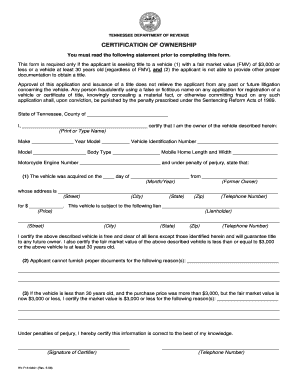

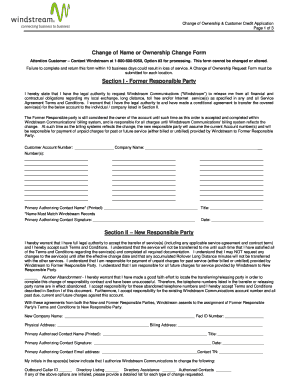

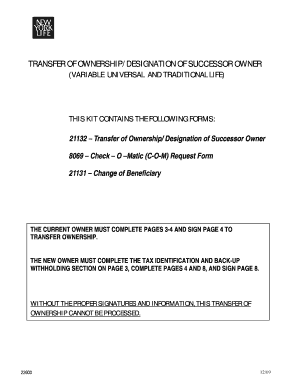

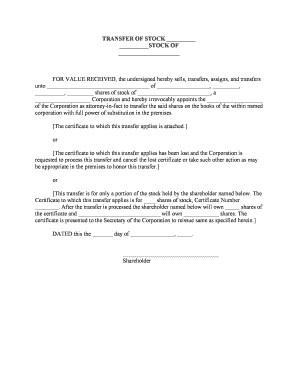

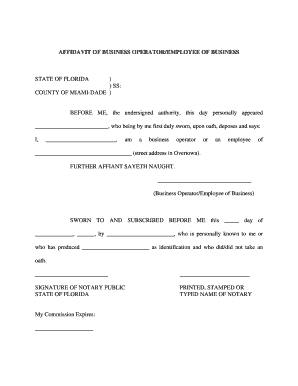

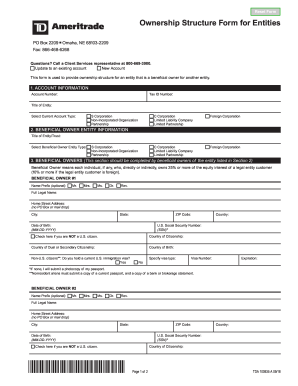

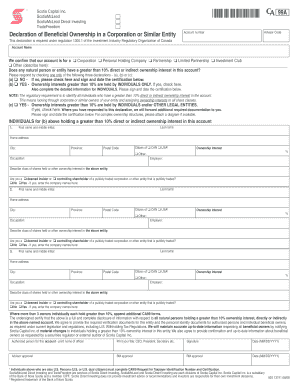

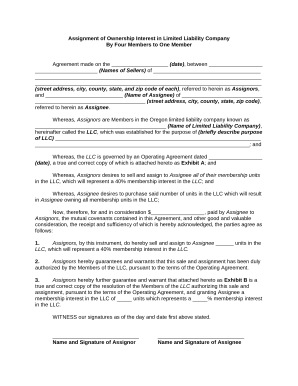

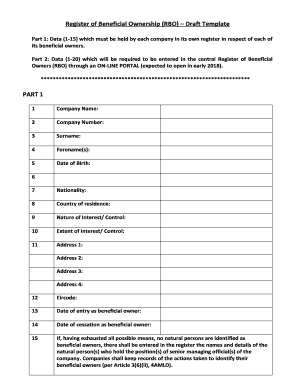

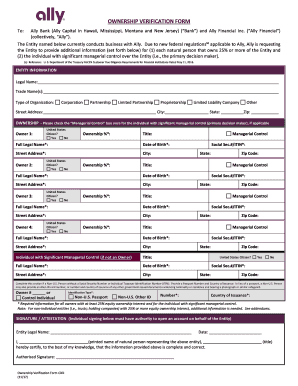

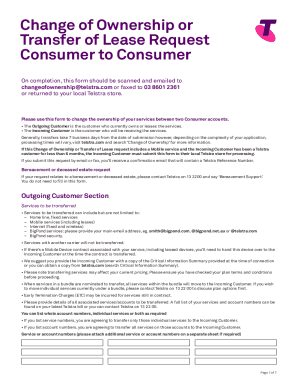

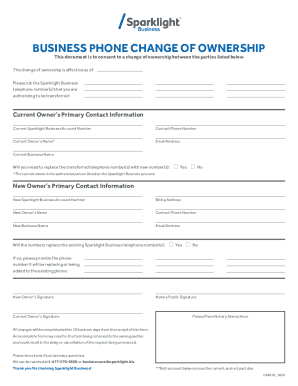

Get started with a comprehensive library of Various ownership Business Forms. Select, adjust, complete, and distribute your business forms without issues.

Papers management occupies to half of your office hours. With DocHub, you can easily reclaim your office time and increase your team's efficiency. Access Various ownership Business Forms category and check out all templates relevant to your day-to-day workflows.

Easily use Various ownership Business Forms:

Speed up your day-to-day file management with the Various ownership Business Forms. Get your free DocHub profile right now to explore all templates.