Understanding NY Form Use 2013

NY Form Use 2013 is a document used in New York State for reporting, compliance, or data submission processes. Forms like this are often utilized by businesses, individual taxpayers, or entities to ensure their activities align with state regulations. It's essential for users to comprehend the specific purposes and requirements of the form to ensure accuracy and compliance.

Definition & Meaning

-

NY Form Use 2013: The form serves a specific reporting or compliance function within New York State's legal framework. Understanding the form's purpose, whether it's related to taxes, sales, or data collection, is crucial.

-

Key Elements: Typical components include fields for personal or business information, reported figures, and specific documentation requirements, among other items relevant to its primary function.

How to Obtain the NY Form Use 2013

-

Online Platforms: Most New York State forms, including NY Form Use 2013, can be downloaded from official government websites. Navigate to the appropriate section on the New York State Department's website to find the form.

-

Physical Copies: For those who prefer hard copies, the form may be available at state offices or by request through mail by contacting relevant New York State departments.

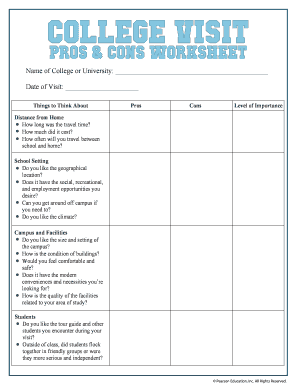

Steps to Complete the NY Form Use 2013

-

Gather Required Documents: Identify all necessary documents and information needed to complete the form, such as taxpayer identification, relevant financial records, and any previous filings that may relate.

-

Fill Out Personal and Business Details: Enter all required personal or business information. Ensure accuracy in details such as names, addresses, and identification numbers.

-

Detail Reporting Figures or Information: Carefully fill in all numerical data or descriptive sections. Double-check figures to avoid errors that might lead to incorrect reporting.

-

Review and Verify Entries: Before submission, review the entire form for any discrepancies or omissions. Verify all entered data against sourced documents.

-

Sign and Date: Ensure the form is signed and dated where applicable. Unsigned forms may not be processed or considered valid.

-

Submit Form: Depending on the form’s specific requirements, submit it online, via mail, or in-person to the designated state office.

Who Typically Uses the NY Form Use 2013

-

Businesses: Often used by businesses operating in New York State for tax, sales, or operational reporting.

-

Individuals: Some forms may have personal applications, requiring individuals to submit reports or applications to state entities.

-

Institutions and Organizations: Depending on the form's purpose, educational institutions, non-profits, or other organizations may need to file.

Important Terms Related to NY Form Use 2013

-

Taxpayer ID: A unique identifier for an individual or business within the tax system, often required for form completion.

-

Filing Deadline: The final date by which the completed form must be submitted to avoid late penalties.

-

Submission Process: The methods available for form submission, including electronic, paper, or in-person.

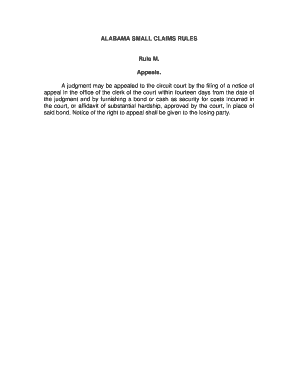

Legal Use of the NY Form Use 2013

-

Compliance: Properly filing this form ensures compliance with New York State laws and regulations related to its function, whether tax-related or otherwise.

-

Penalties for Non-Compliance: Failing to file the form by deadlines or incomplete submissions may result in penalties, fees, or legal repercussions.

Key Elements of the NY Form Use 2013

-

Filing Requirements: A clear understanding of what needs to be reported, including financial information, supporting documents, and other requirements.

-

Sections and Fields: A breakdown of sections within the form and their specific purpose, such as identification, reporting figures, and declarations.

Form Submission Methods

-

Online: Many prefer the convenience of online submissions which are often tracked and verified quickly.

-

Mail: Traditional submission through post, which can be slower but preferred for those without internet access.

-

In-Person: Dropping off forms at designated offices may offer immediate confirmation of receipt and allow for any questions.

Examples of Using the NY Form Use 2013

-

Tax Filings: An example scenario could include a small business using the form to report use tax or sales data.

-

Compliance Reporting: Another scenario could involve an organization filing to comply with state regulatory requirements or data submission mandates.

State-Specific Rules for the NY Form Use 2013

-

New York Regulations: Understand and adhere to unique New York State regulations associated with the form to ensure accuracy and compliance.

-

State Amendments: Stay informed on any legislative changes that may affect the form's content or filing procedures.

Providing this detailed guidance allows users to navigate the NY Form Use 2013 with confidence, ensuring that they fulfill their obligations accurately and effectively.