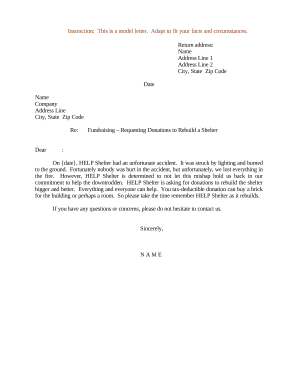

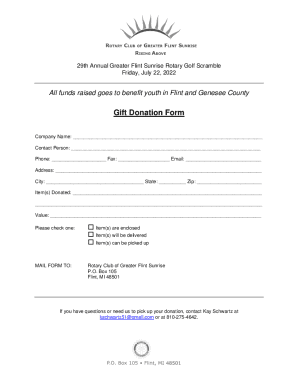

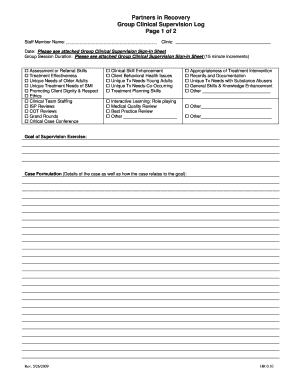

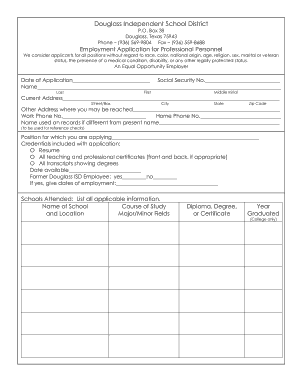

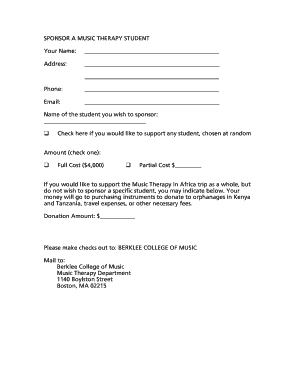

Improve your fundraising efforts with DocHub's customizable Scale Donation Forms templates. Make a lasting effect on supporters with professional and customized donor templates.

Improve your file management using our Scale Donation Forms category with ready-made templates that suit your requirements. Access the form, change it, complete it, and share it with your contributors without breaking a sweat. Start working more effectively with the documents.

The best way to manage our Scale Donation Forms:

Explore all the possibilities for your online document management using our Scale Donation Forms. Get your totally free DocHub account today!