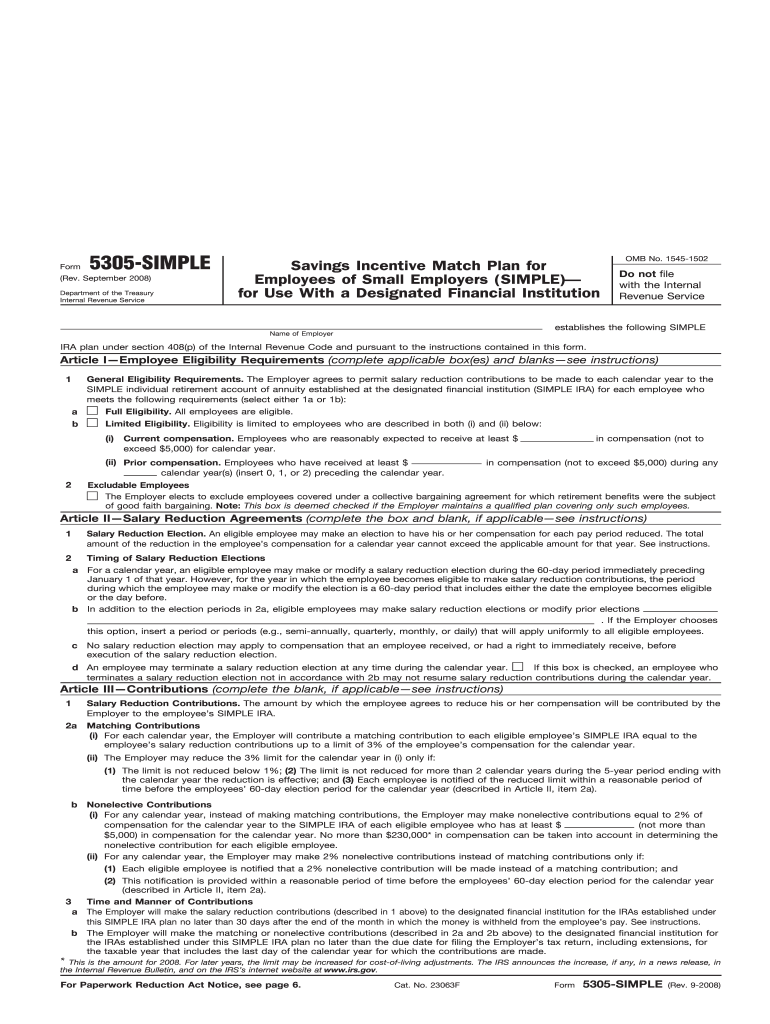

Definition and Purpose of Form 5305-SIMPLE

Form 5305-SIMPLE, titled "Savings Incentive Match Plan for Employees of Small Employers," serves as a document for employers to establish a SIMPLE IRA plan. The SIMPLE (Savings Incentive Match Plan for Employees) IRA offers a streamlined way for small businesses to provide retirement savings options to their employees without the complex administrative burdens associated with traditional retirement plans. This form outlines critical details such as eligibility requirements, contribution types, and administrative procedures. In using Form 5305-SIMPLE, employers enable their employees to participate in a retirement savings program funded through salary reduction contributions, matched by the employer’s own contributions. This form is intended for use by employers rather than employees, simplifying retirement savings offerings in small business settings.

How to Obtain Form 5305-SIMPLE

To procure Form 5305-SIMPLE, employers can visit the Internal Revenue Service (IRS) website, where it is available for download. This provides the most direct and official source for obtaining the form. Alternatively, business owners might receive the form through financial institutions that offer SIMPLE IRA services as part of their retirement plan packages. It's imperative for employers to use the most current version of the form; thus, consulting the IRS website ensures that the form is up-to-date. Financial advisors or retirement plan consultants may also assist employers in acquiring and understanding the form.

Steps to Complete Form 5305-SIMPLE

Completing Form 5305-SIMPLE involves several critical steps that ensure compliance and accuracy:

-

Identification Information: Begin by entering the business name, address, and employer identification number. This establishes who is setting up the SIMPLE IRA plan.

-

Eligibility Requirements: Indicate the criteria for employee participation, such as minimum age and tenure requirements, ensuring that all eligible employees are offered the opportunity to participate.

-

Contribution Details: Specify the contribution type the employer intends to make – either matching contributions or nonelective contributions. This section dictates the funding structure of the SIMPLE IRA.

-

Effective Date and Plan Year: Identify the plan's effective date and the fiscal year for administrative purposes. This timeline ensures proper tracking and management of contributions.

-

Signature and Date: The form concludes with a section for the employer’s signature and the date, formalizing the establishment of the SIMPLE IRA plan.

Each step requires careful attention to ensure that all information is accurate and consistent with the company’s intentions and resources.

IRS Guidelines for Form 5305-SIMPLE

The IRS provides comprehensive guidelines for using Form 5305-SIMPLE to ensure that employers comply with legal standards. These guidelines emphasize eligibility requirements, ensuring that any employee who earned at least $5,000 in any two preceding years can participate. Employers must also adhere to the contribution limits set forth by the IRS, which includes both employer and employee contributions. Additionally, there are rules about notice requirements, which mandate that employees be informed about their rights and responsibilities concerning the SIMPLE IRA plan. Understanding these IRS directives is vital to maintaining compliance and maximizing the benefits of the retirement plan.

Contribution Options in Form 5305-SIMPLE

Form 5305-SIMPLE allows for two primary types of employer contributions:

- Matching Contributions: Employers match the employees' salary reduction contributions up to 3% of the employees’ compensation.

- Nonelective Contributions: Alternatively, employers can choose to contribute 2% of each eligible employee's compensation, regardless of whether the employee contributes to the plan or not.

Each option offers different incentives both for the employer and its employees. For instance, matching contributions can encourage higher employee participation rates, while nonelective contributions offer a straightforward benefit for all eligible employees.

Legal Use and Compliance

Employers must utilize Form 5305-SIMPLE in accordance with specific legal guidelines to ensure compliance with federal retirement plan regulations. The form is used solely for establishing a SIMPLE IRA plan, and it must not be altered when electing to use the model without filing it with the IRS. Adhering to legal protocols includes maintaining precise records of employee eligibility, contributions, and notifications. Failure to comply with legal requirements may lead to penalties or disqualification of the plan, emphasizing the importance of understanding the legal context of its use.

Important Terms Related to Form 5305-SIMPLE

Understanding key terminology associated with Form 5305-SIMPLE can enhance comprehension and application:

- SIMPLE IRA: A retirement savings plan that allows employees and employers to contribute simultaneously.

- Salary Reduction Contributions: Voluntary employee contributions deducted from their salary pre-tax.

- Matching Contributions: Employer contributions that match the amount of the employees' salary deferral.

- Nonelective Contributions: Employer contributions made regardless of employee deferral participation.

- Eligibility Requirements: Criteria determining which employees can participate in the plan.

These terms ensure a clear understanding of how the form operates within the retirement plan framework.

Examples of Using Form 5305-SIMPLE

Consider a small consulting firm with ten employees, where the employer decides to implement a SIMPLE IRA plan using Form 5305-SIMPLE. The firm elects to offer a 3% matching contribution, encouraging employees to maximize their retirement savings through salary deferral. In another case, a retail business might choose the 2% nonelective contribution to provide a universal benefit that ensures retirement support for all eligible employees, even those unable to make additional contributions.

These examples highlight how different businesses can leverage the form depending on their financial strategy and goals, demonstrating the form's versatile application in various business contexts.