Important Dates

Timeliness is critical in filing the SC990-T form. Missing deadlines can lead to penalties and interest charges.

Key Deadlines

- Due Date: The SC990-T form is due on the 15th day of the fifth month after the close of the tax year.

- Extensions: Organizations may request an extension if additional time is needed to prepare the form, but any taxes due should still be paid by the original due date.

Legal Use of the SC990-T Form

Proper use of the SC990-T form ensures compliance with state tax laws and avoids potential legal issues for the organization.

Compliance and Regulations

- Organizations must correctly classify and report unrelated business income according to IRS definitions.

- Failure to accurately complete or timely file the form could result in penalties, interest, and potential revocation of exempt status.

Penalties for Non-Compliance

Non-compliance with SC990-T filing requirements can result in severe financial repercussions for exempt organizations.

Potential Penalties

- Late Filing Penalties: Fees are assessed for each month or part of a month the return is late, based on the amount of tax owed.

- Underpayment Penalties: Failure to pay the full tax amount owed by the due date can result in additional penalties and interest.

- Loss of Exempt Status: Repeated non-compliance or fraudulent reporting can jeopardize the organization's tax-exempt status.

Form Submission Methods

Organizations have several options for submitting the SC990-T form. Choosing the appropriate method depends on the organization's resources and preferences.

Available Submission Options

- Online Filing: Utilize e-filing systems available through the South Carolina Department of Revenue's website.

- Mail Submission: Send a completed paper form and payment to the designated address.

- In-Person Submission: Deliver the form directly to a local Department of Revenue office for processing.

State-Specific Rules for the SC990-T Form

While the SC990-T form is specific to South Carolina, state-specific nuances can impact filing requirements and procedures.

State Rules and Considerations

- Organizations must comply with South Carolina-specific definitions of unrelated business activities.

- Certain exemptions or deductions may differ from federal rules, requiring careful consideration during form preparation.

Digital vs. Paper Version

Choosing between digital and paper versions of the SC990-T form can affect efficiency and accuracy.

Digital Filing Benefits

- Speed: E-filing offers faster processing times.

- Accuracy: Digital platforms often include checks for common errors.

- Confirmation: Immediate confirmation upon submission.

Paper Filing Considerations

- Documentation: Retain copies of all submitted materials for your records.

- Manual Checking: Additional time may be needed to manually review the form for errors.