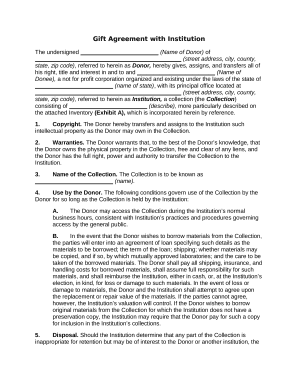

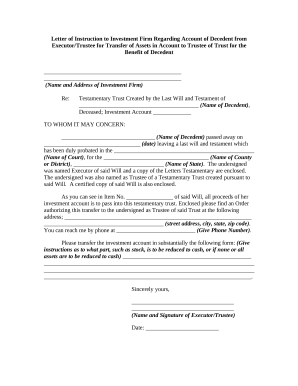

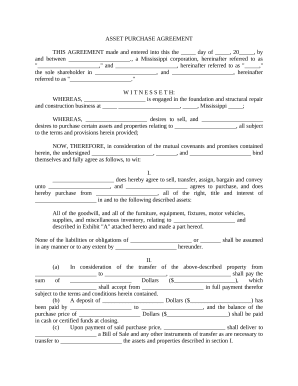

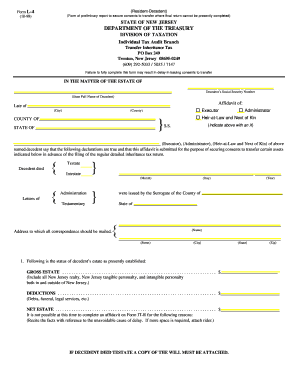

Select Assets agreement Donation Forms and effortlessly modify them online. Enhance your document managing procedures with DocHub.

Improve your file administration with our Assets agreement Donation Forms collection with ready-made form templates that suit your needs. Access your form template, edit it, fill it, and share it with your contributors without breaking a sweat. Start working more efficiently with your documents.

The best way to use our Assets agreement Donation Forms:

Examine all of the opportunities for your online file administration with our Assets agreement Donation Forms. Get a totally free DocHub account today!