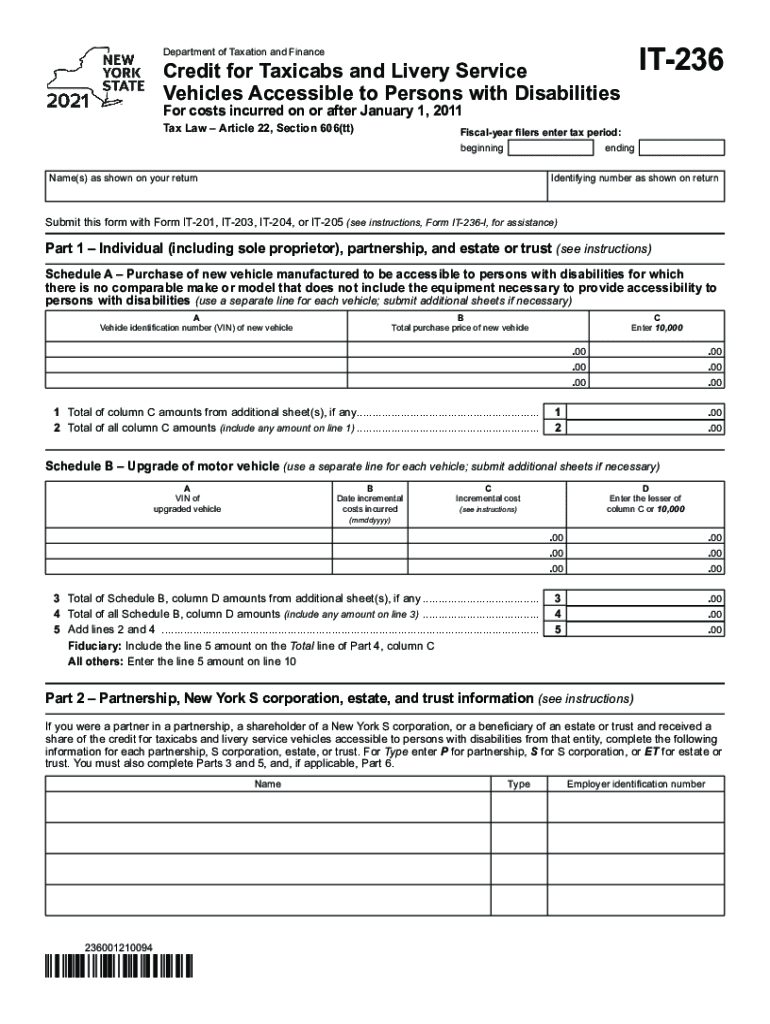

Definition and Purpose of IT-236

The IT-236 form is a tax document used to claim a tax credit for the purchase or upgrade of taxicabs and livery service vehicles that are accessible to persons with disabilities. Introduced effective from January 1, 2011, this form is crucial for reporting vehicle details, costs incurred, and sharing credits among individual filers, partnerships, and trusts. By allowing a claim on certain expenses, the IT-236 helps promote the conversion and upgrade of vehicles to be accessible, contributing significantly to inclusive transportation solutions.

Steps for Completing the IT-236

Efficiently completing the IT-236 involves a clear understanding of its sections and requirements. It is designed to capture information critical for calculating the tax credit correctly. Follow these structured steps to ensure accuracy:

- Gather Necessary Information: Collect details about the upgraded or purchased vehicle, including purchase date, cost, and specifics about its accessibility features.

- Fill Out Personal or Entity Information: Include details relevant to the taxpayer, whether an individual, partnership, or trust.

- Report Vehicle Details: Provide comprehensive data about the vehicles, such as make, model, and year.

- Calculate Eligible Expenses: Enter expenses incurred for making the vehicle accessible.

- Compute Tax Credit: Follow instructions in the form to calculate the available tax credit, ensuring every eligible expense is accurately included.

- Attach Required Documentation: Include necessary receipts or evidence supporting the vehicle upgrades for accessibility.

- Review and Submit: Ensure all data is accurate before submitting alongside other tax filings.

Eligibility Criteria and Key Users

The IT-236 primarily serves those in the transportation sector, specifically operators of taxicabs and livery services aiming to make their services more inclusive. Eligibility requires that the vehicles in question be used within appropriate contexts and meet specific criteria set forth in the form guidelines. Businesses or individuals involved must have incurred expenses directly related to converting or acquiring vehicles to be accessibility-compliant.

Key Elements and Sections of IT-236

The form’s structure is designed to guide users through multiple sections that capture the necessary data. Some primary components include:

- Taxpayer Information: Basic details necessary for processing.

- Vehicle Information: Detailed descriptions of accessible vehicles.

- Cost Breakdown: Specifics on expenditure related to accessibility modifications.

- Credit Calculation: Steps to derive the total credit amount.

Submission Methods: Online, Mail, or In-Person

Submitting the IT-236 can be done through various channels depending on individual preferences and resources:

- Online Filing: Preferred for its efficiency and immediate verification, providing a seamless integration with electronic tax submission systems.

- Mail Submission: Ideal for those who prefer physical copies or lack access to digital filing systems.

- In-Person Filing: Available in specific instances where consultation and clarification might be necessary directly with tax offices.

Document Submission Deadlines and Compliance

The IT-236 must be submitted in tandem with annual tax filings. Delays can negate the possibility of claiming the credit, necessitating awareness of scheduling to maintain compliance. Regular updates from taxation authorities can provide guidance on precise deadlines. Failure to comply with submission regulations may result in penalties or denial of the credit claim.

Legal Considerations and Implications

There are specific legal aspects to consider when filing the IT-236. This includes ensuring all vehicle modifications meet standards for accessibility as defined by regulations. The tax credit is also contingent upon adherence to documentation accuracy and compliance with submission norms, forming a legally binding declaration of claimed expenditures.

Examples and Scenarios for IT-236 Usage

Consider the following scenarios where the IT-236 plays a critical role:

- Small Taxi Services: An upgrade of a fleet of vehicles to include ramps and handicap-accessible features to cater to a broader clientele.

- Partnership Organizations: Multiple entities involved in a collaborative transportation project claiming shared credits based on collective vehicle modification costs.

- Trusts: Entities managing funds for transportation, enhancing service accessibility, and applying credits towards maintenance or further upgrades.

IRS Guidelines and Taxpayer Scenarios

The IRS provides detailed guidance on the utilization of the IT-236 within varied taxpayer scenarios, such as self-employed individuals adapting their vehicle for combined personal and service purposes. Understanding these directions can prevent misunderstandings and inaccuracies in credit claims, optimizing advantages under set taxation structures.

Digital vs. Paper Versions: Software Compatibility

The IT-236 can be managed both digitally and on paper. These versions are compatible with common tax software such as TurboTax and QuickBooks, providing users scalable options for document preparation and submission. The digital version offers benefits in terms of convenience and integration, while paper versions cater to traditional preferences.