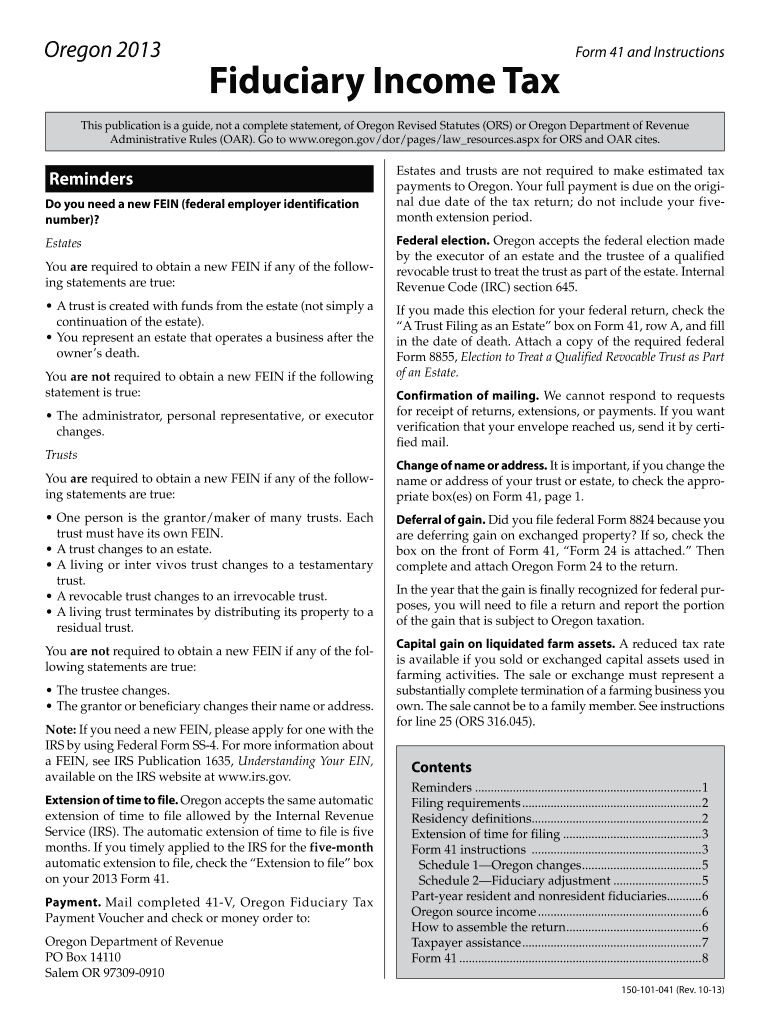

Definition and Purpose of Oregon Form 41 (2013)

Oregon Form 41 for the year 2013 is a fiduciary income tax return form used specifically for estates and trusts. This form is essential for reporting income, deductions, and other pertinent financial details related to fiduciary interests in the state of Oregon. Its primary purpose is to ensure compliance with state tax regulations by accurately reflecting the financial activities of estates and trusts. Through this form, the state of Oregon can assess the appropriate taxes due based on the financial data provided.

Steps to Complete Oregon Form 41 (2013)

-

Gather Required Documentation: Before starting, ensure you have all necessary documents, including income statements, deduction records, and any credits related to the fiduciary entity.

-

Obtain a Federal Employer Identification Number (FEIN): An FEIN is essential for formal identification of the estate or trust. Follow IRS guidelines to secure this number if not already obtained.

-

Fill Out Income Information:

- Enter the total income received by the estate or trust. This includes dividends, interest, and any other taxable income.

-

Document Deductions and Credits:

- Detail all applicable deductions and credits on the form. This step is critical for ensuring that the taxable income is calculated accurately.

-

Calculate Tax Due:

- Use the outlined formula to determine the total tax obligation based on the reported income and deducted amounts.

-

Review for Accuracy and Completeness: Carefully check all sections for errors or omissions that could result in processing delays or penalties.

-

Submit the Form: File the form with the Oregon Department of Revenue either online, by mail, or in person following submission guidelines.

Filing Deadlines and Important Dates

Filing the Oregon Form 41 for 2013 must adhere to deadlines to avoid penalties. Typically, the deadline matches the federal filing deadline for tax returns, usually April 15 of the following year. Extensions may be granted under specific conditions, but these must be requested proactively to be considered.

Legal Use and Compliance

Form 41 is used strictly for fiduciary tax reporting in Oregon. It's legally required to ensure accurate and timely payment of taxes by estates and trusts. Failure to comply with filing requirements can result in penalties, interest on overdue taxes, and potential legal ramifications. It's essential to understand the legal responsibilities associated with using this form.

Key Elements of Oregon Form 41 (2013)

- Part One: Identifies the fiduciary entity, including name and FEIN.

- Part Two: Captures income details and total income calculations.

- Part Three: Lists deductions and credits applicable for estates and trusts.

- Part Four: Computes the tax liability based on net income.

Each part demands precise information and careful attention to detail to ensure proper tax assessment and payment.

State-Specific Rules for Filing

Oregon has specific state laws governing fiduciary income tax that may not align with federal regulations. For instance, adjustments to taxable income or specific fiduciary adjustments unique to Oregon should be made as instructed. Understanding these nuances helps prevent errors and ensures compliance with state tax law.

Examples of Using Oregon Form 41 (2013)

For practical application, consider a trust established to manage financial affairs for a beneficiary. The income generated through investments held under the trust must be reported accurately using Form 41. Deducting expenses related to managing these assets can significantly impact the taxable income, showcasing the form's critical role in fiduciary financial management.

IRS Guidelines and Compliance

While Oregon Form 41 relates to state taxes, adherence to IRS guidelines for federal reporting is also necessary. Estates and trusts might need to file federal returns, and ensuring consistency between federal and state filings is crucial. This entails using the same FEIN and aligning income and deductions reported on both state and federal forms.

Required Documents for Filing

Filing Form 41 requires specific documents, such as:

- Income statements detailing dividends, interest, and other gains

- Records of deductible expenses

- Copies of federal returns if required for additional verification

Ensuring these documents are complete and accurate aids in the smooth processing of the form and minimizes the risk of errors.

Eligibility Criteria

Form 41 is exclusively for estates and trusts with financial activities occurring in Oregon. Both revocable and irrevocable trusts are required to file if they meet the income thresholds as stipulated by Oregon tax law. Understanding who is required to file helps in avoiding unnecessary penalties.

Penalties for Non-Compliance

Failing to submit Oregon Form 41 or doing so inaccurately can result in significant fines, calculated based on the overdue taxes and duration of delay. Interest on unpaid taxes continues to accrue, thus amplifying the financial impact. Ensuring timely and accurate filing mitigates these risks and promotes fiscal responsibility for fiduciary entities.