Definition & Meaning

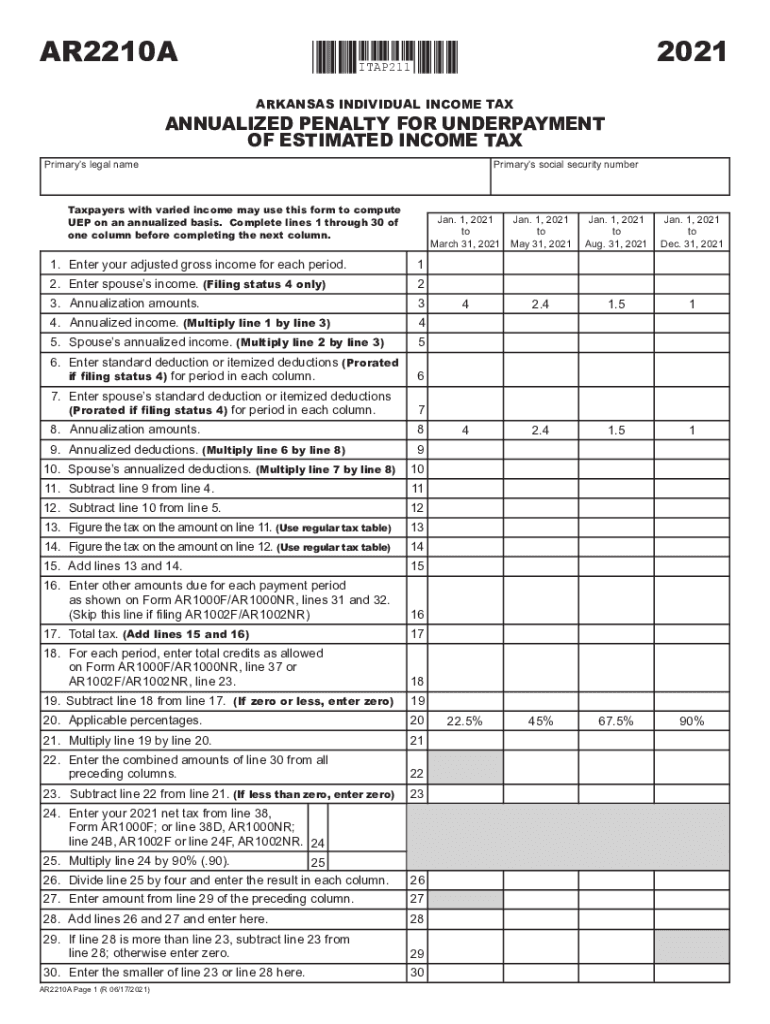

The Arkansas AR2210A form is a pivotal document for Arkansas taxpayers, specifically designed to calculate the annualized penalty for underpayment of estimated income tax. It functions as a detailed guide through which taxpayers can report adjusted gross income, deductions, and perform tax calculations over designated periods within the tax year. This process aids taxpayers in determining the exact nature of their tax liabilities, including any underpayments or overpayments and the consequences of late payments. Understanding the form's utility ensures that taxpayers can fulfill their obligations accurately and avoid additional penalties.

How to Use the Arkansas AR2210A

To appropriately use the AR2210A form, individuals must follow a series of methodological steps that align with its intended purpose. First, the taxpayer should gather all relevant financial documents that report income, deductions, and credits for the tax period in question. Armed with this information, they can proceed to fill out the form by inputting data at each specified section to calculate their estimated tax liabilities. Taxpayers should pay special attention to the instructions provided within the form as they detail how to compute various line items. By following these guidelines, users can ensure that they are completing the form correctly, thereby minimizing the chances of errors that could lead to penalties.

Steps to Complete the Arkansas AR2210A

-

Collect Essential Documents: Gather all necessary financial records such as income statements, deduction details, and tax credits for accurate reporting.

-

Determine Adjusted Gross Income: Calculate your total income and subtract allowable deductions to determine your adjusted gross income (AGI) for each relevant period.

-

Estimate Tax Obligations: Use the AGI and related deductions to compute your estimated tax liability using the provided guidelines in the form.

-

Compare to Payments Made: Evaluate the estimated tax against the payments you have already made to identify any underpayments or overpayments.

-

Calculate Penalties if Applicable: Follow the instructions to determine any penalties due to underpayment, making sure to apply the correct rates for each period.

-

Review and Submit the Form: Once completed, ensure the accuracy of all entries and submit the form using the appropriate method, such as online submission or mail.

By meticulously following each step, taxpayers can complete the Arkansas AR2210A with confidence and accuracy.

Why Should You Use the Arkansas AR2210A

Arkansas taxpayers stand to benefit significantly from using the AR2210A form as it provides a structured method for calculating tax liabilities. By proactively determining potential underpayments of estimated income taxes, taxpayers can avoid the financial pitfalls associated with penalties. Additionally, the form promotes financial accuracy and transparency, offering taxpayers a clear view of their obligations and ensuring compliance with state tax laws. Utilizing the form is a prudent measure to safeguard against unforeseen tax penalties and to maintain an accurate record of tax filings.

Who Typically Uses the Arkansas AR2210A

The primary users of the Arkansas AR2210A form include self-employed individuals, retirees, and those receiving significant income not subject to withholding. These taxpayers often deal with varying income levels throughout the year, necessitating accurate estimations and adjustments to prevent underpayment issues. Small business owners and individuals with large investment income may also utilize this form to ensure that they are meeting estimated tax obligations proactively. The form is thus a vital tool for various segments of taxpayers who strive to maintain compliance and avoid the ramifications of underpayment.

Important Terms Related to the Arkansas AR2210A

- Adjusted Gross Income (AGI): The total income minus specific deductions, crucial for determining tax liability.

- Estimated Tax: The approximation of tax owed throughout the year based on income forecasts.

- Underpayment Penalty: Fees imposed for failing to pay sufficient tax on income over a period.

- Annualization: Method of calculating income, expenses, and other tax details across different segments of the year to reflect accurate tax liability.

- Penalty Calculation Period: Specified time frames on the form used for assessing potential penalties.

Familiarity with these terms enhances comprehension and the effective use of the AR2210A form.

Examples of Using the Arkansas AR2210A

Taxpayer scenarios provide practical insight into the AR2210A's application. For instance, consider a self-employed individual whose income fluctuates quarterly due to seasonal variations in business. By using the AR2210A form, they can compute their quarterly tax obligations based on income received and deductions claimed during each period, ensuring compliance and appropriate tax payments.

Another example involves retirees who receive income from various sources, including pensions and investment returns. They may use the AR2210A to calculate how much tax they need to prepay or withhold to avoid penalties arising from potential underpayments over the year.

Penalties for Non-Compliance

Failing to submit or accurately complete the Arkansas AR2210A form can result in significant penalties. Taxpayers who underpay their estimated taxes face financial repercussions calculated based on the shortfall across the specified calculation periods. These penalties can accumulate if not addressed promptly, thus understanding and adhering to the form’s requirements is crucial to minimize financial liability.

Filing Deadlines and Important Dates

Understanding the submission timelines for the AR2210A form is essential for compliance. Typically, the form mirrors the tax year cycle, with specific deadlines for quarterly payments to mitigate underpayment risks. Failing to meet these deadlines might incur penalties, therefore, taxpayers should consult official guides to track and meet the requisite deadlines. Following these timelines ensures adherence to state tax regulations while providing ample opportunity to rectify any errors.