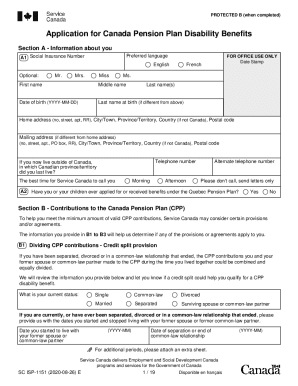

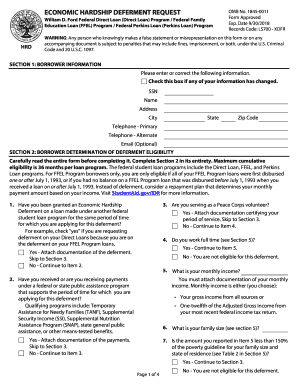

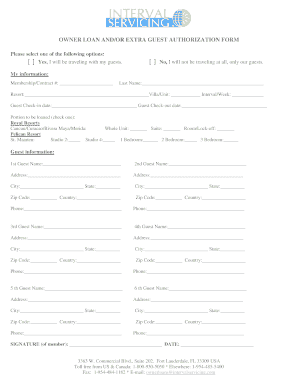

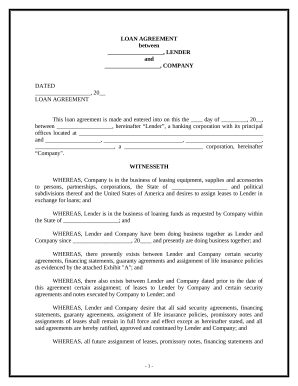

Browse our extensive library of Loan document Canada Forms and find the template you require. Fill out and organize your documents easily with DocHub.

Form managing consumes to half of your office hours. With DocHub, you can reclaim your time and improve your team's efficiency. Access Loan document Canada Forms collection and discover all document templates related to your daily workflows.

Easily use Loan document Canada Forms:

Speed up your daily file managing with our Loan document Canada Forms. Get your free DocHub account today to discover all templates.