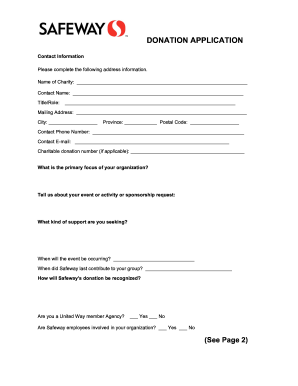

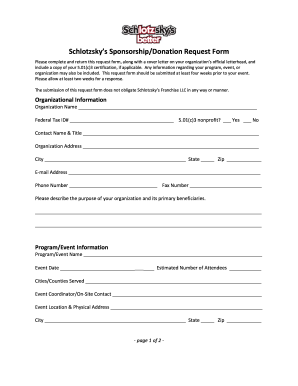

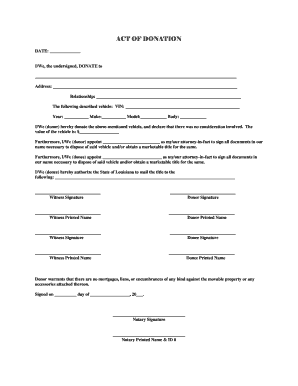

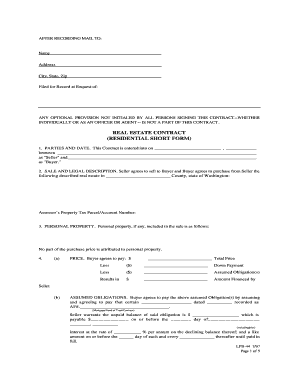

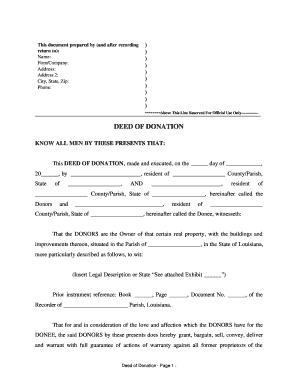

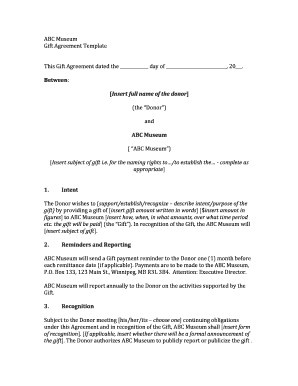

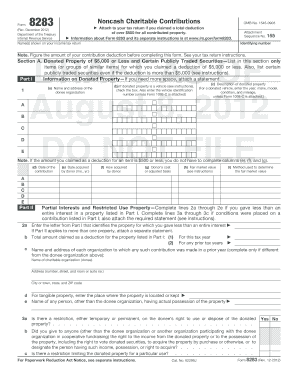

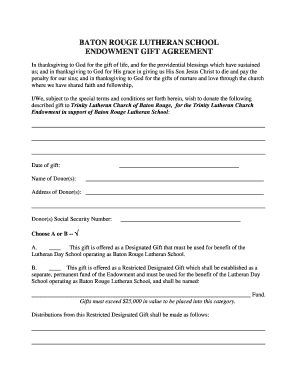

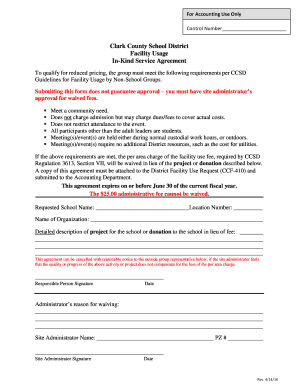

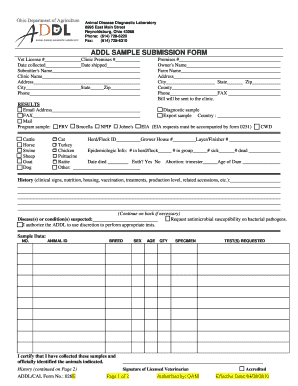

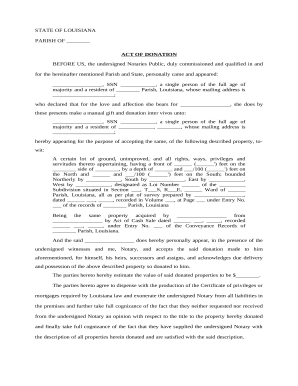

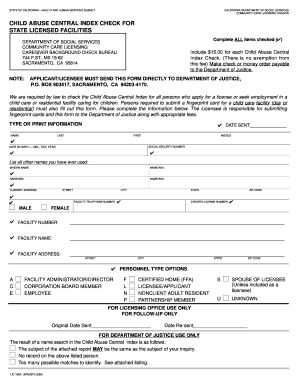

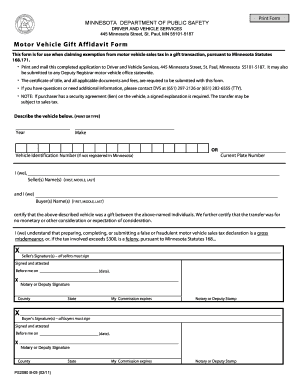

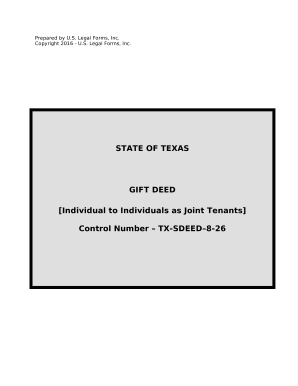

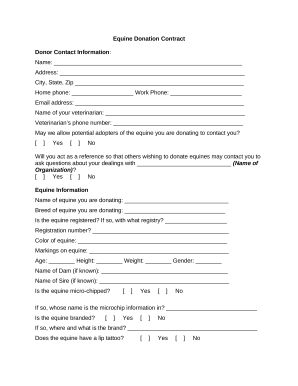

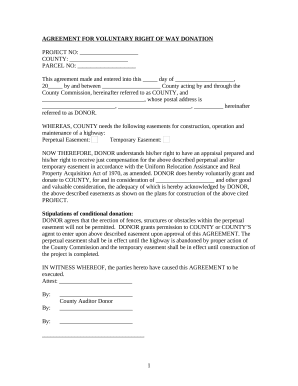

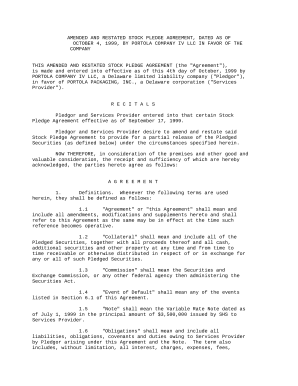

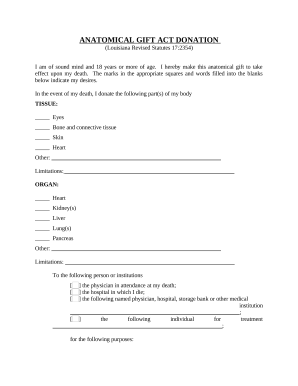

Explore Gift agreement agreement Donation Forms catalog and choose the appropriate template for your organization. Improve transparent and clear communication between you and your supporters.

Document management takes up to half of your business hours. With DocHub, it is simple to reclaim your time and enhance your team's efficiency. Access Gift agreement agreement Donation Forms online library and check out all document templates relevant to your day-to-day workflows.

Easily use Gift agreement agreement Donation Forms:

Boost your day-to-day document management with our Gift agreement agreement Donation Forms. Get your free DocHub account today to explore all templates.