Definition and Purpose of the 2011 IT 1040EZ

The 2011 IT 1040EZ is a simplified tax return form designed specifically for full-year residents of Ohio. It is part of the Ohio Department of Taxation’s filing system and is intended for taxpayers with straightforward financial situations. Typically, this form is used by individuals whose total income is less than a threshold set by the state, who do not claim dependents, and who take the standard deduction.

Key Features of the 2011 IT 1040EZ

- Eligibility Requirements: Taxpayers must meet certain criteria, such as a maximum adjusted gross income limit, no claim for dependents, and standard deductions only.

- Simplicity: Designed to streamline the filing process, the IT 1040EZ form minimizes complexity for individuals with simple tax situations.

- Focus on Income Types: The form primarily accommodates wages, salaries, and pensions, excluding more complicated income sources like self-employment earnings.

Steps to Complete the 2011 IT 1040EZ

Filling out the 2011 IT 1040EZ requires careful attention to detail to ensure accuracy and compliance with Ohio tax laws. Below are the essential steps to guide you through the process.

- Gather Necessary Documents: Collect all sources of income documentation, including W-2 forms, and any applicable deductions or credits you may wish to claim.

- Fill in Personal Information: Start by entering your name, Social Security Number, and address on the form. Ensure all details are accurate to avoid processing delays.

- Report Income: List your total income from all sources that qualify under Ohio tax regulations. This usually includes wages and any unemployment compensation.

- Calculate Ohio Adjusted Gross Income: Subtract any permissible adjustments to arrive at your adjusted gross income, which will be used to determine your tax obligation.

- Follow the Deductions Instructions: Input any applicable standard deductions and credits that you qualify for other than those listed on the form.

- Review and Submit: After ensuring all information is accurate, submit your completed form via mail or electronically if available.

Important Filing Deadlines

Timely filing of the 2011 IT 1040EZ is crucial to avoid penalties and ensure compliance with state laws. The significant deadlines to be aware of include:

- Filing due date: Generally, tax returns for the previous year must be filed by April 15 of the current year, unless that date falls on a weekend or holiday.

- Extension Request: If unable to file by the deadline, taxpayers may request an extension, which allows for additional time to file but not to pay owed taxes.

- Payment Due Dates: Any tax owed should be paid by the same deadline to avoid interest and penalties accruing.

Required Documents for Filing

To successfully complete the 2011 IT 1040EZ, several key documents are essential:

- W-2 Forms: These forms report your annual wages, withheld taxes, and are necessary for accurately determining your income.

- Proof of Deductions: Any documentation supporting your eligibility for deductions, such as property tax receipts or charitable donation records.

- Driver's License or State ID: While not mandatory, it can be helpful to verify your identity if there are questions regarding your filed return.

Who Typically Uses the 2011 IT 1040EZ?

The primary users of the 2011 IT 1040EZ are individuals who meet specific qualifications:

- Single Individuals or Married Filing Jointly: Many single taxpayers with uncomplicated tax situations prefer this form due to its straightforward nature.

- Low to Moderate Income Earners: Taxpayers whose financial circumstances allow them to use this simplified tax form typically earn a moderate income, making it easier to file without extensive documentation or lengthy calculations.

- Those Without Dependents: Individuals with no dependents or only basic deductions find this form suitable, as it eliminates the need for complex documentation typically associated with claiming dependent credits.

Key Elements of the 2011 IT 1040EZ

Understanding the essential components of the 2011 IT 1040EZ can simplify the filing process and ensure compliance. The key elements include:

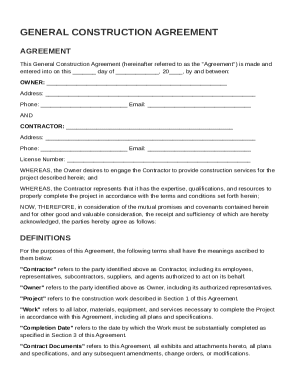

- Basic Information Section: This includes fields for taxpayer identification, address, filing status, and personal details.

- Income Section: Designed to capture various income streams, the income section is foundational for calculating tax liability.

- Deductions and Credits: The form also provides sections for entering any deductions or credits that might apply, along with instructions for determining eligibility.

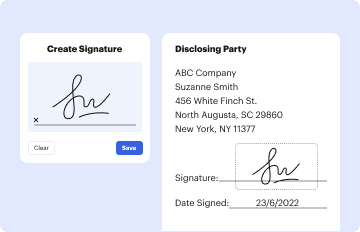

- Signature Requirement: A valid signature is necessary to affirm that all information provided is accurate and complete as per Ohio tax laws.

Legal Use of the 2011 IT 1040EZ

The 2011 IT 1040EZ serves as an official record for tax submission to the state of Ohio. Its legal validity is upheld by compliance with federal and state tax laws. Key legal considerations include:

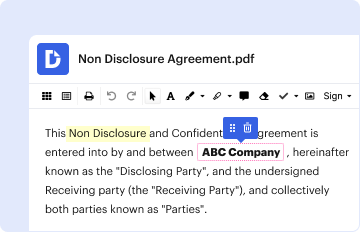

- Compliance with ESIGN Act: When submitting electronically, the process must adhere to legal frameworks established for electronic signatures.

- Accuracy of Information: Providing accurate and truthful information is required to fulfill legal obligations. Inaccurate filings can lead to audits or penalties.

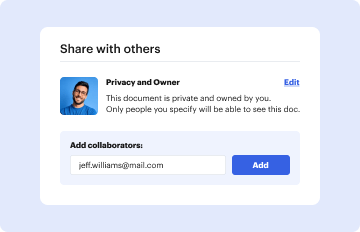

- Retention of Records: Taxpayers are advised to maintain a copy of their submitted form and any supporting documents for at least four years in case of inquiries or audits by the state.

How to Obtain the 2011 IT 1040EZ

Acquiring the 2011 IT 1040EZ can be easily accomplished through multiple channels to ensure all taxpayers can access the necessary forms:

- Online Access: Taxpayers may access the form directly from the Ohio Department of Taxation's website, which often features downloadable PDF versions.

- Tax Preparation Services: Many tax preparation services and accountants provide copies of the form as part of their filing services, ensuring that the correct version is used.

- Local Libraries and Post Offices: Public resources such as libraries and post offices often keep copies of tax forms during the tax season for individuals to fill out.

By familiarizing yourself with these aspects of the 2011 IT 1040EZ, you can approach your tax filing with confidence, ensuring compliance while streamlining the process in accordance with Ohio law.