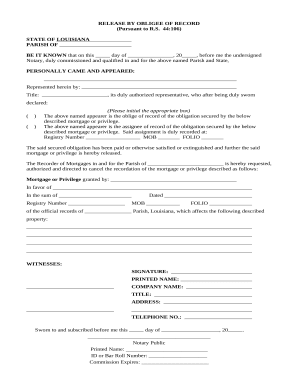

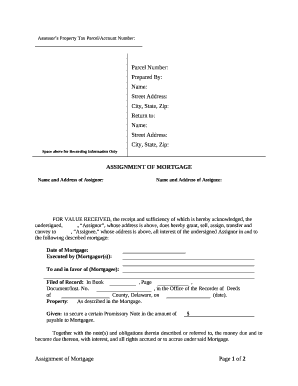

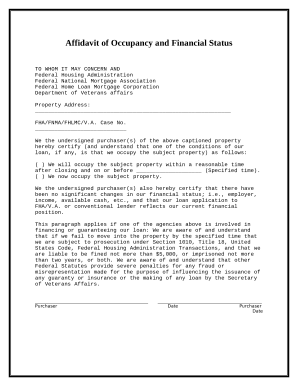

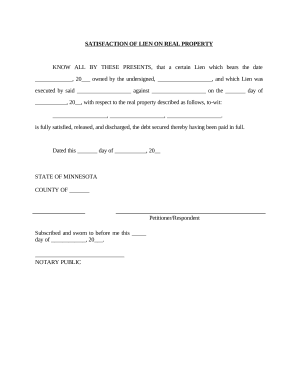

Your workflows always benefit when you can get all the forms and files you may need on hand. DocHub gives a a huge library of forms to alleviate your everyday pains. Get hold of Mortgage Documentation category and quickly browse for your document.

Start working with Mortgage Documentation in a few clicks:

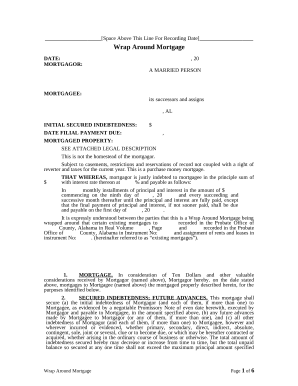

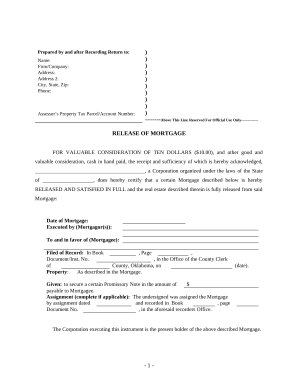

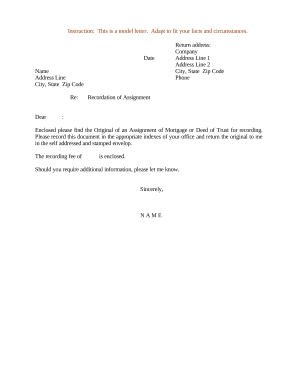

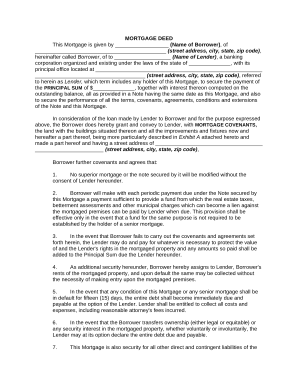

Enjoy effortless record administration with DocHub. Discover our Mortgage Documentation collection and locate your form today!