Your workflows always benefit when you are able to find all of the forms and files you will need at your fingertips. DocHub offers a wide array of forms to alleviate your daily pains. Get hold of Trust Formation category and quickly find your form.

Begin working with Trust Formation in several clicks:

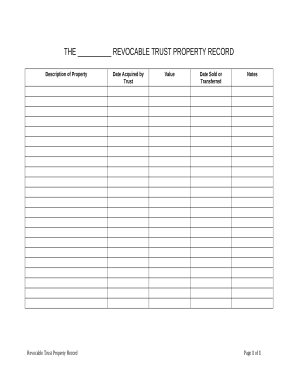

Enjoy effortless record management with DocHub. Explore our Trust Formation online library and discover your form right now!