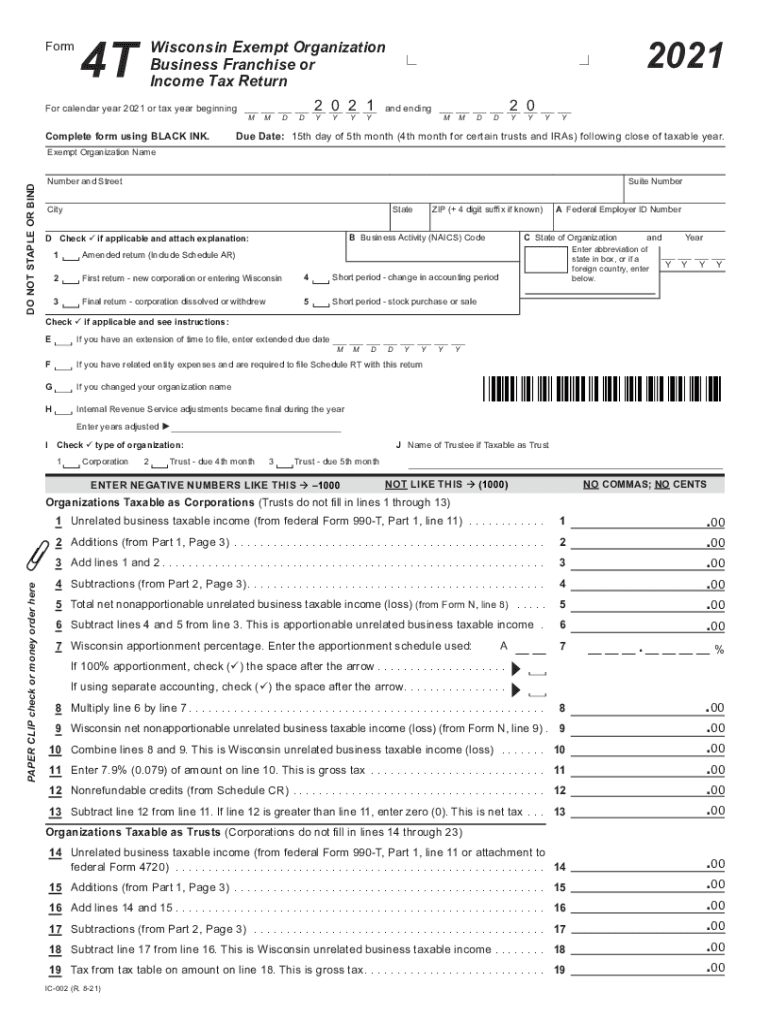

Definition and Purpose of the 2021 IC-002 Form 4T

The 2021 IC-002 Form 4T, known as the Wisconsin Exempt Organization Business Franchise or Income Tax Return, is a critical document for tax-exempt organizations operating within Wisconsin. This form is specifically designed for organizations that need to report any unrelated business taxable income. It facilitates the process of ensuring compliance with state tax obligations while maintaining the organization's tax-exempt status. By filing this form accurately, organizations can avoid potential penalties and ensure transparency in their financial reporting.

Understanding Key Terms

- Unrelated Business Taxable Income (UBTI): Income generated from activities not substantially related to the charitable, educational, or other purpose that is the basis of the organization's exemption.

- Exempt Organizations: Entities that have obtained an exemption from federal income tax under section 501 of the Internal Revenue Code or similar provisions.

- Franchise Tax: A tax levied by a state on certain businesses for the right to exist as a legal entity and do business in that state.

Steps to Complete the 2021 IC-002 Form 4T

-

Collect Entity Information:

- Gather necessary details such as the organization’s name, address, and federal employer identification number (FEIN).

-

Report Unrelated Business Income:

- List gross income derived from unrelated business activities.

- Deduct allowable expenses directly connected to the earning of this income.

-

Calculate Taxable Income:

- Subtract the allowable deductions from the gross income to determine the taxable income.

-

Credits and Deductions:

- Review applicable tax credits and deductions that could lower the overall tax liability.

-

Finalize and Review:

- Ensure all sections of the form are complete and accurate.

- Attach required schedules or additional documentation.

-

Submission:

- Choose your preferred method to submit the form. It can be filed online, through mail, or in person.

Detailed Breakdown of Necessary Information

- Entity Information: Include accurate details such as organization type and contact information.

- Tax Details: Ensure all financial figures are correct to prevent discrepancies.

- Attachments and Schedules: Attach appropriately labeled schedules for additional deductions or credits claimed.

Obtaining the 2021 IC-002 Form 4T

The 2021 IC-002 Form 4T can be accessed online through the Wisconsin Department of Revenue's official website. Alternatively, organizations can obtain the form by visiting physical offices of the Wisconsin Department of Revenue or requesting it via mail by contacting the department directly. This accessibility ensures that any exempt organization requiring this form can easily secure it for their tax filing needs.

Submission Methods for the 2021 IC-002 Form 4T

Organizations have several options for submitting the IC-002 Form 4T:

- Online Submission: This is the most efficient method, allowing electronic filing through the Wisconsin Department of Revenue's website. It provides immediate confirmation of receipt.

- Mail: Forms can be mailed to the designated address provided by the Department of Revenue. Ensure all necessary attachments and signatures are included.

- In-Person: Direct submission at a local Department of Revenue office is possible, which might be beneficial for those requiring assistance or confirmation.

Considerations for Each Method

- Online: Quick and secure but may require familiarity with digital filing systems.

- Mail: Reliable for those preferring traditional methods but involves longer processing times.

- In-Person: Offers the advantage of immediate support from department staff but may require scheduling.

Legal Implications and Compliance

Filing the 2021 IC-002 Form 4T accurately is vital to maintaining compliance with Wisconsin tax laws. Non-compliance can lead to penalties, including fines or the forfeiture of tax-exempt status. It is crucial for organizations to adhere to filing deadlines and ensure accuracy in reporting to avoid legal repercussions.

Key Compliance Considerations

- Accuracy: Accurately report income and deductions to prevent audits.

- Timeliness: Submit the form by the prescribed deadline to avoid late filing penalties.

- Documentation: Retain copies of all submitted documents and related correspondence for record-keeping purposes.

Penalties for Non-Compliance

Failing to file the 2021 IC-002 Form 4T correctly or on time can result in several penalties:

- Financial Penalties: Monetary fines that increase with the duration of non-compliance.

- Loss of Tax-Exempt Status: Revocation of tax exemption, subjecting the organization to full taxation.

- Legal Action: Potential for legal proceedings initiated by the state for severe cases of non-compliance.

Avoidance Strategies

Organizations should implement internal checks and utilize professional accounting services to ensure compliance with all filing requirements and prevent costly mistakes.