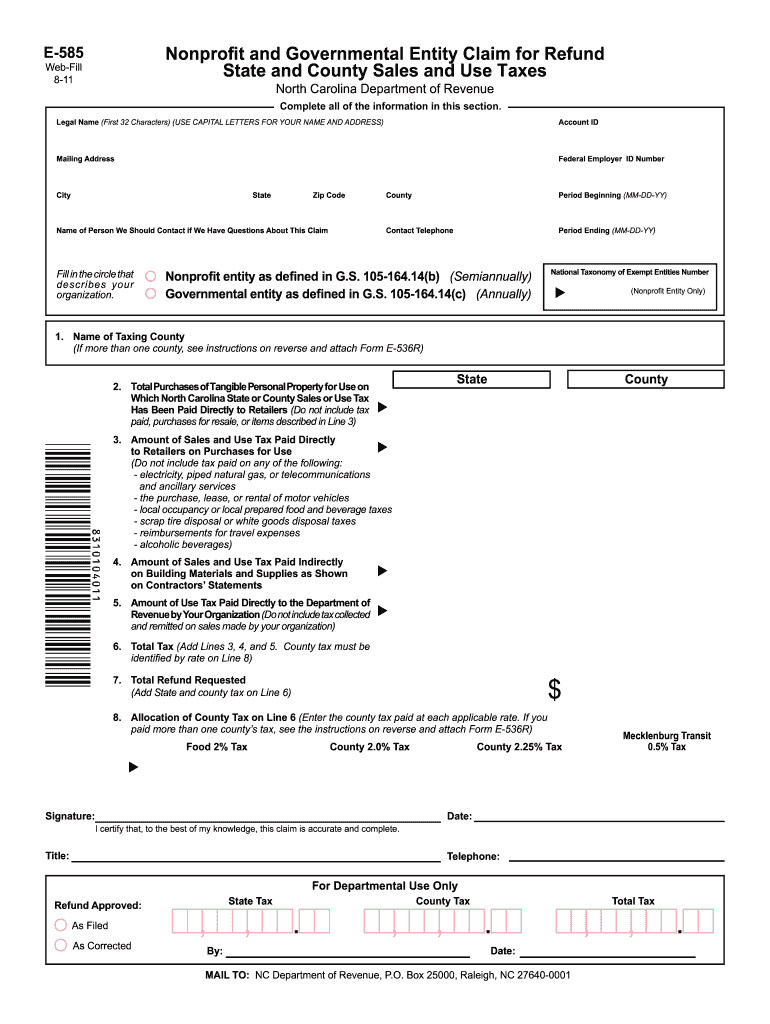

Definition and Meaning of NC DOR E-585

The NC DOR E-585 form is specifically designed for nonprofit and governmental entities in North Carolina to claim refunds of state and county sales and use taxes. It enables these organizations to recover certain tax amounts, easing their financial burdens and ensuring compliance with tax exemptions available to them. The form requires detailed entries concerning the organization’s identity, periods of tax applicability, total amounts purchased, and taxes already paid to the state. Understanding its official purpose and structure helps users accurately report these figures and comply with legal stipulations.

Steps to Complete the NC DOR E-585

-

Obtain Entity Information: Start by accurately completing your organization’s name, address, and federal employer identification number (FEIN). This ensures that the return is properly filed under your entity’s record.

-

Declare Eligible Purchases: Itemize your organization's eligible purchases during the claim period, including the date and description of each purchase.

-

Calculate Refundable Tax: Subtract the taxable from non-taxable purchases to determine the refund amount. This step requires careful verification to avoid discrepancies.

-

Attach Necessary Documents: Provide copies of invoices or receipts verifying each listed transaction to support your claim. Ensure these documents correlate with the entries on the E-585 form.

-

Verification and Submission: Double-check all entered information for accuracy and completeness. Sign and date the form, then submit it according to the outlined methods – either via mail, online submission, or in-person filing.

Why Use the NC DOR E-585

Using the NC DOR E-585 ensures that nonprofit and governmental entities recoup taxes for which they are exempt. This reclaiming process is crucial for maintaining organizational budgets and ensuring that funds are allocated towards their primary operational needs rather than tax liabilities. In addition, by keeping these processes up-to-date, entities remain compliant with state regulations, avoiding potential fines or penalties.

Important Terms Related to NC DOR E-585

-

Sales and Use Tax: These are taxes imposed on goods and services purchased in North Carolina, intended for funding state operations.

-

Nonprofit Entity: These organizations operate for the benefit of the public or specific causes without profit intention.

-

Refund Claim: This refers to the request submitted for returning certain tax amounts mistakenly paid or exempted during specific periods.

-

Exempt Purchases: Goods or services that qualify under tax laws to be free from sales tax charges, often benefiting nonprofit and governmental organizations.

State-Specific Rules for NC DOR E-585

North Carolina imposes distinct rules governing the filing and eligibility criteria for the NC DOR E-585. Entities must be officially registered as nonprofit or governmental bodies and have clear documentation proving their purchase transactions. Accurate declaration of all tax periods and purchases is mandatory. Additionally, these refund claims must adhere strictly to filing deadlines to prevent delays in fund recovery and avoid potential statutory penalties.

Filing Deadlines / Important Dates

The NC DOR mandates specific periods during which refund claims via Form E-585 must be submitted. Filing deadlines are generally annual, and adhering to these dates is crucial for a successful refund application. It’s advised to check the NC DOR website or recent updates to ensure compliance with current dates to avoid the risk of forfeiting potential refunds due.

Penalties for Non-Compliance

Failing to accurately complete or submit the NC DOR E-585 by the applicable deadlines can result in significant penalties. These may include denial of the tax refund claim, potential fines, or alterations to the entity’s tax exemption status. Ensuring meticulous preparation, verification, and timely filing helps nonprofits and governmental entities to mitigate such risks.

Digital vs. Paper Version of NC DOR E-585

The NC DOR provides both digital and paper options for filing the E-585 form, catering to the varied preferences of different entities. The digital filing typically offers faster processing and feedback, with built-in verification systems to minimize errors. Conversely, the paper version might appeal to more traditional or digitally challenged organizations but requires a longer review period. Opting for the appropriate filing format can significantly affect how swiftly a refund is processed and finalized.