Definition and Meaning of the Illinois ICR Form

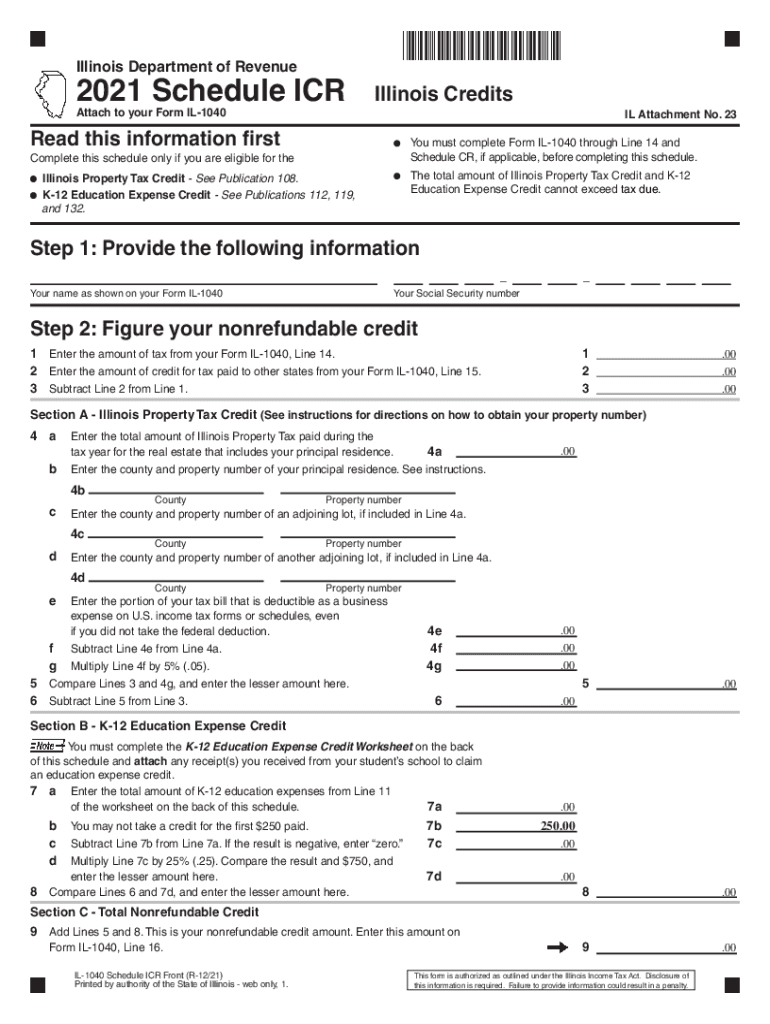

The Illinois Department of Revenue's Schedule ICR is a critical document used by residents to claim nonrefundable tax credits related to property taxes and K-12 education expenses on the individual income tax return, known as the IL-1040. Specifically, the ICR form assists taxpayers in reducing their overall Illinois state tax liability by detailing eligible expenses.

Key Components of the Illinois ICR Form

- Illinois Property Tax Credit: This component allows homeowners to claim a credit based on the amount of property taxes paid for their primary residence. The eligibility hinges on the property being used as a principal residence on January first of the taxable year.

- K-12 Education Expense Credit: Taxpayers can also qualify for a credit related to educational expenses incurred for K-12 education. This includes tuition fees, textbooks, and necessary materials required by the educational institution.

- Nonrefundable Tax Credit: Unlike refundable credits, the ICR provides a tax break up to the amount owed; any excess cannot be refunded to the taxpayer.

Steps to Complete the Illinois ICR Form

Completing the Illinois ICR requires careful attention to detail and proper documentation. Here is a step-by-step guide to navigate the process:

-

Gather Required Documents: Collect all relevant documents, including Form IL-1040, property tax bills, and K-12 education expense receipts.

-

Determine Eligibility: Confirm eligibility for both the Property Tax and K-12 Education Expense credits. Review the current year's requirements, as they may evolve annually.

-

Fill Out the ICR Form:

- Begin with your personal information, including name, address, and Social Security number.

- Indicate the total amount of property taxes paid.

- List K-12 education expenses qualified for the credit.

-

Calculate Credits: Use the designated lines on the form to calculate the appropriate credits based on the expenses and guidance provided.

-

Review for Accuracy: Double-check all entries for accuracy. Errors can lead to delays in processing or potential audit triggers.

-

Submission: Attach the completed ICR form to your IL-1040 and submit it either through e-file or mailing it directly to the Illinois Department of Revenue.

Important Terms Related to the Illinois ICR Form

Understanding specific terminology related to the Illinois ICR form is vital for navigating tax filings effectively. Here are some commonly encountered terms:

- Nonrefundable Credit: A credit used to reduce tax liability but cannot lead to a refund if the amount exceeds the tax due.

- Pro Rata: A method used to allocate credits when a taxpayer does not qualify for the full amount due to mixed-used property.

- K-12 Interface: A term referring to the educational context that encompasses kindergarten through 12th grade, relating to qualifying educational expenses.

State-Specific Rules for the Illinois ICR Form

Illinois has unique regulations and guidelines governing the use of the ICR form, which are essential for compliance:

- Filing Status: The credits can only be claimed on the IL-1040 form. Different filing statuses, such as single, married filing jointly, or head of household will impact the eligibility.

- Income Limitations: There may be income restrictions that reduce or eliminate eligibility for certain credits based on the taxpayer's overall income level.

- Local Variations: Local municipalities may have additional requirements or forms needed to substantiate the credit claims.

Examples of Using the Illinois ICR Form

Practical scenarios illustrate how various taxpayers can utilize the ICR form to claim benefits:

- Homeowners: A homeowner who pays $5,000 in property taxes can file the ICR to effectively reduce their Illinois tax liability by a calculated percentage of that amount.

- Parents of School Children: A family incurs $1,500 for a child's school tuition, and by documenting these expenses, they can also receive a K-12 education expense credit on their tax return, thereby reducing their taxable income.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is crucial for the timely submission of the ICR form:

- Tax Filing Deadline: Generally, individual tax returns in Illinois must be filed by April fifteenth of each year unless extensions are requested.

- Extensions for Filing: Taxpayers may file for an extension, but any taxes owed must still be paid by the original due date to avoid penalties.

Required Documents for the Illinois ICR Form

To accurately complete the ICR form, certain documents must be collected:

- Tax Bills: Property tax statements detailing amounts paid during the tax year.

- Educational Expense Receipts: Documentation of K-12 expenses, including tuition statements and itemized receipts for educational supplies.

- IL-1040: Your completed individual income tax return form, which must accompany the ICR.

Who Issues the Illinois ICR Form?

The Illinois Department of Revenue is the authority responsible for issuing and regulating the ICR form, ensuring compliance with state tax laws and providing guidance for taxpayers to maximize their eligible credits and deductions. Their website and customer service can provide further assistance regarding the completion and submission of the ICR.