Definition and Meaning of MO-1040

MO-1040 is the form used for the Missouri Individual Income Tax Return, which individuals in Missouri use for reporting their income taxes. The form helps taxpayers calculate their taxable income, deductions, exemptions, and credits against state taxes for a specific calendar year. By filing the MO-1040, individuals ensure compliance with the Missouri Department of Revenue requirements, contributing their fair share to state funds.

Components of the MO-1040

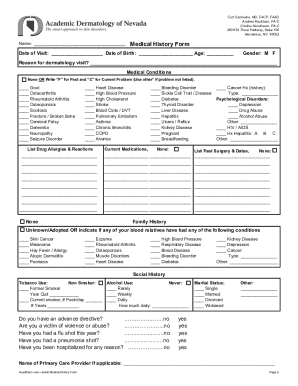

The MO-1040 includes several sections that taxpayers must complete accurately:

- Personal Information: This section collects basic identification details such as the taxpayer’s name, address, Social Security number, and filing status.

- Income Calculations: Taxpayers report their total income earned from various sources, such as wages, dividends, and interest.

- Deductions and Exemptions: Individuals list applicable deductions and exemptions to reduce taxable income, including available standard and itemized deductions.

- Payments and Credits: This segment details tax payments made throughout the year, including tax credits and rebates available to eligible taxpayers.

How to Use the MO-1040

Completing the MO-1040 requires careful preparation and attention to detail. Taxpayers need to ensure all income sources are reported, along with claiming applicable deductions and credits.

- Gather Documents: Collect all necessary documentation such as W-2s, 1099s, and receipts for deductible expenses.

- Calculate Income: Sum any wages, salaries, and additional income streams.

- Deduct Allowances: Apply eligible deductions and exemptions to lower taxable income.

- Determine Tax Liability: Calculate the total tax owed after credits and payments.

- Submit the Form: Complete all required sections and submit the form via the Missouri Department of Revenue's recommended methods.

How to Obtain the MO-1040

The MO-1040 form is readily accessible through various channels:

- Download from the Missouri Department of Revenue Website: Visit their official site to download the form in PDF format.

- Order by Phone or Mail: Request a paper copy by contacting the Missouri Department of Revenue directly.

- Pickup at Tax Assistance Centers: Obtain printed forms from local tax offices or assistance centers.

Digital Version Availability

The electronic version of the MO-1040 can be utilized through tax software compatible with Missouri's requirements, facilitating an easier process for digital filing.

Steps to Complete the MO-1040

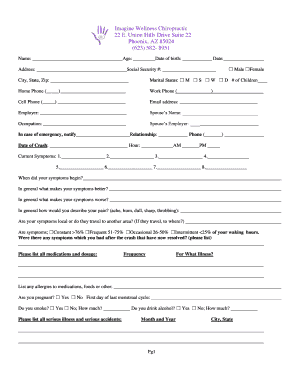

Completing the MO-1040 involves a series of detailed steps. Taxpayers must ensure all calculations and reported information are precise:

- Personal Information Entry: Start with filling out personal information and selecting the filing status.

- Income Reporting: Use supporting documents to list all income precisely.

- Apply Deductions and Exemptions: Detail out deductions and exemptions for which you qualify.

- Calculate Total Tax: After deductions and credits, determine the total tax liability.

- Review and Correct: Double-check all entries for accuracy before submission.

Who Typically Uses the MO-1040

The MO-1040 is utilized by individuals residing or earning income in Missouri who need to file their state income tax returns. These can include:

- Residents: All Missouri residents earning a minimum income set by the state need to file.

- Non-Residents and Part-Year Residents: Those who have lived in the state part of the year or have income earned in Missouri.

- Self-Employed Individuals: Entrepreneurs and freelancers who operate within Missouri.

Important Terms Related to MO-1040

Understanding the terminology associated with Missouri's tax return process is crucial:

- Filing Status: Defines eligibility criteria for deductions and tax rates (e.g., single, married).

- Standard Deduction: A fixed-dollar amount taxpayers can deduct from their taxable income.

- Tax Credits: Programs to reduce the amount of taxes owed, like the Missouri Earned Income Credit.

- Exemptions: Allowances that reduce taxable income based on dependent members.

Legal Use of the MO-1040

Using the MO-1040 correctly ensures taxpayers remain in good standing with state laws, complying with all regulations set by the Missouri Department of Revenue. Legal use involves:

- Accurate Reporting: Providing true and complete data on all aspects of income, deductions, and credits.

- Timely Submission: Adhering to submission deadlines to avoid penalties.

- Amendments and Corrections: Filing amendments for any errors made on the original return.

Filing Deadlines and Important Dates for MO-1040

Taxpayers need to be aware of critical dates for the MO-1040 submission:

- Filing Deadline: Generally due by April 15th.

- Extensions: Requests for filing extensions must be submitted before the initial deadline.

- Payment Dates: Taxes owed must be paid by the filing deadline to avoid interest and penalties.

Understanding and respecting these deadlines ensures compliance and minimizes stress related to late filings.