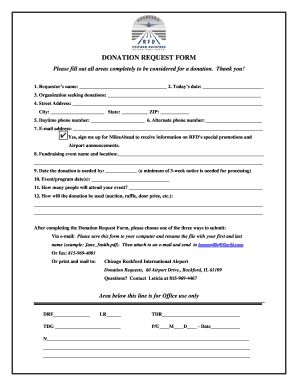

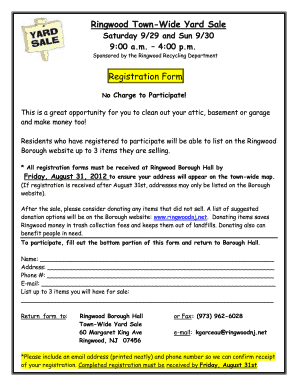

Enhance your fundraising efforts with DocHub's modifiable Non profit fundraiser sale receipt Donation Forms templates. Make a lasting impact on contributors with professional and personalized donor templates.

Your workflows always benefit when you can discover all of the forms and documents you may need on hand. DocHub offers a wide array of forms to relieve your daily pains. Get a hold of Non profit fundraiser sale receipt Donation Forms category and quickly browse for your document.

Start working with Non profit fundraiser sale receipt Donation Forms in a few clicks:

Enjoy effortless document administration with DocHub. Check out our Non profit fundraiser sale receipt Donation Forms collection and find your form today!