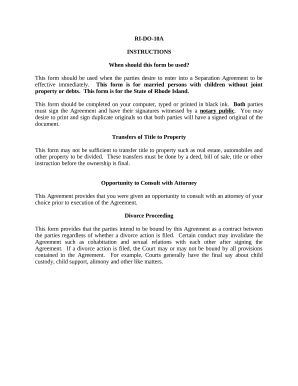

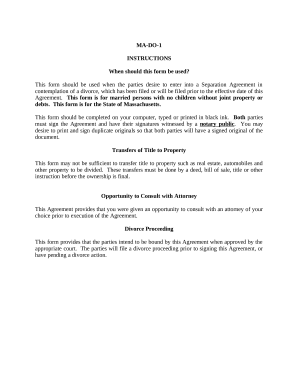

Your workflows always benefit when you can find all of the forms and documents you will need at your fingertips. DocHub delivers a wide array of form templates to relieve your daily pains. Get a hold of Divorce without Joint Property or Debts category and quickly browse for your document.

Start working with Divorce without Joint Property or Debts in several clicks:

Enjoy seamless record managing with DocHub. Discover our Divorce without Joint Property or Debts category and discover your form right now!