Definition and Purpose of Trinidad Customs Declaration Form

The Trinidad customs declaration form is an official document required by the government of Trinidad and Tobago for individuals and businesses importing goods into the country. It serves as a critical tool to declare the items being brought into Trinidad and Tobago, ensuring compliance with customs regulations and facilitating the proper assessment of applicable duties and taxes. This form is particularly essential for travelers, expatriates, and businesses that are transporting items across international borders.

Key Purposes of the Form

- Declaration of Goods: The form allows importers to specify the nature and value of the items being brought into Trinidad and Tobago.

- Duty Assessment: Customs authorities utilize the information to calculate any tariffs, duties, or taxes owed on imported goods.

- Regulatory Compliance: Adherence to customs regulations is essential for avoiding fines and ensuring legal entry of goods.

Steps to Complete the Trinidad Customs Declaration Form

Filling out the Trinidad customs declaration form requires careful attention to detail to ensure accuracy and compliance. Here are the key steps to complete the form effectively.

-

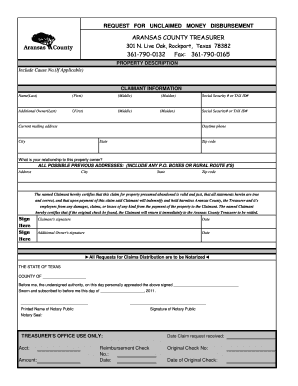

Obtain the Form: Access the Trinidad customs declaration form C15, either online in PDF format or at the customs office.

-

Personal Information: Enter details such as your name, address, and contact information to identify yourself as the importer.

-

Item Description: Clearly describe each item you are declaring. Include quantities, values, and the purpose of the import. For example:

- Electronics: Laptops, value $1,000 each

- Clothing: 10 shirts, value $200

-

Duty Value Declaration: Indicate the total market value of the items accurately. This value helps customs assess the applicable duty fees.

-

Sign and Date: Ensure the form is signed and dated to validate the declaration. This is a legal agreement to the accuracy of the information provided.

-

Submit the Form: Present the completed form to customs officials upon arrival at a port of entry in Trinidad and Tobago.

Important Considerations

- Review the form for any errors or omissions before submission, as inaccuracies may lead to fines or seizure of goods.

- Be aware of prohibited and restricted items that cannot be imported into Trinidad and Tobago, as listed by the customs department.

Important Terms Related to Trinidad Customs Declaration Form

Understanding the terminology associated with the Trinidad customs declaration form can make the process easier and ensure compliance with regulations.

- Tariff: A tax imposed by the government on imported goods.

- Duty-Free: Items that can be imported without the payment of duties.

- Prohibited Items: Goods that cannot be imported under any circumstances, such as certain firearms or narcotics.

- Restricted Items: Goods that require special permits or licenses before importation.

Legal Use of the Trinidad Customs Declaration Form

The Trinidad customs declaration form not only fulfills regulatory requirements but also encompasses legal protections for both the importer and customs authorities. The precise completion of this form is essential, as it serves as a binding legal document.

Legal Implications

- Customs Compliance: Submission of the form signifies agreement to comply with local customs regulations and laws.

- Liability: Incorrect or false information may result in penalties, including fines or legal action.

- Audit Trail: The form provides a record for customs authorities to reference in case of audits or disputes over imports.

Examples of Using the Trinidad Customs Declaration Form

Practical applications of the Trinidad customs declaration form illustrate its importance for both individuals and businesses. A few scenarios include:

-

Travelers Bringing Gifts: A traveler arriving from the United States wishes to bring wedding gifts back to Trinidad. They must declare the items on the customs form to ensure transparency and compliance with duty assessments.

-

Importing Commercial Goods: A local business owner imports electronics for resale. They are required to fill out the customs declaration form to facilitate the clearance of goods and payment of appropriate duties.

-

Bringing Household Items: An expatriate relocating to Trinidad must declare personal effects, ensuring that none of the items fall under the prohibited list.

Practical Scenarios to Consider

- Customs Inspections: During customs inspections, having an accurately completed form can expedite the clearance process and reduce wait times.

- Penalties for Inaccuracy: If a traveler forgets to declare a high-value item, they could face substantial fines or legal action.

This comprehensive overview of the Trinidad customs declaration form highlights its significance in ensuring that individuals and businesses comply with regulations when importing goods into Trinidad and Tobago.