Definition and Meaning of the Credit Report Dispute Form

The Credit Report Dispute Form for Pelican State Credit Union is a dedicated document that individuals use to report inaccuracies they identify in their credit reports. This form is specifically designed to facilitate communication between credit union members and the Member Solutions Department. The goal is to resolve discrepancies related to credit entries that may impact the individual's credit score or financial standing. Disputes might involve a variety of errors, such as incorrect account information or amounts, and require a precise explanation to initiate correction processes.

How to Use the Credit Report Dispute Form

When utilizing the form, individuals should clearly list detailed information about the disputed credit entry. This includes identifying both the error and the correct information. The form may require specifics such as account numbers, dates of transactions, and the nature of the claimed errors. By providing comprehensive details, the Member Solutions Department can effectively begin investigating the discrepancies. Users should also adhere to specific guidelines prescribed by the credit union to ensure smooth processing of their disputes.

Steps to Complete the Credit Report Dispute Form

-

Gather Required Information: Before filling out the form, collect all relevant documents and information related to the disputed entry. This may include credit reports, bank statements, or correspondence from the credit reporting agency.

-

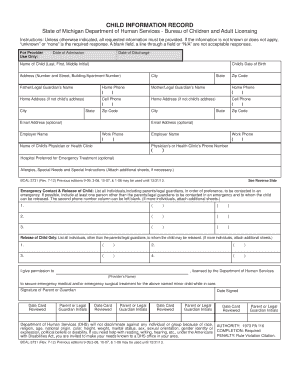

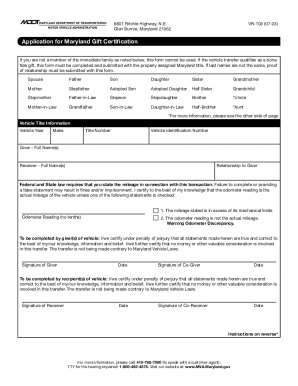

Fill Out Personal Information: Provide identifying details such as your full name, account number, and contact information.

-

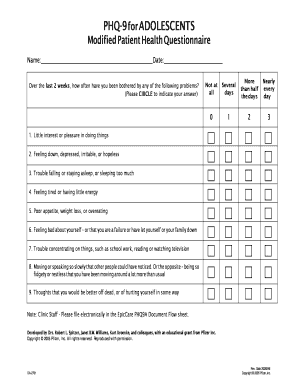

Detail the Dispute: Clearly describe the error found in the credit report. Include specific information such as the name of the creditor, account number, and the type of error.

-

Attach Documentation: Provide supporting documents that validate your claims. This may involve copies of correspondences, transaction receipts, or any other related documentation.

-

Submit the Form: Follow the submission guidelines outlined by Pelican State Credit Union, which might include online submission, mailing the form, or delivering it in-person at a local branch.

Why You Should Dispute Errors on Your Credit Report

Disputing inaccuracies on your credit report is crucial because these errors can adversely affect your credit score and financial health. Incorrect information may lead to higher interest rates or loan application rejections. Therefore, rectifying such errors ensures that your credit report accurately reflects your financial behavior, promoting better loan terms and financial opportunities in the future.

Key Elements of the Credit Report Dispute Form

- Personal Information Section: Captures basic data to identify the report's owner.

- Disputed Item Details: Specifics about the erroneous entry that needs correction.

- Explanation of Dispute: A detailed narrative surrounding the error and requested corrections.

- Attachments: Space for supplemental documentation supporting the claim.

- Submission Instructions: Directions on how to return the form for review.

Legal Use of the Credit Report Dispute Form

The dispute process aligns with the Fair Credit Reporting Act (FCRA), which mandates that credit reporting agencies and providers ensure the accuracy of consumer credit reports. By submitting the form, you are exercising your legal right to dispute incorrect credit report information, prompting agencies to investigate and amend any verifiable inaccuracies.

Form Submission Methods

Pelican State Credit Union provides multiple avenues for submitting the completed dispute form. Members may choose:

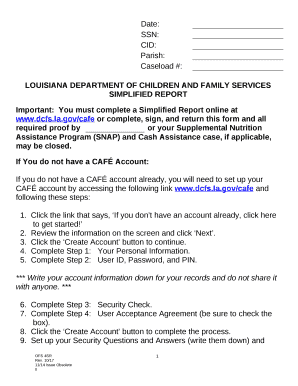

- Online Submission: Upload the form and accompaning documents directly through the credit union's secure portal.

- By Mail: Send the completed form with supporting documents to the Member Solutions Department.

- In-Person Delivery: Drop off the documents at any local Pelican State Credit Union branch.

Who Typically Uses the Credit Report Dispute Form

The primary users of this form are members of Pelican State Credit Union who have discovered discrepancies in their credit reports. These individuals seek to ensure the accuracy of their financial records, a critical step for maintaining a favorable credit standing and securing beneficial financial terms.