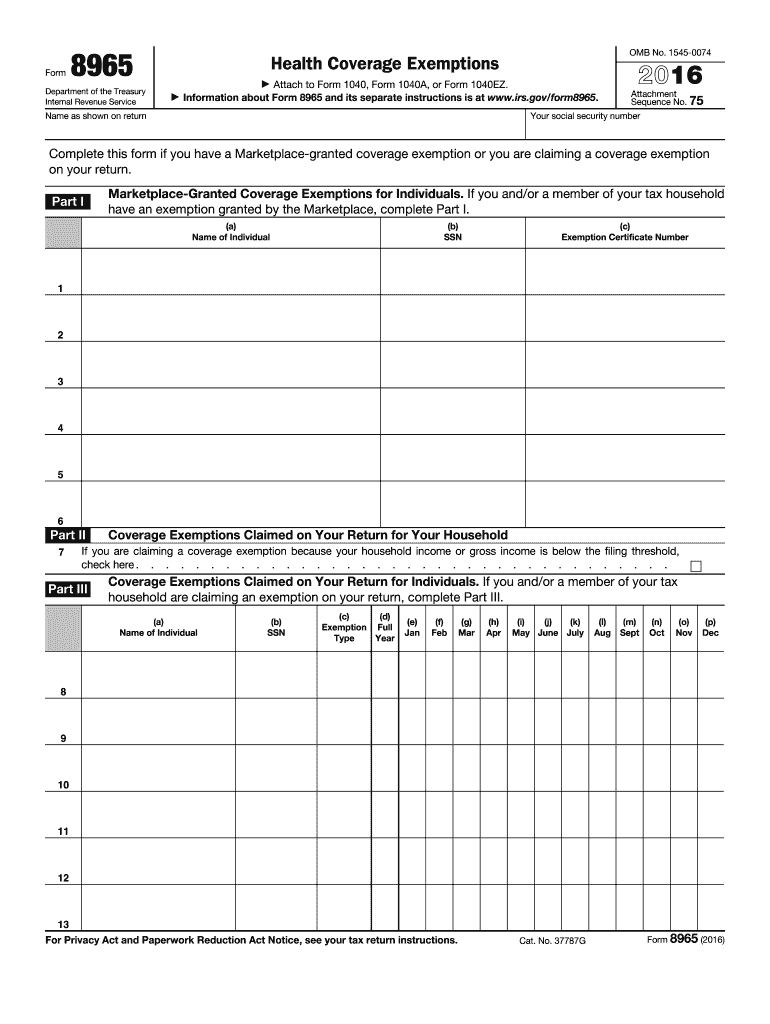

Definition and Purpose of IRS Form 8965

Form 8965, Health Coverage Exemptions, is a form used by individuals to claim exemptions from the requirement to have health coverage under the Affordable Care Act. This form was integral for tax year 2016 as it allowed taxpayers to avoid the individual shared responsibility payment if they qualified for certain exemptions. The form outlines various exemption types related to financial hardships, living situations, or membership in recognized groups.

Common Exemption Types

- Income Below Filing Threshold: For taxpayers whose income is below the level required to file a tax return.

- Coverage Unaffordable: If the least expensive coverage available amounts to more than a set percentage of the household income.

- Short Coverage Gap: Allowing for a gap in health coverage of less than three consecutive months.

How to Use the 2016 IRS Form 8965

Filing Form 8965 involves determining which exemptions apply to your situation. Individuals need to report each exemption on their tax return.

- Review Exemptions: Begin by identifying which types of exemptions apply.

- Complete Part I: List personal information and exemption codes corresponding to each applicable member.

- Provide Documentation: Sometimes supplementary documents are necessary to validate claims, especially for hardship exemptions.

How to Obtain the 2016 IRS Form 8965

For the 2016 tax year, the form was accessible through several methods.

- IRS Website: Direct download from the official IRS portal.

- Tax Software: Programs like TurboTax or H&R Block include IRS forms for e-filing.

- Tax Preparation Services: Local tax professionals or services may provide physical copies.

Steps to Complete the 2016 IRS Form 8965

Completing this form requires accuracy in recording and reporting exemption claims:

- Gather Necessary Documents: Collect tax returns, health coverage documents, and income statements.

- Identify Covered Individuals: List each household member that the exemption applies to.

- Consult IRS Tables: Refer to provided tables for matching exemption codes.

- Review for Accuracy: Ensure all information is complete before attaching to your tax return.

Key Elements of the 2016 IRS Form 8965

Parts of the Form

- Part I: Personal exemptions that don't require approval from the Marketplace.

- Part II: Exemptions that require Marketplace approval.

- Part III: Calculating and reporting any owed individual shared responsibility payment if exemptions don’t apply.

Important Considerations

- Code Accuracy: Failure to report correct exemption codes can result in filing errors.

- Attachments: Properly attach completed Form 8965 to your tax return forms, either 1040, 1040A, or 1040EZ.

Who Typically Uses the 2016 IRS Form 8965

This form is generally used by:

- Low Income Earners: Those whose income is below filing thresholds.

- Individuals Without Coverage: Particularly those experiencing short lapses in insurance.

- Marketplace Participants: Those needing to claim exemption approvals obtained from the Health Insurance Marketplace.

IRS Guidelines for Form 8965

IRS Resources

- The IRS provides extensive reference materials, including Publication 5172, for detailed guidance.

- Online tools and FAQs are available on the IRS website for taxpayer assistance.

Filing Process

- Amendments: If a mistake is discovered post-filing, taxpayers should file an amended return using Form 1040X.

- Marketplace Involvement: Marketplace exemptions require proof of exemption certificates.

Filing Deadlines and Important Dates

Understanding submission timelines is crucial:

- Filing Deadline: Generally coincides with the tax return due date, April 15, but extensions may be available.

- Exemption Certificate Timing: Requests for Marketplace exemptions should be submitted as early as possible due to processing times.

Examples of Using 2016 IRS Form 8965

Real-World Scenarios

- Example 1: A self-employed individual earning below the tax threshold claims the "No Requirement to File" exemption.

- Example 2: A retired couple with insurance gap due to waiting period claim the "Short Coverage Gap" exemption.

- Example 3: A university student whose school-provided healthcare is more than 8.05% of household income claims "Coverage Unaffordable."

Penalties for Non-Compliance

Failure to submit Form 8965 or inaccurately claiming exemptions can lead to penalties:

- No Exemption Penalty: If exemptions aren't recognized, taxpayers may face an additional tax liability called the individual shared responsibility payment.

- Audit Risks: Incomplete or erroneous forms can result in IRS audits or additional requests for substantiation.