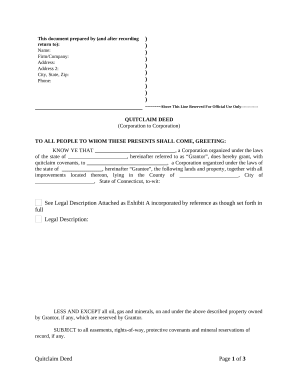

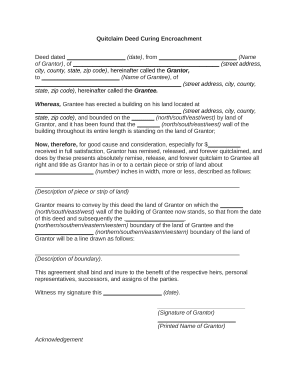

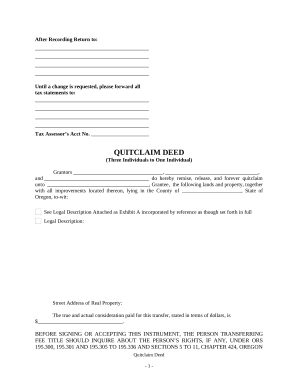

Your workflows always benefit when you can easily locate all the forms and files you may need at your fingertips. DocHub delivers a a large collection document templates to alleviate your everyday pains. Get a hold of Quitclaim Deed category and easily discover your document.

Start working with Quitclaim Deed in several clicks:

Enjoy fast and easy file administration with DocHub. Check out our Quitclaim Deed collection and look for your form today!