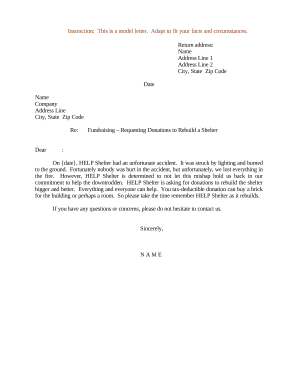

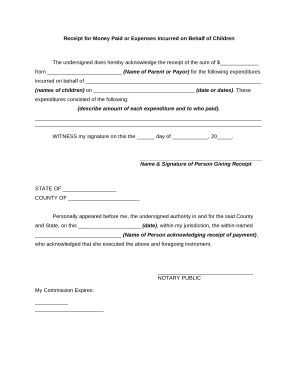

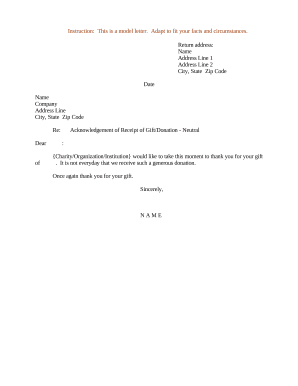

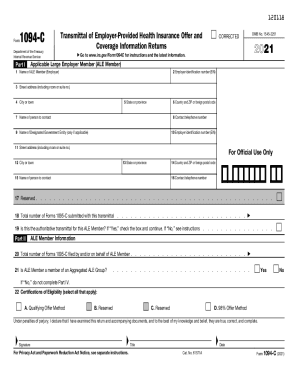

Remove the difficulty from donation forms with DocHub's web Charitable acknowledgement Donation Forms catalog. Effortlessly modify, fill out, and safely share forms with your contributors.

Your workflows always benefit when you are able to obtain all the forms and files you require on hand. DocHub offers a wide array of document templates to alleviate your daily pains. Get a hold of Charitable acknowledgement Donation Forms category and quickly find your form.

Begin working with Charitable acknowledgement Donation Forms in several clicks:

Enjoy fast and easy file management with DocHub. Explore our Charitable acknowledgement Donation Forms online library and locate your form right now!