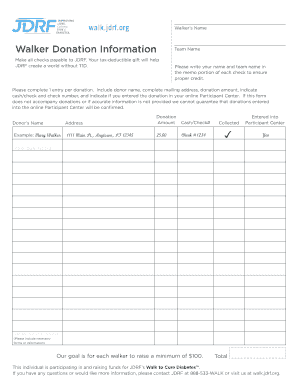

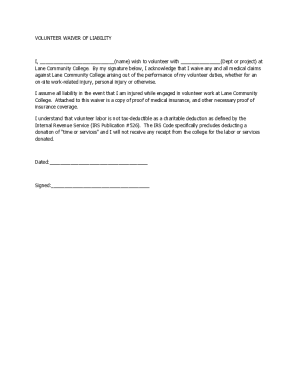

Improve your fundraising efforts with DocHub's modifiable Nonprofits Donation Forms templates. Create a lasting impact on supporters with professional and customized donor templates.

Accelerate your form operations with the Nonprofits Donation Forms online library with ready-made form templates that meet your needs. Get the form, edit it, complete it, and share it with your contributors without breaking a sweat. Begin working more efficiently with your documents.

How to use our Nonprofits Donation Forms:

Explore all of the possibilities for your online file administration with our Nonprofits Donation Forms. Get a free free DocHub profile right now!