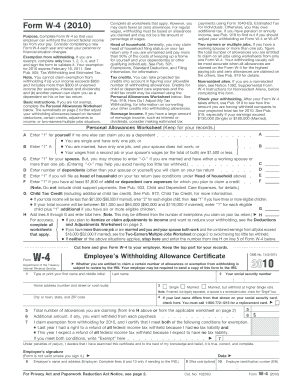

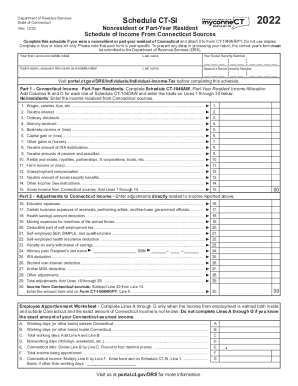

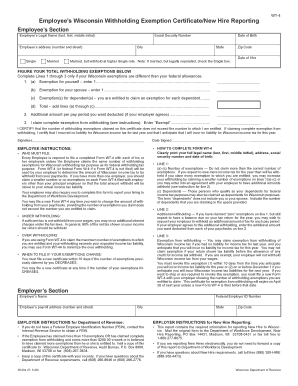

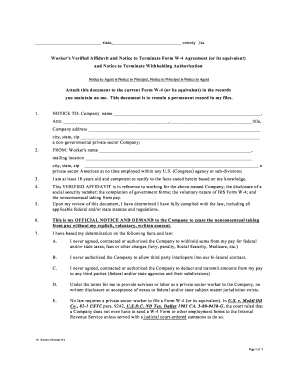

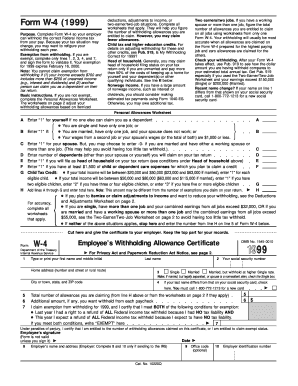

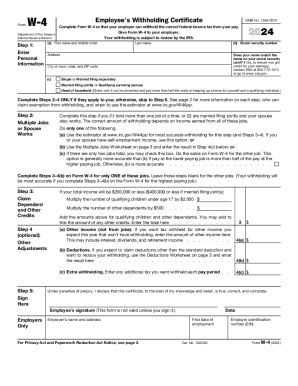

Discover state-specific W4 Order Forms and edit them online. Utilize DocHub's effective document management tools and track your templates' status with an audit log.

Speed up your file operations using our W4 Order Forms category with ready-made document templates that suit your requirements. Get your document, change it, complete it, and share it with your contributors without breaking a sweat. Start working more efficiently together with your documents.

The best way to manage our W4 Order Forms:

Discover all of the possibilities for your online document administration with the W4 Order Forms. Get a free free DocHub account today!