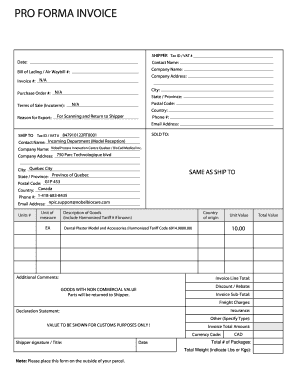

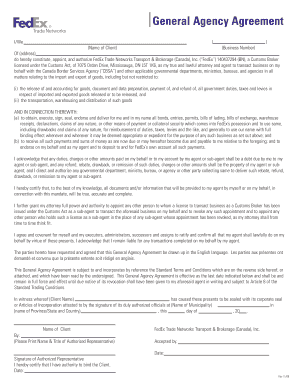

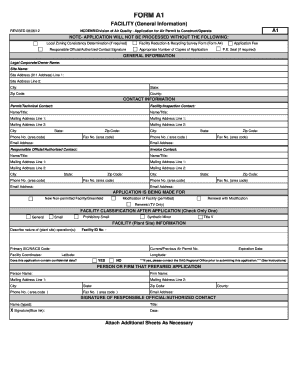

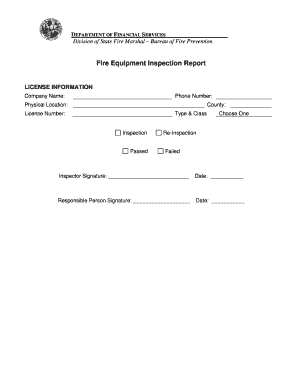

Streamline your common processes with Invoice with gst Canada Forms. Locate, modify, and share forms online with DocHub robust document management tools.

Your workflows always benefit when you can easily locate all the forms and documents you may need on hand. DocHub offers a a large collection documents to relieve your daily pains. Get hold of Invoice with gst Canada Forms category and quickly find your document.

Begin working with Invoice with gst Canada Forms in a few clicks:

Enjoy fast and easy form management with DocHub. Discover our Invoice with gst Canada Forms collection and locate your form today!