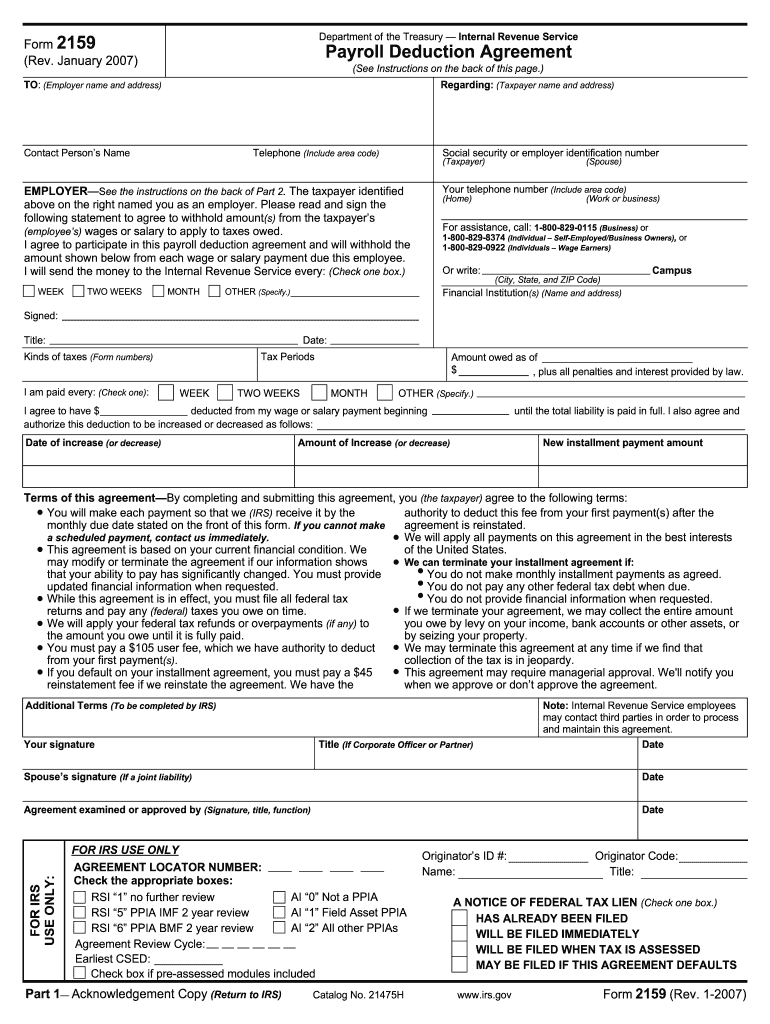

Definition and Meaning of the Wapmonxxxxx 2007 Form

The wapmonxxxxx 2007 form serves a specific purpose related to financial transactions governed by U.S. regulations. While the exact nature of this document may vary, it often encompasses important data collection, reporting, or compliance aspects tied to taxation, business operations, or legal requirements. Understanding its definition involves recognizing that this form may be utilized in various contexts, including tax filings, regulatory compliance, or as part of administrative procedures in organizations.

Examples of common contexts for this form include:

- Tax reports for individuals or businesses.

- Regulatory compliance in financial institutions.

- Documentation for specific business transactions requiring formal acknowledgment.

The significance of the wapmonxxxxx 2007 form lies in its ability to standardize and streamline processes involving critical financial information, contributing to transparency and accountability in business operations.

How to Obtain the Wapmonxxxxx 2007 Form

Acquiring the wapmonxxxxx 2007 form can be achieved through several channels, ensuring that users can easily access this important document when needed. The most common methods include:

-

Internal Revenue Service (IRS) Website: Many forms are available directly from the IRS website. Users can navigate to the forms and publications section to find the specific version they need.

-

Official State Websites: Depending on the context of the form, specific states may provide their own version or additional instructions related to the use of the form. Users should check state government websites for regions relevant to them.

