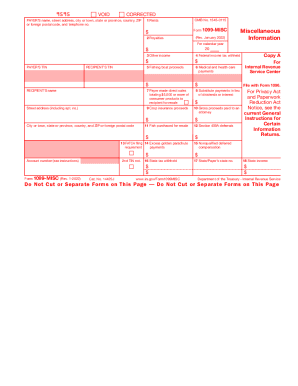

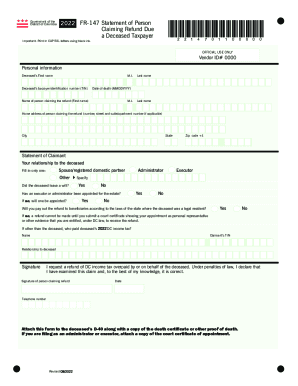

Keep your records arranged and up-to-date with our comprehensive Irs com tax Order Forms catalog. Effortlessly customize and edit forms to ensure data accuracy.

Papers managing takes up to half of your office hours. With DocHub, you can reclaim your time and improve your team's efficiency. Get Irs com tax Order Forms category and check out all form templates related to your day-to-day workflows.

Effortlessly use Irs com tax Order Forms:

Accelerate your day-to-day file managing using our Irs com tax Order Forms. Get your free DocHub account today to discover all forms.