Definition and Meaning

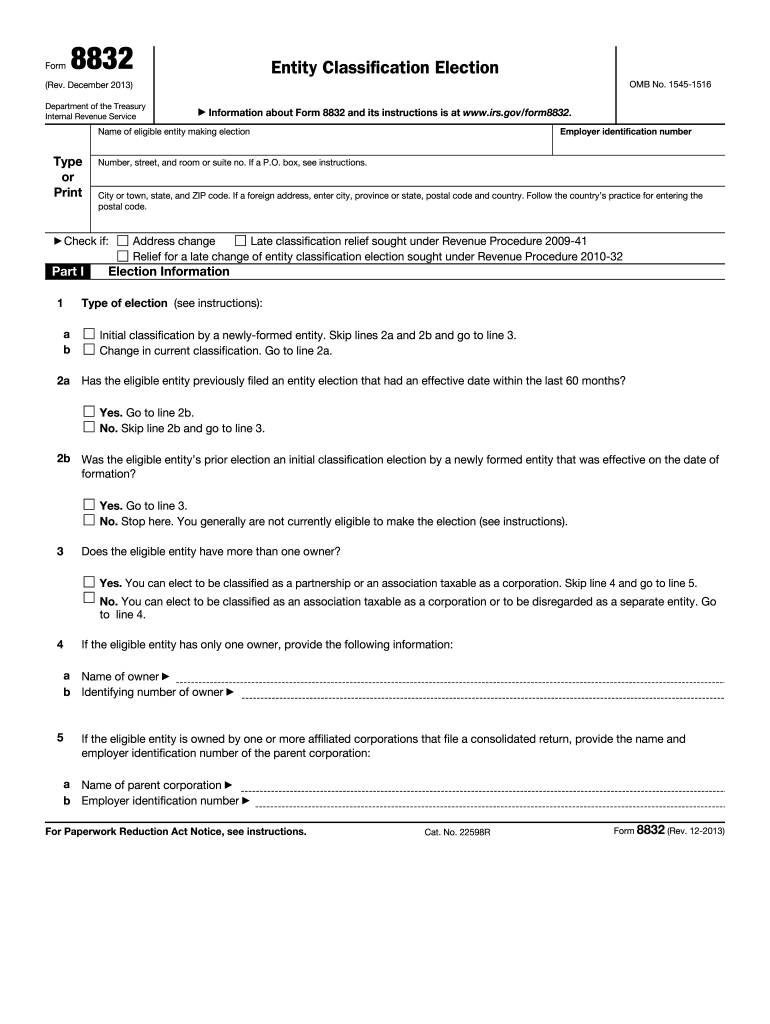

Form 8832, formally known as the "Entity Classification Election," is an Internal Revenue Service (IRS) document that allows eligible entities to elect their federal tax classification. Entities, such as limited liability companies (LLCs), partnerships, and corporations, can choose to be taxed as a corporation, partnership, or disregarded entity. The form includes sections for providing entity information, election details, and consents. Understanding this form is crucial for businesses wanting flexibility in how they are taxed at the federal level.

How to Use Form 8832

Using Form 8832 involves several steps. Fill out the form to specify the desired tax classification, which could significantly affect the business’s tax obligations. The entity must provide accurate details, including its name, address, and Employer Identification Number (EIN). After completion, a responsible party within the entity must sign the consent statement. The form is then submitted to the IRS for processing, where the IRS reviews and processes the election.

- Ensure all details on the form are correct

- Verify the tax classification's effective date

- Maintain a copy of the completed form for the business's records

How to Obtain Form 8832

Form 8832 can be obtained directly from the IRS website. The form is available in PDF format, which can be downloaded and printed for physical completion or filled out digitally. It is essential to refer to the latest version of the form and accompanying instructions to ensure compliance with current IRS requirements.

Additional Ways to Obtain:

- Through tax preparation software like TurboTax or QuickBooks

- Consulting with a tax professional who can provide the form and guidance

Steps to Complete Form 8832

- Entity Information: Enter the business name, address, and EIN.

- Election Information: Specify the election type, such as corporation, partnership, or disregarded entity status.

- Consent Statement: Obtain signed consent from all members of the entity.

- Signatures: A responsible party must sign and date the form.

- Submission: File the completed form with the IRS.

Each step requires careful attention to ensure the election is recognized and effective.

Why Use Form 8832

Businesses use Form 8832 to optimize tax liabilities or align with strategic financial goals. For instance, an LLC might choose to be taxed as a corporation to avoid self-employment taxes or because it intends to go public. The form provides flexibility for tax planning, offering potential savings and strategic advantages.

Benefits:

- Flexibility in tax planning

- Potentially reduced tax liabilities

- Aligning tax treatment with business operations

Who Typically Uses Form 8832

Various entities, particularly LLCs, frequently use Form 8832 to select their preferred tax status. Partnerships and single-member entities also benefit from using this form, allowing them to tailor their tax obligations according to their operational structure.

- LLCs seeking a corporate tax structure

- Partnerships wanting different tax treatment

- Single-member LLCs opting for disregarded entity status

Key Elements of Form 8832

The form comprises several critical sections:

- Entity Information: Basic identifying details of the business

- Election Information: Details the specific tax classification being elected

- Consent Statement: Signatures from members acknowledging the election

- Signatures: Verification by a responsible party of the entity

Each element plays a vital role in the form’s acceptance and must be filled accurately.

IRS Guidelines

The IRS provides detailed instructions for completing Form 8832, ensuring the process complies with federal regulations. These guidelines explain eligibility, filing procedures, and how the election affects tax reporting. They also outline any late-election relief options available for entities that failed to file timely.

Key Aspects:

- Eligibility requirements and filing instructions

- Impact of election on tax reporting

- Options for late elections or changes

Understanding and following these guidelines is crucial for ensuring the correct tax classification and avoiding future complications.

Filing Deadlines and Important Dates

Entities must be aware of critical filing deadlines when submitting Form 8832. The form must typically be filed within 75 days before or after the effective date of the classification change.

- 75-Day Rule: Can file up to 75 days before the classification’s effective date

- Specific deadlines ensure timely elections and compliance

- Consideration for special conditions, such as fiscal year entities

Eligibility Criteria

To file Form 8832, entities must meet specific eligibility criteria. Generally, domestic entities like LLCs, partnerships, and some corporations can file the form, provided they haven't automatically determined tax classification or unilaterally changed classifications too early.

- Must be a recognized business entity with IRS

- Cannot have a previously default classification without a proper change

- Prior consent from entity members is required

These criteria help determine if the business can elect a different tax classification using Form 8832. Understanding these requirements ensures correct application and compliance with IRS regulations.