Definition and Purpose of NY IT-637

The NY IT-637 form is designed for claiming the Alternative Fuels and Electric Vehicle Recharging Property Credit within New York Tax Law Section 606(p). This tax credit serves to promote and financially support the installation of refueling or recharging stations for electric vehicles in New York. By encouraging the adoption of alternative fuel systems, the State aims to reduce carbon emissions and foster sustainable energy solutions.

Key Benefits of Utilizing NY IT-637

- Tax Credits for Installation: Homeowners and businesses can lower their tax liabilities for installing eligible equipment.

- Support for Green Initiatives: The credit supports environmental goals through promoting cleaner energy sources.

- Broad Eligibility: Available to a wide array of taxpayers including individuals, partnerships, and corporations.

Steps to Complete the NY IT-637

Filing the NY IT-637 involves several steps that need careful attention to detail to ensure correctness and compliance. Below is a structured guide on how to complete this form:

- Collect Necessary Documentation: Gather records of all expenditures related to the installation of alternative fuel or electric vehicle recharging property.

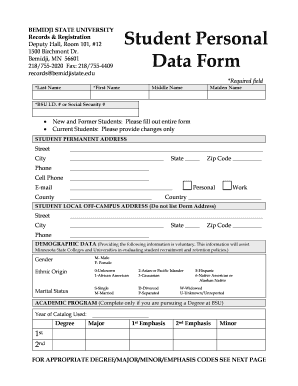

- Complete General Information: Enter basic taxpayer information, including names, addresses, and tax identification numbers.

- Calculate Expenses: Assign costs to designated sections for refueling/recharging property installations.

- Fill Out Required Schedules: Complete applicable schedules to determine credit amounts and potential recaptures.

- Submit the Completed Form: Ensure submission before the filing deadline as indicated in the NY state tax instructions.

Specific Considerations

- Proper Documentation: Each claimed expense must be backed by proper invoices and receipts.

- Accuracy in Calculations: Precise entry of figures is crucial for correct credit application.

Legal Use of the NY IT-637

Taxpayers need to adhere to legal stipulations when claiming credits via the NY IT-637. Compliance with all regulations ensures that claims are legitimate and supportable under New York Tax Law.

Legal Requirements

- Eligible Property: Only certain types of refueling and recharging properties qualify for the credit; check current NY regulations for the most up-to-date qualifying criteria.

- Assessment and Review: New York State may audit returns to verify correct credit application and any calculation errors can lead to penalties or disqualification.

Key Elements of the NY IT-637

Every section of the NY IT-637 form plays a vital role in the calculation and validation of tax credits. Understanding these elements helps ensure accurate completion of the form.

Important Sections to Note

- Expense Reporting: This section requires detailed inputs of all related costs incurred.

- Credit Calculation Schedules: Used to compute the exact credit amount based on reported figures.

Essential Tips

- Review Each Section Carefully: A thorough review helps catch common mistakes such as incorrect figures or incomplete fields.

- Understand Tax Implications: Consider how claiming this credit impacts overall tax liabilities.

Eligibility Criteria for the NY IT-637

To apply for the Alternative Fuels and Electric Vehicle Recharging Property Credit, one must meet specific eligibility conditions. These criteria ensure that only qualified taxpayers benefit from this incentive.

Eligibility Requirements

- Taxpayer Type: Available to individuals, estates, trusts, and partnerships engaged in New York state tax reporting.

- Approved Installations: Property installations must align with characteristics defined by the state, which may include specific technical or regulatory standards.

Common Situations and Examples

- Homeowners Installing Electric Chargers: Tax credits apply for residential installation of EV charging stations.

- Businesses Implementing Fleet Refueling Systems: Companies transitioning to alternative fuel vehicle fleets often qualify for significant tax relief.

IRS Guidelines and State-Specific Rules for NY IT-637

Understanding applicable IRS guidelines in conjunction with New York State rules is critical for anyone considering filing the NY IT-637.

Federal and State Alignment

While the NY IT-637 is a state-specific form, it is essential to remain consistent with federal tax regulations to avoid costly discrepancies.

Unique State Rules

- New York-Specific Clauses: Ensure compliance with state-specific rules that may differ from federal provisions.

Required Documents for NY IT-637 Submission

Gathering all requisite documents beforehand ensures a smooth and complete submission of the NY IT-637.

Documentation Checklist

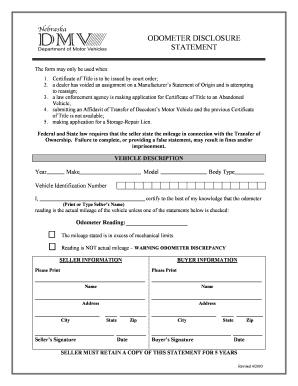

- Proof of Installation Costs: Detailed invoices, payment confirmations, and vendor contracts documenting the installations.

- Completed Form Attachments: Any additional worksheets or supporting schedules required by New York State tax authorities.

Submission Recommendations

- Maintain Thorough Records: Keep copies of all documents submitted for future reference or audits.

- Double-Check Completeness: Verify that every necessary field is completed properly on the form.

Filing Deadlines and Important Dates for NY IT-637

Meeting specified deadlines is crucial for applicants looking to capitalize on the available tax credits.

Key Filing Dates

- Annual Tax Filing Deadline: Align submission with New York State's annual tax filing timeline.

- Amendment and Resubmission Windows: Be aware of deadlines for amending submissions should errors or omissions be identified.

Important Considerations

- Submit Early When Possible: Early submissions reduce processing delays and provide time for adjustments if required.

- Track Changes in Date Requirements: Stay informed on potential changes to filing deadlines.

Who Issues the NY IT-637

The NY IT-637 is disseminated by New York State Department of Taxation and Finance, ensuring it aligns with state tax purposes and legislative intents.

Departmental Roles

- Oversight and Regulation: The department monitors submissions and enforces compliance with the tax code.

- Guidance and Resources: Offers assistance and resources to taxpayers for better understanding and correct filing practices.

Authority and Support

- Audits and Inspections: Regular audits might be conducted to ensure integrity in claims.

- Helpline Assistance: Tax professionals and customer service representatives can provide help for questions or issues related to the form.