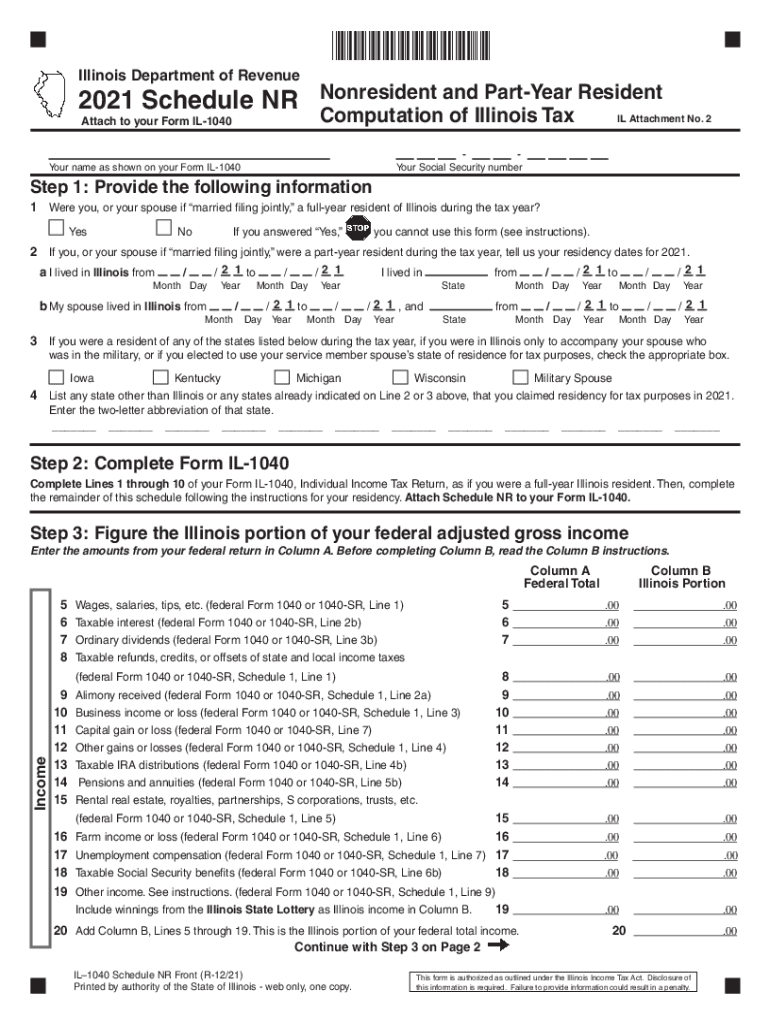

Definition and Purpose of Illinois Schedule NR

Schedule NR is a tax form utilized by nonresidents and part-year residents to determine their Illinois state tax obligations. It specifically calculates the Illinois portion of the federal adjusted gross income. This form differentiates between income earned within the state and elsewhere, enabling taxpayers to accurately declare what should be taxed by Illinois authorities. It plays a crucial role for individuals who have financial ties to Illinois but do not reside within the state for the entire tax year.

How to Obtain Illinois Schedule NR

Illinois Schedule NR can be downloaded from the Illinois Department of Revenue’s official website. It is readily available for taxpayers who need to report income sourced from Illinois. For those using tax preparation software like TurboTax or QuickBooks, Schedule NR is typically included and integrated into the suite of supported forms. Taxpayers can also request a physical copy from the Illinois Department of Revenue, or visit a local IRS office to obtain one in person.

Steps to Complete Schedule NR

Completing Schedule NR involves several steps to ensure accurate reporting:

- Residency Information: Provide details about your residency status, including the dates you lived inside and outside Illinois during the tax year.

- Income Details: Report all income sources, explicitly identifying the amount attributable to Illinois.

- Adjustments: Calculate any income modifications that might affect your taxable income within the state.

- Apportionment Calculation: Determine the portion of your total income that should be taxed by Illinois.

- Deductions and Credits: Identify applicable Illinois exemptions, deductions, and credits to potentially lower your tax liability.

- Final Calculation: Sum up all sections to ascertain your Illinois tax obligation, ensuring reconciliation with any payments or estimates already made.

Key Elements of Illinois Schedule NR

Several critical components form the backbone of Schedule NR:

- Residency and Domicile Information: Essential for determining your status as a part-year or nonresident taxpayer.

- Income Allocation: A breakdown of income earned inside versus outside Illinois, necessary for fair apportionment.

- Deductions: Information about deductions available at both the federal and state levels, directly affecting taxable income.

- Filing Status: Your status influences responsibility and eligibility for certain credits and reliefs.

Understanding these elements is vital in completing the form accurately and effectively.

Important Terms Related to Schedule NR

Familiarity with particular terms is indispensable when dealing with Schedule NR:

- Nonresident: Someone who earns income in Illinois but does not meet residency requirements.

- Part-Year Resident: An individual who resides in Illinois for a portion of the tax year.

- Apportionment: The method of allocating income to Illinois based on state-specific guidelines.

- Adjusted Gross Income (AGI): Your total income after accounting for allowable deductions pertinent to Illinois tax laws.

These terms facilitate easier navigation through the nuances of the form and its instructions.

Examples of Using Illinois Schedule NR

Situational examples illustrate the application of Schedule NR:

- Nonresident Consultant: A consultant lives in Indiana but works in Illinois; all income from Illinois clients needs reporting on Schedule NR.

- Part-Year Employee: An individual moves from Illinois to California mid-year for a new job; they report Illinois earnings up to the move date.

- Remote Worker: An Iowa resident telecommutes for an Illinois company; Schedule NR is used to declare income obtained while working remotely.

These examples highlight the scenarios where Schedule NR is applicable and necessary.

Legal Use of Illinois Schedule NR

Schedule NR must be filled out correctly to ensure compliance with Illinois tax laws. Legal implications include understanding residency definitions and ensuring only Illinois-source income is taxed. Incorrect filing might lead to audits, fines, or adjustments. Nonresidents should consult with tax professionals if there are uncertainties regarding income sources or state residency laws.

Deadlines and Important Dates for Filing Schedule NR

The typical deadline to submit Schedule NR coincides with the federal tax filing deadline, usually April 15. Taxpayers should submit it alongside their main Illinois filing. Extensions are possible but do not extend the payment deadline. Late filings can incur penalties and interest, making adherence to deadlines essential.

Separate from federal submissions, taxpayers must ensure that submissions meet Illinois state deadlines to avoid complications or potential penalties. Accurate and timely filing helps maintain compliance with state tax regulations.