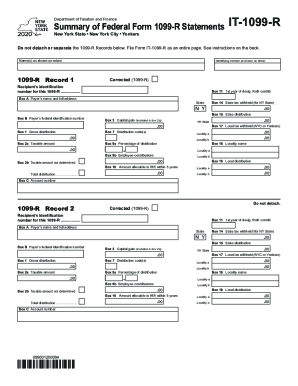

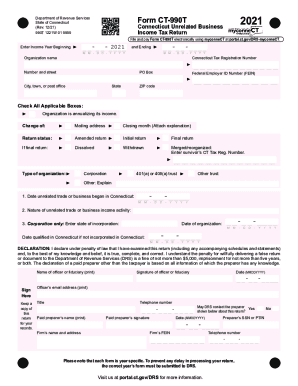

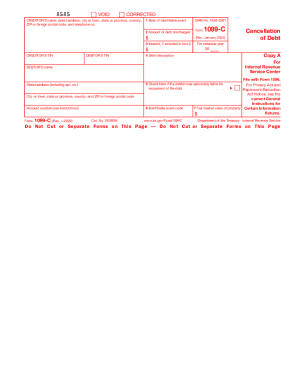

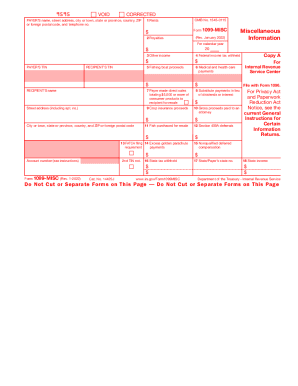

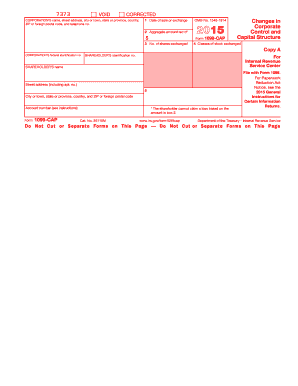

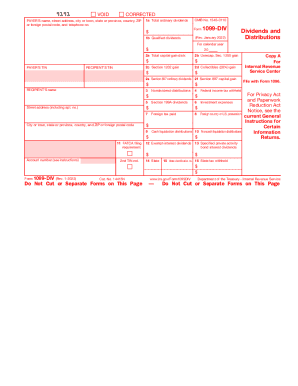

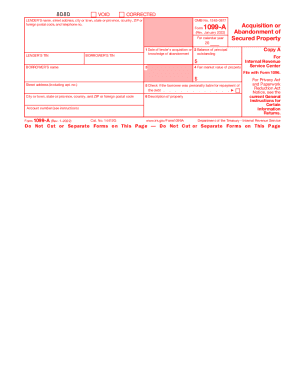

Handle your order documents and browse 1099 tax Order Forms. Keep sensitive information safe with DocHub's data encryption and access controls.

Accelerate your document administration with our 1099 tax Order Forms category with ready-made templates that suit your needs. Get your document, modify it, complete it, and share it with your contributors without breaking a sweat. Begin working more efficiently with your forms.

The best way to manage our 1099 tax Order Forms:

Explore all the opportunities for your online document management with our 1099 tax Order Forms. Get a totally free DocHub profile right now!