Definition and Meaning of Kansas Individual Income Tax Form

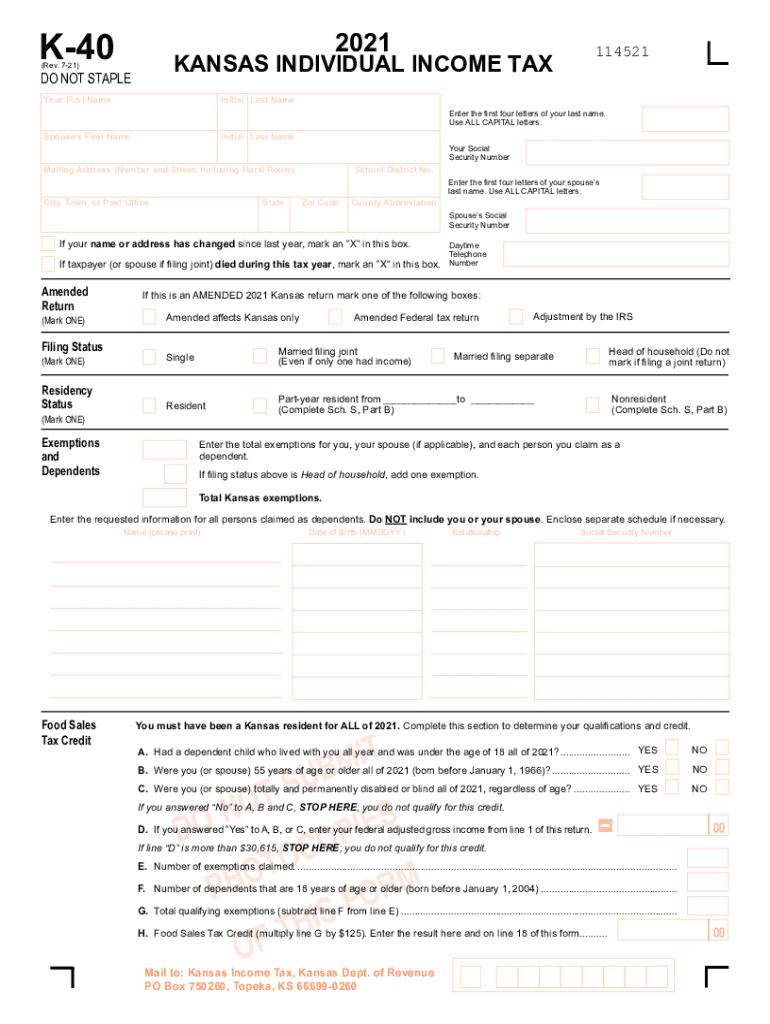

The Kansas Individual Income Tax form is a document utilized by residents of Kansas to report their income, calculate their tax liability, and claim any deductions or exemptions for the fiscal year 2021. This form requires details on personal information, including filing status and residency confirmation. It is designed to assist taxpayers in accurately determining their state tax obligations while ensuring compliance with Kansas tax regulations.

Key Elements of the Form

- Personal Information: Requires taxpayer’s full name, social security number, and contact details.

- Filing Status: Options include single, married filing jointly, married filing separately, etc.

- Residency Status: Must specify if you are a full-time resident, part-year resident, or non-resident.

How to Use the Kansas Individual Income Tax Form

To effectively use the Kansas Individual Income Tax form, it is crucial to follow a structured approach. Begin by gathering necessary documents that reflect your income, such as W-2s and 1099s. Next, determine your filing status and calculate your taxable income using the provided sections of the form. Ensure all entries are accurate to avoid potential issues during processing.

Steps to Complete the Form

- Begin with Personal Information: Enter your personal details and social security number.

- Determine Filing Status: Choose the correct filing status based on your situation.

- Calculate Income: Summarize all sources of income, including wages, interest, and capital gains.

- Claim Deductions and Credits: Identify applicable deductions and credits to reduce taxable income.

- Review and Submit: Double-check for accuracy before submission. Enclose necessary documents without stapling.

How to Obtain the Kansas Individual Income Tax Form

The Kansas Individual Income Tax form can be accessed through various methods. Taxpayers can download the form directly from the Kansas Department of Revenue's official website. Additionally, the form can be obtained from local tax offices or mailed upon request by contacting the department.

State-Specific Rules for the Kansas Individual Income Tax Form

Kansas residents must adhere to specific state rules when completing their Individual Income Tax form. This includes understanding state-specific deductions, such as the food sales tax credit and any exemptions unique to Kansas. Additionally, it is critical to ensure that all income is sourced correctly, especially for individuals with multi-state income, to avoid discrepancies.

Filing Deadlines and Important Dates

Meeting the necessary deadlines is crucial when filing the Kansas Individual Income Tax form. Typically, the annual filing deadline aligns with the federal tax deadline of April 15, unless it falls on a weekend or legal holiday, in which case it is extended to the next business day. Extensions may be requested but must adhere to state guidelines.

Required Documents for Filing

When filing your Kansas Individual Income Tax form, you must include various documents to substantiate your financial declarations. This includes:

- W-2 Forms: To report wages earned.

- 1099 Forms: For income from freelance work, investments, and other sources.

- Proof of Deductions: Such as receipts for deductible expenses or statements reflecting eligible transactions.

Legal Use of the Kansas Individual Income Tax Form

Utilizing the Kansas Individual Income Tax form legally requires honesty and accuracy in reporting all financial transactions and personal information. Misrepresentation or omissions can lead to penalties, fines, or legal actions. Taxpayers should consider consulting with a tax professional if uncertain about any aspect of their filing to ensure compliance with state tax laws.