-

Professional Tax Software: Many individuals opt to use commercial tax preparation software that includes access to legal forms, ensuring convenience and accuracy during the filing process.

-

Physical Locations: Public libraries, community centers, or government offices often have physical copies of commonly used forms available to the public.

An example of how to locate the form online could involve going to the IRS site, using the search function to type “wapmonxxxxx 2007 form,” and downloading the necessary document in a compatible format.

Steps to Complete the Wapmonxxxxx 2007 Form

Completing the wapmonxxxxx 2007 form requires attention to detail and a clear understanding of the information required. The following steps outline a general approach to filling out the form effectively:

-

Gather Required Information: Prior to starting, compile all necessary information such as names, addresses, Social Security numbers, and any other relevant financial details.

-

Review Instructions: Carefully read any instructions that accompany the form to understand specific requirements or details unique to that year’s version of the form.

-

Fill Out the Form: Start entering the required data, ensuring that all entries are legible and accurately reflect the information you have gathered. Double-check spelling, numbers, and dates.

-

Review for Errors: Before finalizing the document, conduct a thorough review to identify any mistakes or missing information. Incomplete or erroneous forms can lead to delays or penalties.

-

Submit as Instructed: Follow the specified submission methods, which may include electronic filing, mailing the form to a designated address, or delivering it in person.

Completing the wapmonxxxxx 2007 form accurately is crucial to ensure compliance and avoid potential issues related to reporting or taxation.

Important Terms Related to the Wapmonxxxxx 2007 Form

When working with the wapmonxxxxx 2007 form, familiarity with relevant terminology can enhance understanding and compliance. Key terms include:

-

Filing Status: This refers to the classification that determines the rate at which residents are taxed and the specific form requirements based on personal circumstances. Understanding your status (single, married, etc.) is essential for proper form completion.

-

Tax Identification Number (TIN): A TIN is necessary for individuals or businesses submitting tax forms. This may include Social Security numbers or Employer Identification Numbers (EIN).

-

Deadline: This term refers to the date by which the form must be submitted to avoid penalties or disruptions in compliance. Different forms have varied deadlines.

-

Penalties for Non-Compliance: It's essential to be aware of the repercussions of failing to submit the form correctly or by the required date, including fines or legal consequences.

Each term plays a crucial role in understanding the wapmonxxxxx 2007 form and ensuring proper procedures are followed.

Digital vs. Paper Version of the Wapmonxxxxx 2007 Form

When considering how to submit the wapmonxxxxx 2007 form, users may choose between digital and paper versions. Each option has its advantages and potential drawbacks:

-

Digital Version:

- Benefits include instant access, ease of editing, and reduced processing time when submitted electronically.

- Provides improved security with encryption methods, allowing for safer handling of sensitive information.

- Enables straightforward integration with tax software, simplifying filing processes.

-

Paper Version:

- Some users may prefer a physical document for complete control over their submission.

- Allows for handwritten notes or additional comments if necessary.

- However, it involves longer processing times and reliance on postal services, which can introduce delays.

Understanding both options allows individuals to select the most appropriate method for their specific needs, influenced by factors such as urgency, personal preference, and available technology.

Filing Deadlines and Important Dates for the Wapmonxxxxx 2007 Form

Timely submission of the wapmonxxxxx 2007 form is vital to avoid penalties. Key dates typically include:

-

Filing Start Date: This marks when taxpayers can begin submitting forms, usually aligned with the calendar year for tax forms.

-

Final Submission Deadline: Most forms require submission by a specified date, commonly April 15 for personal tax returns unless extended by law.

-

Extension Requests: If additional time is needed, filers must submit a specific request form before the standard deadline to avoid potential penalties.

-

Amendment Deadlines: Should corrections be necessary, understanding the timeframe within which amendments can be made (often within a specified number of years after the initial filing) is critical.

Paying attention to these dates ensures compliance and helps taxpayers avoid unnecessary penalties.